Report Code: 10496 | Available Format: PDF | Pages: 275

Dermatology Drugs Market Research Report: By Treatment (Topical Corticosteroids, Retinoids, Biologics, Calcineurin Inhibitors, Antihistamines, Hormone Therapy), Drug (Humira, Remicade, Otezla, Stelara, Enbrel, Cosentyx, Neoral, Taltz, Cubicin, Canesten, Zyvox, Dupixent, Protopic, Valtrex, Eucrisa), Prescription Mode (Prescription Drugs, Over-the-Counter Drugs), Therapy Area (Psoriasis, Atopic Dermatitis, Acne, Rosacea, Skin Cancer, Scar), Distribution Channel (Direct, Wholesale/Retail), End User (Hospitals, Clinics, Cosmetic centers, At-home) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 10496

- Available Format: PDF

- Pages: 275

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Dermatology Drugs Market Overview

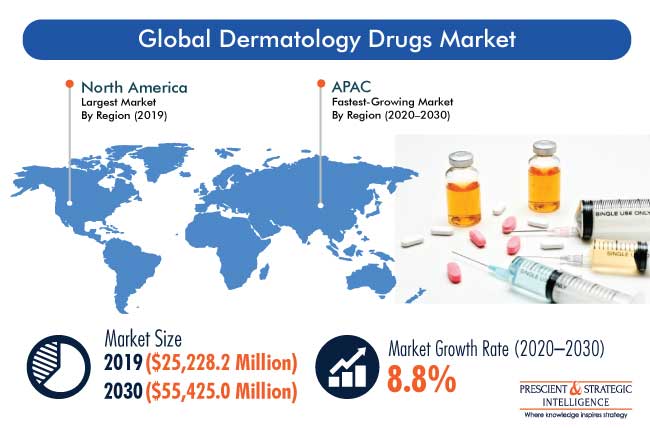

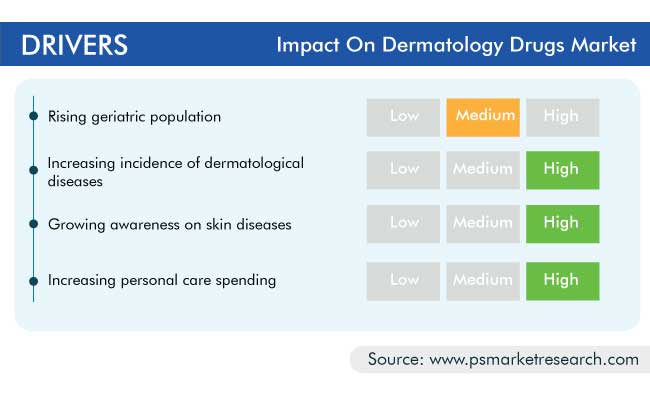

The global dermatology drugs market was valued at $25,228.2 million in 2019, which is expected to progress at a CAGR of 8.8% during the forecast period (2020–2030). The major factors for the growth of the market include the increasing aging population, rising incidence of skin diseases, escalating disposable income in developing countries, and surging number of research programs.

However, the ongoing COVID-19 pandemic has had a significant impact on the healthcare system. It has reduced the growth rate of the global market due to the rapid shift in focus toward COVID-19 treatment. As a result, the majority of the hospitals have delayed vaccinations pertaining to dermatology, chemotherapy sessions, and other non-essential services.

Development of Advanced Molecules Is Supporting Market Domination of Topical Corticosteroids

Based on treatment, the topical corticosteroids category is expected to dominate the dermatology drugs market during the forecast period. This leading position of the category is attributed to the development of advanced molecules with innovative galenic formulations and discovery of novel therapeutic regimens with topical corticosteroids.

Due to Minimal Side-Effects, Eucrisa Drug Is Expected To Witness Fastest Sales Growth

Based on drug, the Eucrisa category is expected to witness the highest CAGR in the market during the forecast period, as this drug has shown extremely few side-effects as compared to other dermatological drugs. This has acted as a key factor in increasing the demand for this drug for the treatment of mild-to-moderate atopic dermatitis in children and adults.

Increasing Preference for Consultation with Dermatologists Is Boosting Prescription Drugs Sales

During the forecast period, the prescription drugs category, under the prescription mode segment, is expected to hold the larger market share. This would be because of the availability of a broad range of prescription drugs, increasing preference for consultation with dermatologists for chronic skin conditions, and growing awareness about skin diseases.

Growing Prevalence of Psoriasis Is Raising Demand for Associated Drugs

In 2019, the psoriasis category accounted for the largest share in the dermatology drugs market, on the basis of therapy area. This was because of the growing prevalence of psoriasis, availability of a broad range of drugs, and rising awareness about the condition.

Direct Distribution of Drugs Generates Highest Revenue in Market

Based on distribution channel, the direct category held the largest share in market during the historical period (2014–2019), and it will keep doing so during the forecast period. Though over the past few years, e-commerce penetration has increased, the direct mode of distribution still continues to be preferred, as dermatology drugs are majorly sold by the manufacturers themselves.

Rising Patient Footfall Propels Growth of Hospital Category

Hospitals were the largest end user in the industry in 2019, and they are further expected to hold the largest share during the forecast years. This is mainly attributed to the increasing prevalence of skin diseases and rising patient footfall at hospitals for their management. Moreover, with the growing pollution and ozone layer depletion rate, the rising number of skin cancer cases are expected to aid the growth of this category.

High Prevalence of Skin Diseases Supports Domination of North American Market

North America accounted for the major share in the dermatology drugs market in 2019, and it is expected to continue to dominate the industry throughout the forecast period. This would be due to the increasing awareness on skin diseases and their treatment, presence of numerous established players in the region, high disposable income of the population, and frequent product launches.

Increasing Disposable Income Is Expected To Positively Impact Asia-Pacific (APAC) Market

Globally, APAC is expected to advance with the highest CAGR in the dermatology drugs market during the forecast period. The major factors responsible for this would be the increasing disposable income, growing number of skin cancer cases, and presence of key players in APAC countries and their engagement in strategic activities to attain a significant market position.

Additionally, the increasing spending in fast-growing economies, such as China and India, on the improvement of the healthcare infrastructure is creating huge revenue generation opportunities for the biopharmaceutical companies in the region. For instance, according to the World Bank, the healthcare expenditure of China was 4.88% of its gross domestic product (GDP) in 2015, which increased to 5.15% in 2017.

Product Approvals Are Key Market Trend

The most-prominent trend in the dermatology drugs market is the product approvals being given by the regulatory agencies. For instance, in May 2020, Sanofi S.A. received the approval of the USFDA for Dupixent (dupilumab) for the treatment of moderate-to-severe atopic dermatitis. Similarly, in April 2020, Bausch Health Companies Inc. and its dermatology business Ortho Dermatologics received the USFDA approval for JUBLIA (efinaconazole) topical solution for the treatment of onychomycosis.

Increasing Incidence of Dermatological Diseases Is Boosting Market Growth

Skin diseases are among the leading causes of the non-fatal disease burden globally. Aging, trauma, and environmental and genetic factors can result in skin diseases. According to the World Health Organization (WHO), skin diseases, which are among the most-common human health disorders, affect almost 900 million people across the world at any given time. Some of the most-common skin diseases reported globally are pyoderma, scabies, acne, eczema, and warts. Acne is the most-common skin condition in the U.S., affecting up to 50 million Americans annually. Furthermore, according to the National Eczema Association, in 2019, 31.6 million people in the U.S. had some form of eczema. Thus, associated drugs are expected to be in a high demand owing to the increasing number of dermatological disease cases, in the coming years.

Growing Awareness on Skin Diseases Is Driving Market

The increasing awareness related to skin diseases is another key growth factor for dermatology drugs market. Several medical product companies engage in programs to create awareness about skin diseases. For instance, in June 2020, Microbiome Connect Skin USA, a virtual summit, was conducted by Kisaco Research in order to recognize the value of skin-microbiome-based products as the next step in a consumer’s skincare regime. Thus, owing to the rising awareness on skin diseases, the demand for dermatology drugs will increase in the coming years.

Increasing Personal Care Spending Is Driving Demand for Dermatology Drugs

With the rise in the disposable income, healthcare spending has increased over time. As reported by the Organisation for Economic Co-operation and Development (OECD), the U.S. recorded a 2.3% increase in its disposable income in 2017 from the previous year. Moreover, the OECD reported that in 2016, around 3% of the total healthcare spending in Germany was for skin diseases. Thus, as people are becoming aware about various skin diseases, they are spending a considerable share of their income on dermatology and related services, which has given a boost to the growth of the dermatology drugs market.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$25,228.2 Million |

Forecast Period CAGR |

8.8% |

Report Coverage |

Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Analysis, Companies’ Strategic Developments, Product Benchmarking, Company Profiling |

Market Size by Segments |

By Treatment, By Prescription Mode, By Therapy Area, By Distribution Channel, By End User, By Region |

Market Size of Geographies |

U.S., Canada, Germany, U.K., France, Italy, Spain, Japan, China, India, Brazil, Mexico, South Africa, Saudi Arabia, U.A.E. |

Secondary Sources and References (Partial List) |

African Society of Dermatology and Venerology, American Academy of Dermatology, American Dermatological Association, Asian Academy of Dermatology and Venerology, Brazilian Society of Dermatology, British Association of Dermatologists, Canadian Dermatological Association, World Health Organization, Organisation for Economic Co-operation and Development |

Explore more about this report - Request free sample

Market Players Are Introducing New Products to Gain Competitive Edge

The dermatology drugs market has various players, such as Bausch Health Companies Inc., Novartis AG, Pfizer Inc., Johnson & Johnson, Merck & Co. Inc., and AbbVie Inc.

In recent years, players in the dermatology drugs industry have pursued product approvals in order to stay ahead of their competitors. For instance:

- In July 2020, Janssen Pharmaceutical Companies, part of Johnson & Johnson, received the approval of the USFDA for TREMFYA (guselkumab) for the treatment of adults with active psoriatic arthritis, a chronic progressive disease characterized by painful joints and skin inflammation.

- In April 2019, AbbVie Inc. announced that it has received the approval of the European Commission (EC) for SKYRIZI (risankizumab) for the treatment of plaque psoriasis. With this approval, the marketing of SKYRIZI in all member states of the European Union, as well as Iceland, Liechtenstein, and Norway, was permitted.

The Key Players in the Dermatology Drugs Market Include:

-

Bausch Health Companies Inc.

-

Novartis AG

-

Pfizer Inc.

-

Bristol-Myers Squibb Company

-

Johnson & Johnson

-

Merck & Co. Inc.

-

Amgen Inc.

-

AbbVie Inc.

-

Eli Lilly and Company

-

Galderma S.A.

-

GlaxoSmithKline plc

-

Mylan N.V.

-

LEO Pharma A/S

-

Sanofi S.A.

Dermatology Drugs Market Size Breakdown by Segment

The global dermatology drugs market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Treatment

- Topical Corticosteroids

- Retinoids

- Biologics

- Calcineurin Inhibitors

- Antihistamines

- Hormone Therapy

Based on Drug

- Humira

- Remicade

- Otezla

- Stelara

- Enbrel

- Cosentyx

- Neoral

- Taltz

- Cubicin

- Canesten

- Zyvox

- Dupixent

- Protopic

- Valtrex

- Eucrisa

Based on Prescription Mode

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

Based on Therapy Area

- Psoriasis

- By prescription mode

- Atopic Dermatitis

- By prescription mode

- Acne

- By prescription mode

- Rosacea

- By prescription mode

- Skin Cancer

- By prescription mode

- Scar

- By prescription mode

Based on Distribution Channel

- Direct

- Wholesale/retail

- Online

Based on End User

- Hospitals

- Clinics

- Cosmetic centers

- At-home

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Asia-Pacific (APAC)

- Japan

- China

- India

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA)

- Saudi Arabia

- U.A.E.

- South Africa

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws