Report Code: 11480 | Available Format: PDF | Pages: 126

Can Coatings Market by Material (Epoxy, Acrylic, Polyester), by Type (Exterior, Interior), by Application (Food Cans, Beverage Cans, General Line Cans, Aerosol Cans), by Geography (U.S., Canada, Germany, France, U.K., Italy, China, India, Japan, Brazil, Mexico, Saudi Arabia, South Africa) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11480

- Available Format: PDF

- Pages: 126

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Can Coatings Market Overview

The global can coatings market is estimated to be valued at $2,100.6 million in 2017 and is projected to reach $2,588.9 million by 2023, witnessing a CAGR of 3.5% during the forecast period. Expanding food and beverage industry and recyclability of cans are the key factors driving the market growth. Can coatings are the materials applied on the exterior and interior surface of the metal (mainly aluminum and tin) or steel cans to protect them from outer environmental factors and prevent corrosion or sulfide staining through internal contents.

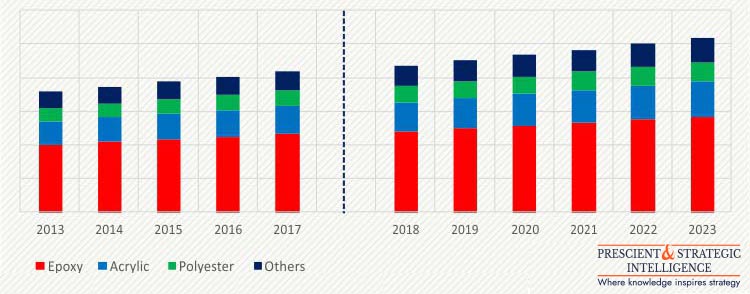

GLOBAL CAN COATINGS MARKET, BY MATERIAL, $M (2013-2023)

Based on material, the can coatings market has been categorized into epoxy, acrylic, polyester, and others; “others” include oleoresins, vinyl, phenolic, and polyolefins. Of these, epoxy held the largest share in the market, with a revenue contribution of more than 55.0% in 2017. The superior qualities of epoxy resins, such as resistance to aggressive media, high temperature, chemicals, corrosion, staining, and solvents, as exterior and interior coatings, is responsible for its major share in the global market.

On the basis of type, the can coatings market has been categorized into exterior and interior coatings. Of the two, the interior category contributed higher revenue to the can coatings market, amounting to more than 55.0% in 2017. This can be attributed to its high use in lining the internal surface of cans for protecting the inside products from coming in contact with the can metal.

The major applications of can coatings include food cans, beverage cans, general line cans, aerosol cans, and others; ‘others’ include cans used for packaging chemicals, pharmaceuticals, and customized products. Of these, beverage cans was the largest application area in the can coatings market, which accounted for more than 65.0% revenue in 2017. Beverage products are generally packed in cans as they are lightweight, made of unbreakable material, are recyclable, and are aesthetic to look at. This drives the use of coatings in beverage cans and is the reason behind the category’s largest share.

Geographically, North America has been the largest market for can coatings. The region contributed more than 35.0% share to the can coatings market in 2017 in terms of value. Increasing demand for these materials for packaging applications in different industries, such as food and beverage, healthcare, and personal care, is driving the market growth in the region.

Can Coatings Market Dynamics

Expanding food and beverage industry is the major factor driving the can coatings market growth. Additionally, rising demand for can coatings in emerging economies is providing ample growth opportunities to the players in the market.

Drivers

The global food and beverage industry has witnessed substantial growth over the last decade, which is expected to continue in the coming years. This can be majorly attributed to the rise in disposable income, growth in population, increase in government regulations, and rise in awareness among people regarding health. Can coatings play a significant role in metallic packaging applications in the food and beverage industry, as they help protect the products in cans from external environmental factors, act as a barrier between the internal surface and contents of can, and lend aesthetic appeal to them. Some of the food and beverage products packed in cans include soft drink, beer, flavored milk, meat, health drink, mushroom, and corn.

Companies are also investing hugely in R&D and product development to attract customers and increase their product sales. In addition, ready-to-eat and ready-to-drink food and beverages are in high demand globally and are usually available in cans in the market. Altogether, the above-mentioned factors are indicating that the expanding food and beverage industry is expected to contribute to the growing demand for cans globally. This in turn is projected to drive the growth of the can coatings market during the forecast period.

Opportunities

The emerging economies in different regions such as Asia-Pacific (APAC), Latin America (LATAM), and Middle East & Africa (MEA) are witnessing rapid industrial growth and development in various industries such as food and beverage, personal care, and health care. Different products under these industries make use of cans for their packaging, selling, and transportation. Food and beverage products offered in cans are considered to have longer shelf life and free from contaminants compared to their counterparts. Personal care and medicated products such as deodorants, shaving foams, energy drinks, spray medication, protein powder, and cosmetics are stored and sold in aerosol or general cans.

The above-mentioned products are being increasingly adopted in various developing countries such as China, India, and South Korea, owing to strong economic growth, increasing awareness and health concerns, rising disposable income, and R&D of products in these countries, leading to new launches during the forecast period. These factors are projected to increase can consumption during the forecast period, which in turn would use can coatings, thereby laying growth opportunities for the can coatings market.

Can Coatings Market Competitive Landscape

Some of the major players operating in the global can coatings market are Akzo Nobel N.V., Eastman Chemical Company, ALTANA AG, Kansai Paint Co. Ltd., National Paints Factories Co. Ltd., PPG Industries Inc., TIGER Coatings GmbH & Co. KG, Toyo Ink SC Holdings Co. Ltd., The Sherwin-Williams Company, and VPL Coatings GmbH & Co KG.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws