Report Code: 12877 | Available Format: PDF | Pages: 290

Enteral Feeding Formulas Market Size and Share Analysis by Product (Standard, Disease-Specific, Peptide-Based), Age Category (Adults, Pediatrics), Flow Type (Intermittent, Continuous), Application (Oncology, Gastrointestinal Diseases, Neurological Disorders, Diabetes), End User (Hospitals, Long-Term-Care Facilities, Homecare Settings) - Global Industry Demand Forecast to 2030

- Report Code: 12877

- Available Format: PDF

- Pages: 290

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

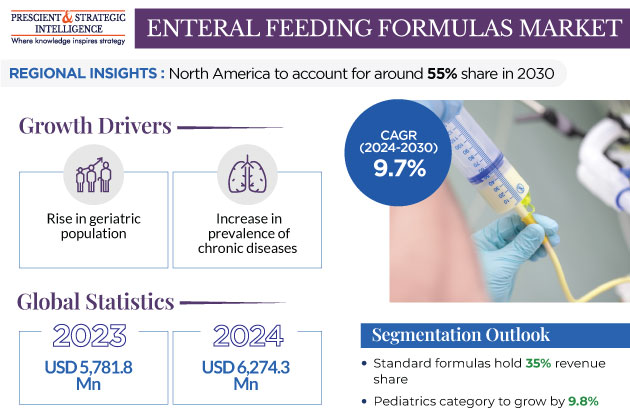

The global enteral feeding formulas market was valued at USD 5,781.8 million in 2023, and it is expected to reach USD 10,963.7 million in 2030, with a growth rate of 9.7% during 2024–2030. This is attributed to the rise in the geriatric population and increase in the prevalence of chronic diseases, such as cancer, diabetes, gastrointestinal diseases, and neurological diseases.

Another factor that is driving the growth of the market is the high incidence of malnutrition or deficiencies in nutrient intake.

- Patients who are malnourished or who are at risk for malnutrition can fulfill their demand for nutrition by taking enteral feeding formulas because they contain all the essential nutrients, such as vitamins, protein, and calories, required for daily activities.

- According to the WHO, roughly 45% of the deaths among children below 5 years of age are linked to undernutrition. They mostly occur in middle-income countries.

Moreover, the growing number of premature births globally is boosting the adoption of enteral feeding formulas to meet the nutritional requirements of newborns, which is expected to drive the market over the years. Furthermore, the increasing number of road accidents and injuries are set to fuel the growth of this market.

- Road traffic crashes kill approximately 1.2 million people annually around the world.

- In addition, the injured require time for healing and are unable to move or chew during this period, which is why they need enteral feeding formulas.

Standard Formulas Dominate Market

Standard formulas held the largest share of 35%, in 2023, and they are expected to dominate the product segment throughout the forecast period. This can be attributed to the fact that this formula is designed for adults or children who have normal digestion. Furthermore, standard formulas can be used for both enteral feeding and as an oral supplement.

- In addition, standard formulas are cost-effective easily available and can be used in hospital and homecare settings.

- Moreover, doctors’ recommendations to take standard formulas for proper growth and nutrition are expected to boost the growth of the market.

The disease-specific formulas category is expected to witness the highest CAGR during 2024–2030. This is due to the increase in the prevalence of chronic diseases, such as cancer, diabetes, and cardiovascular diseases. In addition, disease-specific formulae are formulated for specific patient populations with particular diseases.

Pediatrics Category Held Largest Share

The pediatrics category held the largest revenue share in 2023, and it is expected to grow at a CAGR of 9.8% during 2024–2030. This can be attributed to the growing number of preterm births and high incidence of chronic conditions in small kids. Furthermore, companies are launching formulas especially crafted keeping the nutrition needs of pediatric users in mind. Moreover, companies are launching plant-based foods to allay parents’ concerns over harmful chemicals.

- In November 2021, Abbott Laboratories launched the Similac 360 Total Care line of infant formula with five HMOs, which are contained together only in breast milk. This formula is designed to aid in the development of babies’ digestive system, immune system, and brain.

- In October 2022, Nature’s One LLC introduced an organic infant formula under its Baby’s Only Formula brand. This product is designed to meet all the nutrient requirements for newborns as recommended by the FDA, and to supplement some of the mother’s natural breastmilk.

- In July 2022, Danone S.A. launched the new Dairy & Plants Blend baby formula for babies majorly consuming a vegetarian, vegan, or flexitarian diet.

Further, in March 2020, Kate Farms announced new clinical data for its plant-based enteral nutrition products that demonstrate enhanced GI tolerance in diverse populations with a range of diseases.

Furthermore, in June 2022, Prolacta Bioscience Inc. announced the first evidence-based feeding protocol for the use of an exclusive human milk diet, including Prolacta’s products. Prolacta’s EHMD ProtocolTM is designed for prematurely born babies with below-normal weight who face the risk of the risks of inadequate nutrition.

Companies are even investing to expand and strengthen their manufacturing capabilities in the domain.

- In November 2022, Perrigo Company plc announced an investment of USD 170 million to strengthen its manufacturing capacity for infant formula in the U.S., to meet caregivers and parents’ demand for supply affordable infant formulae.

- As part of this expansion project, Perrigo purchased the Gateway infant formula plants formerly owned by Nestlé’s.

- These investments represented a significant boost to the around USD 20-million annual investment by the company to supply safe, high-quality infant formulae from its facilities in Vermont and Ohio.

Similarly, in October 2022, Abbott Nutrition announced plans to invest USD 500 million in the development of a new factory for specialty and metabolic infant formulas.

The adults category also holds a significant share. This is due to the rise in the adoption of enteral feeding among adults suffering from cancer, diabetes, chronic obstructive pulmonary diseases, stroke, dementia, chronic liver disease, and multiple sclerosis. Moreover, companies are launching plant-based products in multiple flavors for adults.

- In September 2022, Kate Farms Inc. announced the launch of its high-calorie medical formula, Adult Standard 1.4 in chocolate flavor.

By Application, Gastrointestinal Disease Category Holds Largest Share

The gastrointestinal diseases generated the highest feeding formulas market revenue in 2023, of around USD 1.5 billion, and it is expected to dominate the application segment throughout forecast period. This is due to the increasing incidence of gastrointestinal diseases, which affect the GI tract from the buccal cavity to the anus. Some examples are nausea, lactose intolerance, food poisoning, and diarrhea.

Feeding formulas are also preferred in various disease conditions, such as neurological diseases, diabetes, fatigue, cancer, and stroke, which make it difficult to eat. Cancer is the second-largest market for feeding formulas as its prevalence is increasing globally.

- In 2022, 1,918,030 new cases of cancer were projected to occur in the U.S.

- Around 350 deaths were also predicted per day from lung cancer, the main cause of cancer deaths.

Based on End User, Hospitals Category Accounts For Largest Revenue Share

Based on end user, the Hospitals category accounted for the largest share in the market in 2023, of 60%, and it is predicted to grow at a significant rate during the forecast period. This is attributed to the rise in the administration of enteral feeding formulas to patients who require long-term care in the hospital. Furthermore, for many chronic diseases, tube feeding is the only option to give patients nutrition, which is another key factor contributing to the growth of the category.

| Report Attribute | Details |

Market Size in 2023 |

USD 5,781.8 Million |

Market Size in 2024 |

USD 6,274.3 Million |

Revenue Forecast in 2030 |

USD 10,963.7 Million |

Growth Rate |

9.7% CAGR |

Historical Years |

2017-2023 |

Forecast Years |

2024-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Product, By Age Category, By Flow Type, By Application, By End User |

Explore more about this report - Request free sample

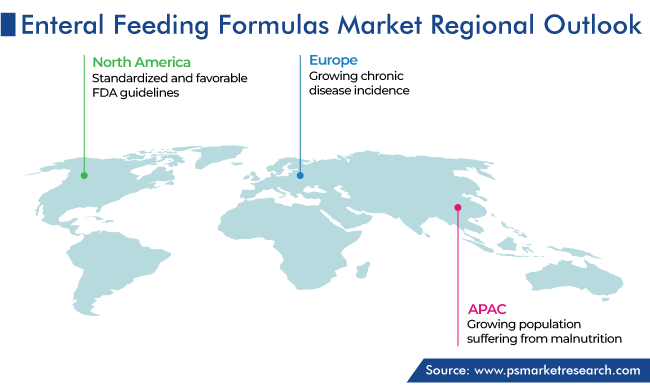

North America Dominates Enteral Feeding Formulas Market

North America is expected to continue leading the market with a share of around 55% in 2030. This will be due to the standardized and favorable FDA guidelines for such products in the U.S.

- The U.S. FDA has announced it would allow manufacturers of infant formula products to use enforcement discretion to increase the supply of pediatrics formula across the country.

- Revealed in 2022, these industry guidelines have given the manufacturers of infant formula a pathway to continue the marketing of their products while following FDA rules.

Moreover, the launch of enhanced and more-nutrition products, resulting from the increasing extent of research and development activities, is expected to boost the market growth in this region in the coming years.

- In October 2022, Bobbie Baby Inc. launched Bobbie Labs, an R&D hub, to advance infant feeding.

- Bobbie Labs also announced plans to invest USD 100 million to raise the quality of its infant formula quality, while enhancing their accessibility for all U.S. citizens by 2030.

In the same way, Canada’s significance in the regional market is because of the innovations in infant formulae.

- In November 2020, Abbott Laboratories launched its Similac Pro-Advance infant formula with 2-fucosyllactose oligosaccharide. This product contains an ingredient with a similar structure to the immunity boosting agents natural breastmilk contains.

Some Key Players Operating in Market Are

- Abbott Laboratories

- Danone S.A.

- Fresenius Kabi AG

- Nestlé S.A.

- Victus Inc.

- Primus Pharmaceuticals Inc.

- Meiji Holdings Company Ltd.

Market Size Breakdown by Segment

This report offers deep insights into the enteral feeding formulas market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Product

- Standard

- Disease-Specific

- Peptide-Based

Based on Age Category

- Adults

- Pediatrics

Based on Flow Type

- Intermittent

- Continuous

Based on Application

- Oncology

- Gastrointestinal Diseases

- Neurological Disorders

- Diabetes

Based on End User

- Hospitals

- Long-Term-Care Facilities

- Homecare Settings

Region/Countries Reviewed for this Report

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws