Crotonic Acid Market Future Prospects

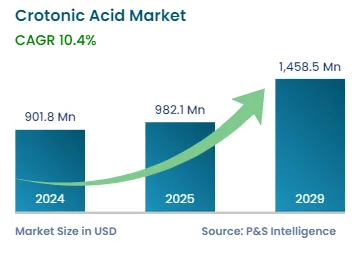

The global crotonic acid market stood at USD 901.8 million in 2024, which is expected to reach USD 1,458.5 million by 2029, demonstrating a CAGR of 10.4% during the forecast period (2025–2029). The growth can be attributed to the rising consumption of crotonic acid-based copolymer dispersions for adhesives, paints, and coatings, which yield better adhesion performance.

The construction industry is growing at a significant pace in countries, such as Sweden, the U.S., China, India, Canada, Australia, and the U.K., owing to the rising population and increasing import and export of construction materials. This has resulted in large-scale investment in construction projects, such as hotels, apartments, offices, retail centers, and civic infrastructure. For instance, the residential sector in India is on an increasing trend, with government support and initiatives that are further boosting the demand. For instance, the Ministry of Housing and Urban Development (MoHUA) allocated the funds of INR 76,549.46 crore in the 2022–23 budget for the construction of houses and the creation of funds in order to complete the halted projects.

Home sales in India's seven most-prominent cities, including Mumbai, New Delhi, and Bangalore, increased by 36% in the July–September quarter of 2023 from the same period the previous year to more than 112,000 units, with an 8–18% increase in prices, according to data released by the Economic Times.

Crotonic acid-based copolymer coatings, being bio-compatible, are used in the pharmaceutical and personal care industries. A mixture of crotonic acid and vinyl acetate forms a copolymer, which is used as a film-forming agent in aerosol hair sprays and other hair preparations. The copolymer resin helps to preserve the curl and shape of the hair after styling. An increasing number of hair problems among men and women across the globe is expected to drive the demand for haircare products; thereby stimulating the demand for crotonic acid.