Report Code: 11586 | Available Format: PDF | Pages: 167

Ethanolamines Market Research Report: By Type (Monoethanolamine, Diethanolamine, Triethanolamine), Application (Herbicides, Surfactants, Chemicals, Gas Treatment, Cement) - Global Industry Analysis and Demand Forecast to 2030

- Report Code: 11586

- Available Format: PDF

- Pages: 167

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Ethanolamines Market Overview

The global ethanolamines market stood at $2,933.5 million in 2019, and the market size is expected to demonstrate a CAGR of 5.0% during the forecast period (2020–2030). The rapidly increasing demand for surfactants, along with a surge in the sale of agrochemicals, is propelling the consumption of the compounds, in turn, promoting the growth of the ethanolamines industry.

On account of the ongoing COVID-19 pandemic, the market for ethanolamines has suffered to a certain extent, on account of the temporary suspension of production across downstream plants, particularly in China, in quarter 1 of 2020. However, by late March, production majorly recovered, but downstream ratios were still far lower than Q4 2019. In addition, the European market witnessed a shortfall in imports, owing to plant shutdowns in the U.S., in turn, creating a negative impact on the ethanolamines market

.jpg)

Segmentation Analysis

Diethanolamine (DEA) To Witness Highest Demand

The DEA category held the largest share, based on type, by value and volume both, in 2019, and it is expected to retain its dominance during the forecast period. The high-volume demand is attributed to the vast application base of DEA in soaps and detergents, production of glyphosate, and treatment of refinery products and natural gas. Owing to its wide industrial usage, the consumption of DEA is witnessing an increase. In addition, the increase in the production of herbicides and surfactants across the globe is further propelling the consumption, in turn, promoting the growth of the ethanolamines market.

Surfactants Application To Retain Its Largest Share throughout Forecast Period

The surfactants category witnessed the highest demand in 2019, based on application. The category is projected to retain its dominance in the coming years, on account of the increasing adoption of ethanolamines for the production of industrial detergents, gel-type cleaners, shaving creams, body lotions, shampoos, and soap bars. The demand for the compound, as a surfactant, is primarily driven by its requirement for the production of fatty-acid amides, ability to form foams, upon reaction with lauryl sulfate, and its emulsifying properties. With the increasing consumption of personal care products worldwide, the demand for the chemical is likely to increase, thereby augmenting the ethanolamines market revenue.

Geographical Outlook

Asia-Pacific (APAC) To Account for Largest Market Share in Industry

Globally, APAC held the largest share in the ethanolamines market in 2019, and the trend is likely to continue during the forecast period. This is majorly attributed to the high-volume consumption of the compound in China. In 2019, the country imported nearly a quarter of its requirement, amounting to 168.4 kilotons, primarily from manufacturers in Thailand and Saudi Arabia.

In addition, a rapid surge in the demand from the end-use industries in regional developing countries, including India, Thailand, and Vietnam, is further propelling the consumption of the compound. With the growth of the end-use sectors in the region, the usage of the chemical is likely to increase, thereby driving the ethanolamines market in the region.

Rest of the World (RoW) To Showcase Fastest Growth

Although the region held a significantly small share in the global market till 2019, it is likely to demonstrate the fastest growth, on account of the opening of large manufacturing facilities in countries including Brazil and Saudi Arabia. With a capacity expansion in such countries, the supply of products has witnessed a rise. In addition, with further expansion plans of manufacturers, in order to leverage the untapped potential of the industry, the ethanolamines market in the region is expected to showcase massive growth during the forecast period.

.jpg)

Trends & Drivers

Surge in Demand for Surfactants

The compound is vastly used as a surfactant and emulsifying ingredient in personal care products, such as soaps, shampoos, and laundry detergents. The rise in the disposable income in developing countries has increased the consumption of such products to a huge extent. This, in turn, is propelling the demand for ethanolamines in personal care products. In addition, with the increasing availability and consumer spending, the consumption of such products is expected to further rise, in turn, driving the ethanolamines market.

Rising Demand for Agrochemicals

DEA is vastly used for the production of glyphosate, which is primarily used as a herbicide, in order to prevent unwanted vegetation at farmlands. The consumption of glyphosate has witnessed a surge in countries across APAC, Latin America, and North America, in order to meet the demands for produce being witnessed by the agricultural sector. In addition, the increasing awareness amongst farmers regarding the benefits of using such herbicides is expected to further propel the consumption, in turn, driving the ethanolamines market.

| Report Attribute | Details |

Historical Years |

2015-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$2,933.5 million |

Forecast Period CAGR |

5.0% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Company Share Analysis, Companies’ Strategical Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

Type, Application, Geography |

Market Size of Geographies |

U.S., Canada, Germany, Sweden, Belgium, Russia, France, U.K., Spain, Japan, China, India, South Korea, Brazil, Saudi Arabia, Mexico |

Secondary Sources and References (Partial List) |

Agro Chem Federation of India, American Chemical Society, Association of the British Pharmaceutical Industry, Brazilian Chemical Industry Association, Brazilian Chemical Society, Chemical Society of Japan, Chemical Society of Mexico, Chinese Chemical Society |

Explore more about this report - Request free sample

Market Players Undertaking Major Facility Expansions

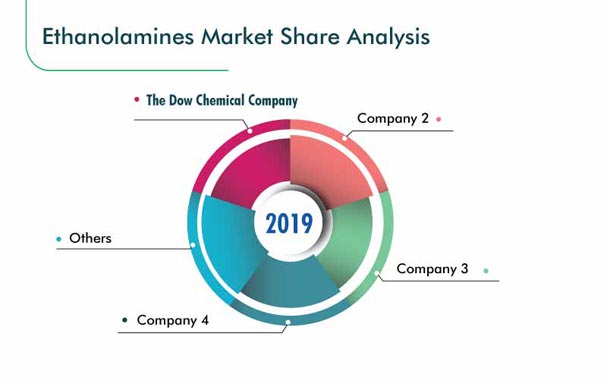

The ethanolamines market is consolidated in nature, with the presence of numerous giant players, such as Oriental Union Chemical Corporation, The Dow Chemical Company, BASF SE, Sadara Petrochemicals, Saudi Kayan Petrochemical Company, Akzo Nobel NV, Huntsman Corporation, and INEOS Group Holdings S.A.

Lately, players in the industry have been putting immense focus on expanding the capacity of their production plants. For instance:

- In September 2019, BASF SE announced the expansion plan for its ethylene oxide and derivatives complex in Antwerp, Belgium, with an expected investment exceeding $562.0 million (EUR 500 million). It adds about 400,000 tons per year to BASF’s production capacity of ethylene glycol, non-ionic surfactants, ethanolamines, glycol ether, and various other downstream alkoxylates. This significant capacity expansion was planned to enable BASF to support the increasing demands of its customers in Europe

- In July 2019, INEOS Group Holdings S.A. announced the new ethylene oxide and derivatives production plant in Houston, U.S. The new plant, which will produce 520,000 tons of ethylene oxide, is expected to be operational by 2023. This will allow the company to address a fast-growing ethylene oxide market, as well as its own requirements.

Some of the key players in the ethanolamines market include:

-

BASF SE

-

Sadara Petrochemicals

-

The Dow Chemical Company

-

Saudi Kayan Petrochemical Company

-

Oriental Union Chemical Corporation

-

Akzo Nobel NV

-

Huntsman Corporation

-

INEOS Group Holdings S.A.

-

Huntsman Corporation

-

Mitsui Chemicals Inc.

Ethanolamines Market Size Breakdown by Segment

The ethanolamines market report offers comprehensive market segmentation analysis along with market estimation for the period 2015–2030.

Based on Type

- Monoethanolamine (MEA)

- Diethanolamine (DEA)

- Triethanolamine (TEA)

Based on Application

- Herbicides

- Surfactants

- Chemicals

- Gas Treatment

- Cement

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- Sweden

- Belgium

- Russia

- France

- Spain

- U.K.

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of the World (RoW)

- Brazil

- Saudi Arabia

- Mexico

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws