Report Code: 11713 | Available Format: PDF | Pages: 227

Europe Automotive Tire Market Research Report: By Vehicle (Two-Wheelers, Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles), Design (Radial, Bias), End-User (OEM, Aftermarket), Geographical Outlook (Germany, France, Italy, Spain, U.K., Poland, Netherlands, Belgium, Switzerland, Austria) - Industry Size, Share Analysis and Growth Forecast to 2024

- Report Code: 11713

- Available Format: PDF

- Pages: 227

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Europe Automotive Tire Market Overview

The European automotive tire market stood at $20,037.8 million in 2018 and is expected to grow with a CAGR of 4.5% during the forecast period. The growth of the market is attributed to the flourishment in the European automotive industry as well as the increase in replacement rate of tire due to greater longevity of vehicles in use.

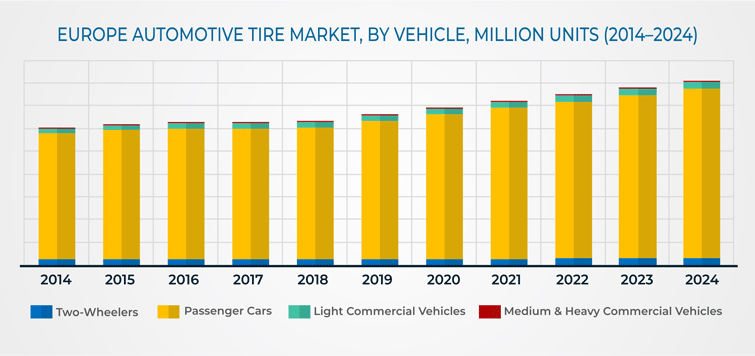

On the basis of vehicle type, the European automotive tire market has been categorized into two-wheelers, passenger cars, light commercial vehicles, and medium and heavy commercial vehicles. Among these, the passenger cars category accounted for the largest market share, in terms of sales volume, in 2018. This can be mainly ascribed to the increased sales of tires due to the increased demand for sport utility vehicles (SUVs) and crossover utility vehicles (CUVs) across the region. The sales of SUVs and CUVs in 2017 was increased by nearly 18% from 2016. Similarly, in 2018, the sales of SUVs and CUVs also increased by about 18% from 2017. Such surge in sales of SUVs and CUVs are contributing to the growth of the market in the passenger cars category in the region.

Based on type, the European automotive tire market has been categorized into winter tires, summer tires, and all-season tires. Under this segment, all-season tires held the largest market share, in terms of sales volume, in 2018. The market dominance of all-season tires can be mainly attributed to their wide applications throughout the year, irrespective of any season. Winter tires are only preferred during the heavy snow season and are comparatively costly. Also, with the advent of all-season tires, the need and demand for separate tires for different seasons have substantially reduced.

Geographically, the European automotive tire market has been categorized into Germany, France, Spain, Italy, the U.K., Poland, Belgium, the Netherlands, Switzerland, Austria, and Rest of Europe. Among these, Germany dominated the market during the historical period, and is projected to continue dominating the market during the forecast period as well. The country is a hub of automobiles and has the largest passenger car customer base with most produced and sold passenger cars, which contribute to the growth of the market in the country.

Europe Automotive Tire Market Dynamics

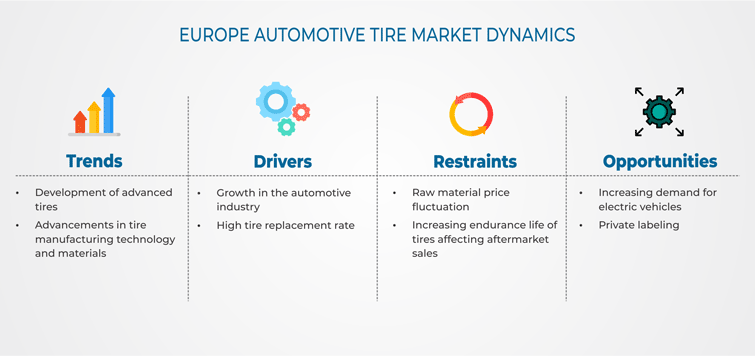

Drivers

Europe is one of the largest automotive markets in the world and home to many global vehicle and automobile part manufacturers. The future of the automotive tire market looks promising in the region, with the extension of tariff wars, impact of new technologies such as autonomous and electric vehicles, and changing preferences of millennial and younger generation consumers. The increasing prosperity of the overall automotive industry is expected to boost the market growth in the region. Growth opportunities are most prominent in the passenger cars segment, owning to rising production of vehicles due to its growing demand compared to other segments.

Furthermore, stringent European Union (EU) regulations and increasing average age of operational vehicles, along with growing demand for green tires boost the market growth. Additionally, with the existence of large consumer market, availability of highly skilled workforce, favorable infrastructural development, and presence of local and state government incentives, Europe stands as a key market for automobiles in the 21st century, thereby driving the growth of the European automotive tire market in the region.

Restraints

Automotive tire manufacturing is a complex process and requires a large number of raw materials such as rubber (both natural and synthetic), carbon black, sulfur, and other chemicals. Prices of these raw materials are often seen to fluctuate, subject to various factors. For instance, the price of natural rubber (TSR20) decreased by 21.0% in 2017–2018, whereas the price of crude oil (WTI) jumped by 30.0% in the same period. Continental AG, is one of the leading players in the European automotive tire market, announced in its 2018 half-year results that the company expects a $57 million negative impact due to increase in oil and synthetic rubber prices.

In addition, the price fluctuation is also a subject to the availability of resources such as natural rubbers. Excessive cutting down of rubber trees is forbidden by the government across the region, which makes availability of natural rubber unpredictable. This results in fluctuation in the pricing of this raw material, which acts as a restraining factor for the European automotive tire market.

Europe Automotive Tire Market Competitive Landscape

The European automotive tire market was consolidated in nature, led by Compagnie Générale des Établissements Michelin. This is majorly due to the presence of a large number of dealer networks across Europe and strong customer base in France. The other major players operating in the market are Continental AG, The Goodyear Tire & Rubber Company, Cooper Tire & Rubber Company, Pirelli & C. S.p.A., Bridgestone Europe NV/SA, Yokohama Rubber Co. Ltd., Hankook Tire Company Ltd., Nokian Renkaat Oyj, Apollo Tyres Limited, and Sumitomo Rubber Industries Ltd.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws