Report Code: 10616 | Available Format: PDF | Pages: 264

Electric Vehicle Supply Equipment Market Size and Share Analysis by Type (Alternating Current, Direct Current), Application (Public, Private) - Global Industry Revenue Estimation and Demand Forecast to 2030

- Report Code: 10616

- Available Format: PDF

- Pages: 264

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

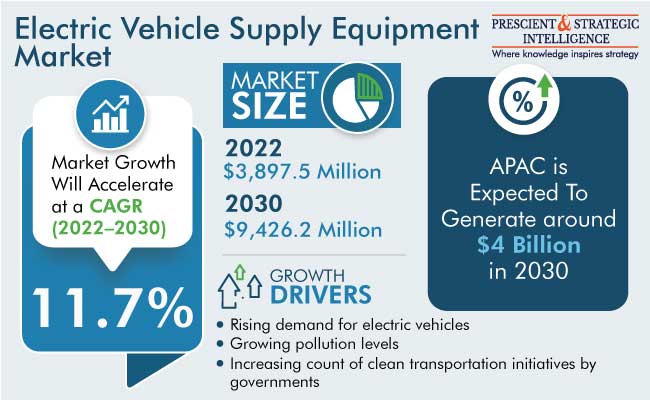

The global electric vehicle supply equipment market size stood at $3,897.5 million in 2022, and it is expected to grow at a CAGR of 11.7% during 2022–2030, to reach $9,426.2 million by 2030. The growth can be primarily ascribed to the rising demand for electric vehicles, the increasing initiatives by governments to boost the development of this equipment, the growing pollution levels, and the surging adoption of charging stations. For instance, in May 2022, China built around 87,000 novel EV charging stations in just one month and it has increased by 60.5%, comparable to 2021.

Furthermore, 42% of vehicular pollution in Delhi is caused by 2&3 wheelers. The rising adoption of EVs will help in reducing vehicular pollution. Thus, the Delhi government plans to leverage the unique advantage of EVs by adopting them, which can be charged when they are idle. The government also plans to roll out at least 30,000 charging points across Delhi to increase the adoption of light electric vehicles and fleet vehicles.

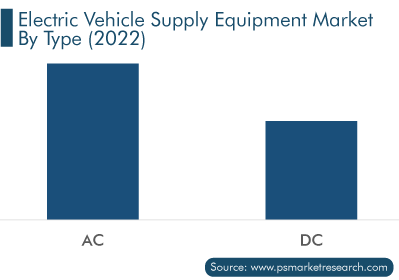

AC Chargers Dominate the Market

Alternating current (AC) chargers dominate the market because AC charging is the most common charging method for electric vehicles with plugs. Charging speed depends on the output power of the charge point and the convertor’s capabilities to convert the power to DC. Also, these chargers are widely adopted and more popular for general day-to-day charging, as these have low costs, including production, installation, and operation. For instance, across China, there are about 1.4 million EV charging stations, among which 806 thousand are AC charging stations.

The AC chargers are further bifurcated into level 1 and level 2 chargers. Of these, the level 1 chargers held a larger share in the market, due to the longer charging time of electric vehicles, which makes these chargers suitable for overnight charging at homes.

Public Category To Grow at a Higher Rate

The public category, based on application, is expected to grow at a higher CAGR, around 12%, in the coming years. This can be attributed to the robust commitments of governments, automakers, and manufacturers for the development of electric vehicle infrastructure in several countries.

Whereas, the private category accounts for a larger industry share. This is because of the larger utilization of home chargers globally. Electric vehicles take considerable time in charging. Thus, most customers prefer home charging or private charging, as they can be installed easily and can be used overnight.

| Report Attribute | Details |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Market Size in 2022 |

$3,897.5 Million |

Revenue Forecast in 2030 |

$9,426.2 Million |

Growth Rate |

11.7% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Type; By Application; By Region |

Explore more about this report - Request free sample

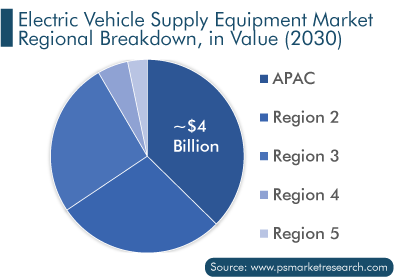

APAC Makes the Largest Contribution to Revenue Generation

APAC has the leading position in the electric vehicle supply equipment market, and it will hold the same position in the coming years as well, accounting for a value of around $4 billion in 2030. This is because of the surging technological advancements and the increasing government and private funding and investments for charging infrastructure in the region. Moreover, the surging environmental concerns, the growing government support in the form of subsidies for EVs and related charging stations, and decreasing total cost of ownership (TCO) are other major factors driving the demand for EVSE in the region.

In APAC, the Chinese market holds the leading position, and it will grow at a CAGR of around 10% during the forecast period. This is due to the rising government focus and faster adoption of electric vehicles in the country and the increasing exports of charging stations. For example, in October 2022, China started shipping EVs to Europe, and 100 more charging stations are expected to be added by the end of 2023.

Furthermore, Europe holds the second-largest position in the market, owing to the rising number of installations of charging stations, due to the increasing sales of plug-in electric vehicles. With the surging adoption of EVs, the development of related infrastructure and technologies is increasing rapidly in the region. Also, in several countries, the public sector has taken several initiatives to install charging points in public places. Moreover, the presence of major players in the region drives the regional market.

Increasing Demand for EVs Fuels the Market

In recent years, the demand for electric vehicles has grown rapidly. In the first half of 2022, approximately 4.3 million EVs were sold globally, which was more than the sales in 2021. The rising concerns toward environmental protection and the target to reduce the usage of gasoline and diesel fuels are the key factors boosting the sales of such vehicles. With the high sales of electric vehicles, the rapid deployment of charging stations is witnessed, worldwide.

Additionally, it is expected that the sales of electric cars will notice more than a 30% growth rate in the coming years, globally. This is enforcing manufacturers and governments to increase the number of charging stations, globally. Moreover, the rising fuel prices, renewed emphasis by e-commerce companies to electrify their last delivery fleets, and incentives rolled out by central and state governments to improve infrastructure are key factors driving the sales of such vehicles.

Increasing Penetration of DC Fast Chargers Is a Key Industry Trend

DC fast chargers are capable of charging batteries of EVs at a rapid pace. In addition, these chargers do not need onboard converters mounted inside the vehicles for the conversion of electric current. The increasing range anxiety among electric vehicle users and the electrification of vehicles are leading private and public organizations to install more DC fast chargers in commercial and public places.

Key Players in the Electric Vehicle Supply Equipment Market Are:

- AeroVironment Inc.

- ABB Group

- Delta Electronics Inc.

- Siemens AG

- Tesla Inc.

- ChargePoint Inc.

- bp Pulse

- Schneider Electric SE

- Enphase Energy Inc.

- Leviton Manufacturing Co. Inc.

Market Size Breakdown by Segment

The report analyzes the impact of the major drivers and restraints on the market, to offer accurate market estimations for 2017–2030.

Based on Type

- Alternating Current (AC)

- Level 1

- Level 2

- Direct Current (DC)

- CHAdeMO

- Combined charging system (CCS)

- GB/T

- Tesla supercharger (SC)

Based on Application

- Public

- Private

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Asia-Pacific

- Japan

- China

- India

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East and Africa

- Saudi Arabia

- South Africa

- U.A.E.

The electric vehicle supply equipment market size stood at $3,897.5 million in 2022.

During 2022–2030, the growth rate of the electric vehicle supply equipment market will be 11.7%.

Public is the largest application area in the electric vehicle supply equipment market.

The major drivers of the electric vehicle supply equipment market include the surging adoption of electric vehicles, the increasing deployment of charging stations with enhanced performance, and the improving EV infrastructure.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws