Data Monetization Market Analysis

Explore In-Depth Data Monetization Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Report Code: 12373

Explore In-Depth Data Monetization Market Analysis, Covering Detailed Segmentation and Geographical Insights for the Period of 2019 to 2032

Solutions are the larger bifurcation in the market on account of the growing focus on using data to make business decisions. All small and large IT companies offer standard and customized data analytics and interpretation software for numerous applications across industries. Additionally, their integration with AI technologies and their availability over the cloud have raised the interest in data-driven decision making.

The services category is the faster-growing, with a CAGR of 19.0%, over the forecast period. This is because users generally require extensive consulting and training before they can use any advanced software. Then, they incur recurring expenses for software operations and maintenance, data backup and disaster recover, and regular upgrades. The emergence of the cloud concept has led to an evolution of the space, with many third parties offer extracted data along with insights as a service over the cloud.

We have analyzed these components:

The analytics-as-a-service method accounts for the largest market share, of 40% in 2024, and the category is also expected to have the highest CAGR. This is owing to its flexible nature, which provides data analytics in real-time with the help of business intelligence and analytics platform.

Embedded analytics is the second-largest revenue-generating method in the market. This is because developers are using embedded analytics in their applications to increase customer satisfaction and offer more robust, visually appealing analytics functions, along with leveraging competitive advantage so as to offer innovative services to their customers and upscale their market position. The most popular use cases of embedded analytics include reporting, data analytics, predictive analytics, machine learning, and data discovery. Moreover, enterprises are largely embedding analytics in their ERP and CRM applications.

The insight-as-a-service method of data monetization category is also significant. This is owing to the increasing trend of big data analytics, cloud computing, and customized insights, and the evolution of the IoT sector along with the swelling market competitiveness and the growing necessity for customer management. Furthermore, firms are focusing on providing specific services in order to offer better customer experience, and attaining operational efficiency at a lower cost and reduced time are also increasing the need for insights services in the data monetization market.

The following methods are covered:

The BFSI sector is the largest end user of data monetization solutions in 2024. This is owing to the increasing number of accounts in banks as well as other financial institutions, resulting in the daily generation of massive amounts of data. Moreover, the payments data monetization trend is driven by the evolving customer expectations, growing margin pressure and competition, and migration to real-time payment infrastructures and ISO 20022, is also boosting the market growth.

The telecommunications & IT sector is the second-largest end user in the market. This can be attributed to the increasing volume of data flowing through telecom networks, as a result of the rising number of smartphones and other mobile devices. Also, telecom operators are using data monetization to reduce customer churn rate.

E-commerce & Retail will have the highest CAGR, of 20.0%, over the forecast period. This is due to the central role data analysis plays in this industry in augmenting revenue, aligning inventories and offerings, marketing and promoting the offerings, and engaging with customers. Retail & e-commerce companies use customer data captured from various channels, including own and third-party shopping portals, social media, blogging and video streaming websites, search engines, smart TVs, and smartphone and desktop applications. To gain an edge over competitors, companies analyze user behavior to offer better recommendations, offer discounts, suggest nearby stores, and offer value additions.

The below-mentioned end users are part of the research scope:

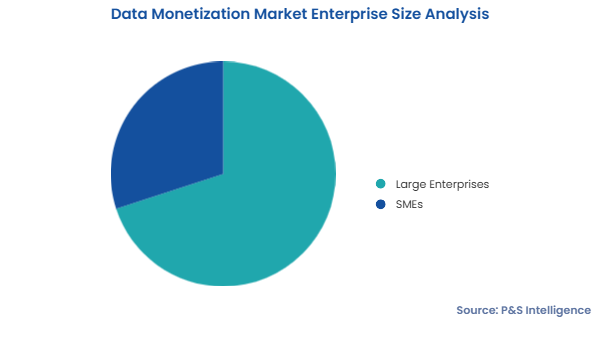

Large enterprises dominate the market with 70% share, as they are continually adopting new and developed technologies, in order to get a larger market share and boost overall production and efficiency. Moreover, large corporations have large corporate networks and numerous revenue streams. As a result, they generate a massive amount of data.

The SMEs category is projected to witness a higher during the forecast period, owing to the large numbers of startups that utilize data analytics for business decisions. The increasing availability of cloud-deployed solutions has widened the access to cutting-edge data analytics software and datasets, especially those integrated with AI technologies, easier for SMEs. These companies already account for over 90% of the businesses, 50% of the employment rate, and up to 40% of countries’ GDP contributions.

The segment is bifurcated as follows:

The cloud category is the larger, and it will also witness the higher CAGR during the forecast period, of 20.0%. This is attributed to the general benefits associated with cloud-based solutions, including scalability, reduction in the need for onsite computer upgrades, anywhere, anytime access, and pay-per-use subscription models. Moreover, the growing popularity of hybrid environments, wherein companies keep some of the data on-premises and the rest on the cloud boosts the market growth in this category. Further, vendors are increasingly integrating their cloud solutions with AI and other advanced technologies for more-efficient data analysis.

The report offers insights into the following deployment modes:

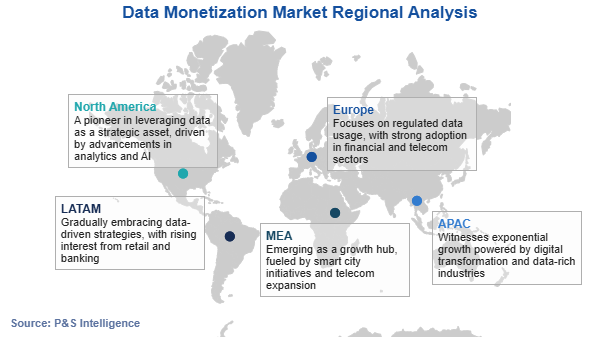

The North American data monetization market has 35% revenue share in 2024, due to the rise in the penetration as well as the adoption of data monetization services, software, and platforms, and the presence of a large number of data providers in the region.

In North America, the U.S. is a larger revenue contributor with a maximum number of data monetization vendors headquartered in the country. However, the Canadian market is expected to grow significantly at a CAGR of 18.5% during the forecast period. This can be ascribed to the surging integration of digital technologies into organizational processes across industries and the increasing need for data monetization solutions to acquire actionable insights from massive volumes of data generated by digitized business operations every day.

The APAC market is projected to witness the highest CAGR, of 19.0%, during the forecast period. The increasing adoption of digital services, such as IoT, mobility, AI, cloud, and over-the-top services, and the rising investments in technological updates in the region are the major factors boosting the market growth.

China is the largest revenue generator in the regional market, holding a share of around 40% in 2021, and the country market is likely to project the fastest growth, advancing at a CAGR of 27.6%, during the forecast period. This is attributed to the presence of a large number of MSMEs and major firms, as well as the constant digitization of business processes, and the increase in the volume of data generated every day. The growing enterprise rivalry is also pushing organizations to capitalize on the value of data, which, in turn, increases the adoption of data monetization solutions.

India is also one of the significant economies in the region, which is expected to capitalize on data monetization, owing to the favorable government regulations. For instance, in February 2022, the national government published a policy ‘Draft India Data Accessibility & Use Policy 2022’ for all the data collected, generated, and stored by every government ministry and department, under which all the data will be open and shareable barring certain exceptions.

Also, the Ministry of Electronics and Information Technology (MeitY) has floated a contemporary draft coverage known as the ‘National Data Governance Framework Policy’, which recommends that non-public firms be stimulated to share non-personal information with startups and Indian researchers via a proposed initiative known as the India Datasets program.

Below is the regional analysis of this market:

Want a report tailored exactly to your business need?

Request Customization

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws

Customize the Report to Align with Your Business Objectives

Request the Free Sample Pages