Report Code: 11092 | Available Format: PDF | Pages: 165

Coding and Marking Systems Market Research Report: By Technology (Continuous Inkjet, Thermal Transfer Overprinting, Thermal Inkjet, Drop on Demand, Print & Apply Labeling, Laser Coding & Marking), Material (Paper & Cardboard, Plastic, Metal), End User (Food & Beverages, Electrical & Electronics, Automotive & Aerospace, Chemicals, Healthcare) - Global Industry Analysis and Demand Forecast to 2030

- Report Code: 11092

- Available Format: PDF

- Pages: 165

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Coding and Marking Systems Market Overview

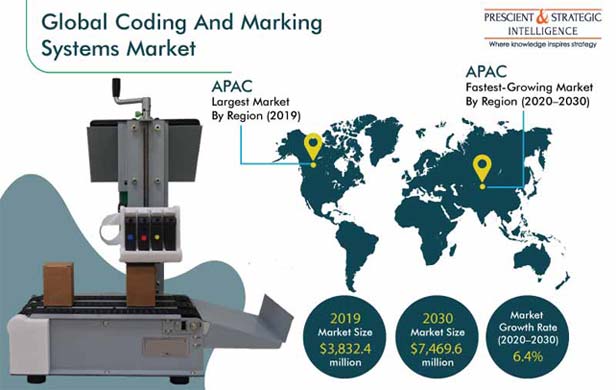

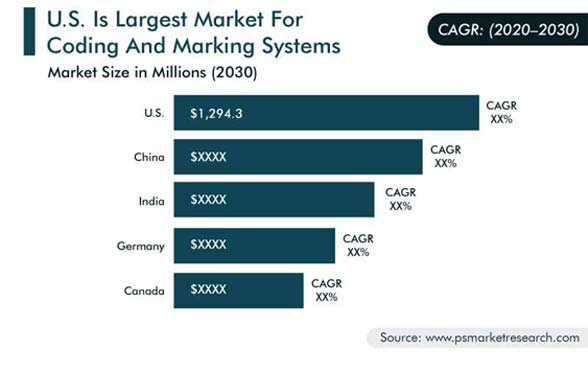

The global coding and marking systems market size stood at $3,832.4 million in 2019, and it is expected to demonstrate a CAGR of 6.4% during the forecast period (2020–2030). One of the key growth factors for the coding and marking systems industry is the growing product application in the food & beverage and pharmaceutical industries, along with a surge in the demand for them from the automotive sector, owing to the increasing sales of electric vehicles.

Owing to the COVID-19 pandemic, several industries across the globe witnessed turmoil; hence, the coding and marking system uptake also witnessed a fall. The suspension of manufacturing activities worldwide led to a temporary erosion of the demand for the systems. In addition, severe repercussions befell the supply lines of the components required for the manufacturing of marking systems in 2020 Q1.

Continuous Inkjet Systems Accounted for Largest Market Share

In 2019, the continuous inkjet category accounted for the largest market size in the coding and marking systems industry, on the basis of technology. This is majorly attributed to the several benefits of the technology, which include high-speed printing and the ability to print characters on virtually any material. Additionally, the usage of the technology allows systems to run for long hours, with minimum servicing requirement, thus making their operations cost-effective.

Paper & Cardboard Category To Demonstrate Fastest Growth

The paper & cardboard category is expected to showcase the fastest growth, based on material, on account of the widespread usage of labels on packaged food products, along with on e-commerce packaging. The growing consumption of packaged food is further propelling the usage of paper and cardboard material for packaging. According to industry experts, the food packaging industry stood at $292.9 billion in 2018 and grew to $308.7 billion in 2019.

Food & Beverage Category To Generate Highest Revenue during Forecast Period

During the forecast period, the food & beverage category is expected to hold the largest share, on the basis of end user. Stringent government regulations across the globe regarding the safety and traceability of shipments have created an urge among producers to properly display the manufacturing date, nutritional facts, ingredient list, and manufacturer’s details on the primary or secondary packaging of food & beverage items. Additionally, supportive regulatory policies to prevent the entry of counterfeit products in the market, along with technological advancements, is expected to drive the global coding and marking systems market.

Asia-Pacific (APAC) Accounted for Largest Share in Coding and Marking Systems Market

Globally, APAC held the largest revenue share in the coding and marking systems market in 2019, and the trend is likely to continue during the forecast period. This is majorly attributed to the stringent government regulations, increase in food production, and surge in the export of packaged food items. Additionally, with the rising population in the region, food consumption in the region is likely to increase, thereby further propelling the packaged food & beverage sector.

APAC To Demonstrate Fastest Growth during Forecast Period

The importance of coding and marking in the APAC region has increased manifold in recent years, owing to the rapid penetration of counterfeiting and piracy in most of the industries. According to the data published by the United Nations Office on Drugs and Crime (UNODC), on average, globally, more than 50% of the counterfeit medical products are sourced from China and India every year.

Additionally, a significant number of counterfeit products, particularly electrical and electronic items, such as computers and smartphone tablets, are manufactured in North Korea, Myanmar, and Vietnam. In order to prevent the penetration of counterfeit products, governments of different countries have introduced legislative norms. Such stringent government regulations have impelled the end users in the region to use coding and marking systems to ensure proper labeling of the produced goods.

Environment-Friendly Coding Technologies Are Key Market Trend

Printing materials used in coding and marking systems are subject to regulations designed by the Restriction of Hazardous Substances Directive (RoHS) and the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) committee. Due to the regulations of these environmental protection agencies, manufacturers of coding and marking systems are being forced to decrease the use of hazardous solvents, such as methyl ethyl ketone (MEK), reduce the content of volatile organic compounds (VOC), and prevent smearing. These regulations are also impelling companies to focus on tackling the odor problem associated with printing consumables. For example, Videojet Technologies Inc. has developed printing consumables that do not acquire odors from their environment.

Growing Application of Coding and Marking Systems in Food & Beverage and Pharmaceutical Industries

The rising demand for such equipment from the food & beverage, pharmaceutical, and cosmetic industries is one of the primary factors driving the coding and marking systems market growth. The food & beverage industry captures the largest market share mainly due to the high demand from food & beverage companies end. The rising sales of packaged food, bottled water, fruit juices, and dairy products have fueled the growth of the packaged food & beverage industry across the globe.

Similarly, the growing demand for pharmaceutical packaging is supported by multiple factors, such as an increase in the awareness among manufacturers on the benefits of citing drug information on the package and rising penetration of blister packaging and special packaging in the pharmaceutical industry. Such factors are expected to drive the usage of such systems, in turn, boosting the coding and marking systems market advance during the forecast period.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$3,832.4 million |

Forecast Period CAGR |

6.4% |

Report Coverage |

Market trends, revenue estimation and forecast, segmentation analysis, regional and country breakdown, company share analysis, companies’ strategic developments, product benchmarking, company profiling |

Market Size by Segments |

Technology, material, end user, geography |

Market Size of Geographies |

U.S., Canada, Germany, France, Italy, U.K., Japan, China, India, South Korea, Brazil, Mexico, Saudi Arabia, South Africa, Turkey |

Secondary Sources and References (Partial List) |

American Chemical Society, American Hardware Manufacturers Association, Asia Print Association, Association of Visual Packaging Manufacturers, Brazilian Packaging Association, Central Intelligence Agency, Contract Manufacturing and Packaging Association |

Explore more about this report - Request free sample

Rising Demand from Automotive Industry

Coding and marking systems are widely used in the automotive sector to code part numbers or anti-counterfeit labels on automobile components, in order to stop the sale of counterfeit parts. Additionally, according to the Automotive Aftermarket Suppliers Association (AASA), the global automotive industry loses around $12.0 billion every year due to counterfeit products, such as brake pads, compression systems, suspension components, batteries, steering linkages, and lighting systems. In order to combat the threat of counterfeits, automotive manufacturers prefer scannable invisible anti-counterfeiting printing inks and barcodes. Such factors are expected to drive the coding and marking systems market in the coming time.

Market Players Launching Improved Products in order to Gain Competitive Edge

The coding and marking systems market is consolidated in nature, with the presence of few major players, including Danaher Corporation, Domino Printing Sciences plc, Dover Corporation, and Matthews International Corporation.

Coding and marking system manufacturers are launching a number of products in order to expand their portfolio, which, in turn, is expected to help them increase their clientele. For instance:

- In June 2020, Domino Printing Sciences plc announced that it will be introducing X630i, its first digital inkjet product offering for corrugated materials. Along with this automated inkjet printing solution, the company will also launch a new ink set based on the novel water-based ink technology.

- In October 2019, ATD Ltd. launched its new range of thermal inkjet printers — the IP2000 online printer and HC2000 handheld coder. The IP2000 thermal inkjet printer is a small-character coder, which delivers industrial printing solutions in one integrated unit. Likewise, the HC2000 is ATD’s first handheld thermal inkjet printer, which is a lightweight and portable coder.

Some of the Key Players in the Coding and Marking Systems Market Are:

-

Danaher Corporation

-

Domino Printing Sciences plc

-

Dover Corporation

-

Matthews International Corporation

-

ATD Ltd.

-

Hitachi Ltd.

-

Diagraph Group

-

ID Technology LLC

-

Inkjet Inc.

-

Overprint Packaging Ltd.

Coding and Marking Systems Market Size Breakdown by Segment

The coding and marking systems market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Technology

- Continuous Inkjet

- Thermal Transfer Overprinting

- Thermal Inkjet

- Drop on Demand

- Print & Apply Labeling

- Laser Coding & Marking

- Direct part marking (DPM)

- Laser coding

Based on Material

- Paper & Cardboard

- Plastic

- Metal

Based on End User

- Food & Beverages

- Electrical & Electronics

- Automotive & Aerospace

- Chemicals

- Healthcare

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- Italy

- U.K.

- Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East and Africa (MEA)

- Saudi Arabia

- South Africa

- Turkey

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws