Desktop Virtualization Market Analysis

Explore In-Depth Desktop Virtualization Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Report Code: 12375

Explore In-Depth Desktop Virtualization Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Virtual desktop infrastructure is the largest category in 2024, with a share of 50%. VDI can be easily deployed inhouse, is accessible from a centralized location, and offers strong safety to enterprise applications, databases, and other software resources. Additionally, large enterprises prefer this approach to comply with the government regulations for data safety and consumer privacy. This approach also offers better customizability and human resource maximization as all the desktops can run on one server, which also reduces operational costs.

Desktop as a service is expected to witness the highest compound annual growth rate, of 11.0%, during the forecast period. This is because of the increasing demand for secured virtual desktops while working from a remote location, especially since the pandemic has enforced hybrid work models. Desktop as a service user base has more than doubled in the past two years.

DaaS offers simplified management, improved flexibility, and a lower total cost of ownership. DaaS can be used to rapidly and simply construct a digital workspace for businesses that want to offer remote work possibilities and personal device freedom.

The below-mentioned types have been studied:

The subscription-based pricing model accounts for the larger desktop virtualization market size. Some vendors provide the software for free, some charge per hour, and some provide on license or charge on a monthly or yearly basis. Subscription-based pricing strategies are more popular and generate the highest revenue in the market. A subscription service is convenient and reliable, which creates a bond between the customer and the company.

The pay as you go bifurcation will have the higher CAGR, of 10.5%, over the forecast period. By charging companies only for the resources they use, this mode offers cost-efficiency, which is vital for SMEs. As per research, these companies spend a larger portion of their revenue on IT resources than multinational organizations, which is why their proliferation will drive the market in this category.

We have analyzed the following pricing models:

Cloud-based virtualization software holds the larger market share in 2024, and it will also be the faster-growing, with CAGR of 12.0%, during the forecast period. Cloud-based computing offers access to software running on shared resources, such as memory, processing power, and disk storage, through the internet. Remote data centers maintain these computing resources, as they are specially created to host applications on different platforms.

Moreover, SMEs can particularly benefit from the cloud, as it allows users to work on applications at a low price, by reducing the hardware and software expenditure on hardware and software. The right cloud provider can help a company efficiently raise its productivity and software capabilities as it grows.

The segment is bifurcated as follows:

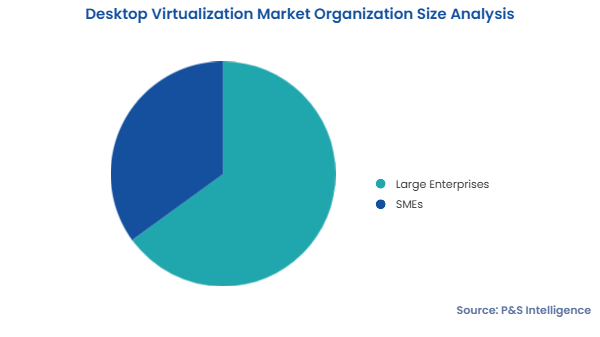

Large organizations hold the larger share, of 65%, in 2024. Numerous companies with more than 1,000 employees are installing virtualization software on their operational systems for easy access to data from centralized sources and for security reasons. Machines have already begun to be virtualized, and now this trend is seeping into desktops too. Desktop and server virtualization can help a business gain a competitive advantage, such as reduced hardware costs, faster desktop and server provisioning and deployment, energy savings, improved data security and disaster recovery, and increased IT operational efficiency. Hence, large organizations are rapidly adopting this technology and holding the largest share in the market.

SMEs will witness the higher CAGR, of 11.0%, over the forecast period. With government support around the world, SMEs are proliferating in every industry. As per the World Bank, over 90% of the companies in the world are SMEs, and they employ almost 50% of the global workforce. In emerging economies, SMEs account for almost 70% of the employment. These companies have historically found it difficult to integrate advanced digital technologies into their operations, but the availability of cloud-based software has alleviated this problem. Since cost-effective operations are key for these companies, they are rapidly deploying their desktops on the cloud to save on operating expenses and maintain profitability.

The report offers insights on organizations of the following sizes:

The IT and telecom category dominates the market, generating 25% of the worldwide revenue in 2024. These companies have extensive IT infrastructure, with thousands of desktops, laptops, tablets, smartphones, and servers. As per research, these companies spend, on average, up to USD 26,000 on IT infrastructure per employee. To reduce operating costs, they are adopting cloud-based approaches, which massively reduce the need for on-site hardware. Additionally, pay-as-you-go models offer scalability, charging these companies only for the storage and computing power they use on third-party servers.

Healthcare is the fastest-growing vertical, with an expected CAGR of 12.0% during the forecast period. This is attributed to the rampant digitization of healthcare operations and the adoption of varied IT approaches. The most-significant healthcare IT solution currently is digital health, which encompasses EMRs, telemedicine, remote patient monitoring and consultations, healthcare analytics, in-silico drug discovery and development, precision medicine, and mHealth. With an increasing number of connected devices being used, healthcare providers are suffering increasing an IT cost pressure; therefore, they are virtualizing their desktops to reduce expenses and enable inter-department and external collaboration on patient care.

The below-mentioned verticals are covered in the report:

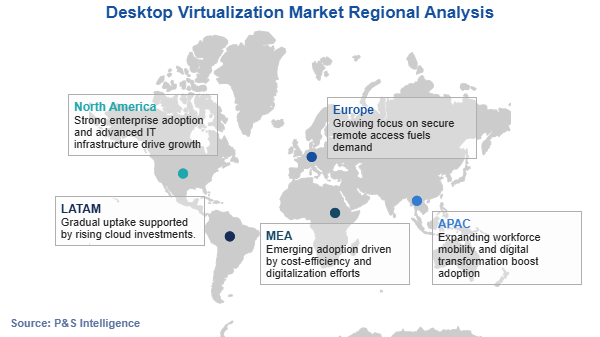

The following countries and regions have been covered:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages