Report Code: 12007 | Available Format: PDF | Pages: 148

Bromine Market Research Report: By Derivative (Hydrogen Bromide, Bromide Salts, Organobromide), Application (Flame Retardants, Clear Brine Fluids, Pharmaceuticals, Water Treatment) - Global Industry Analysis and Growth Forecast to 2030

- Report Code: 12007

- Available Format: PDF

- Pages: 148

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

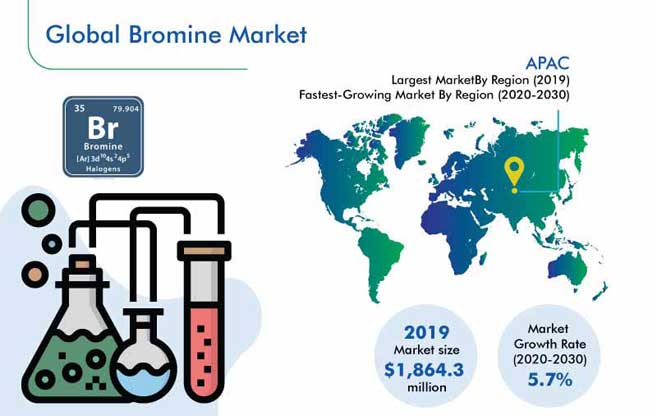

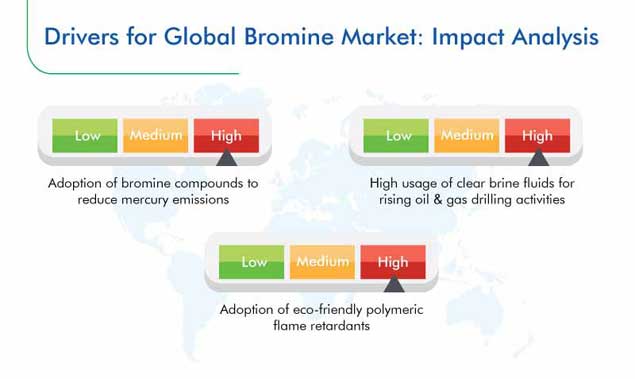

The bromine market revenue stood at $1,864.3 million in 2019, and it is projected to witness a CAGR of 5.7% during 2020–2030. The key factors behind this growth are the surging usage of bromine compounds to reduce mercury emissions, increasing adoption of eco-friendly polymeric flame retardants, and soaring consumption of clear brine fluids while drilling for oil and gas.

Segmentation Analysis of Bromine Market

The organobromide category, under the derivative segment of the bromine industry, accounted for the largest share in 2019. This was due to the high-volume consumption of organobromides, such as ethylene dibromide, propylene bromide, vinyl bromide, and allyl bromide, in the production of fumigants, solvents, gasoline antiknock agents, catalysts, intermediates for organic synthesis, flame retardants, and pesticides.

In the coming years, the clear brine fluids category, within the application segment, will record the fastest growth due to the increasing consumption of this material during oil and gas drilling activities.

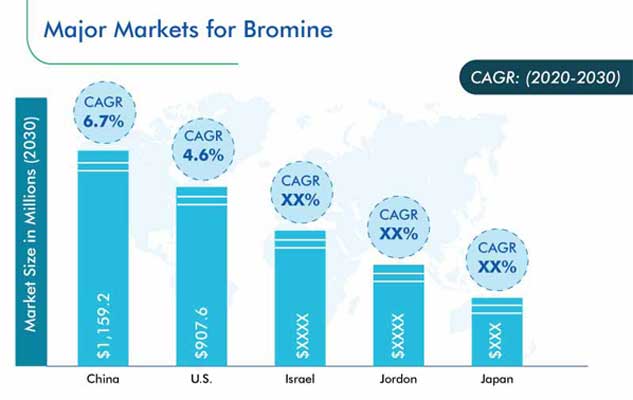

During 2014–2019, the Asia-Pacific (APAC) market for bromine generated the highest revenue on account of the high-volume production and consumption of bromine in China. The leading position of China can be owed to the growing number of derivative manufacturing plants in the country on account of the abundant availability of bromine in nature, cost-effective labor, and a large customer base.

Moreover, the APAC bromine market growth is driven by the wide-scale consumption of bromine-based flame retardants in insulation and plastic and electronic products in the region. The high demand for these products can be ascribed to the high disposable income of the people and rapid urbanization in APAC.

Increasing Usage of Clear Brine Fluids in Oil and Gas Drilling Activities Fueling Market Advance

Clear brine fluids are used in oil and gas drilling activities as they can reduce the bottom hole pressure and temperature in the borewells. Several soluble salts are added to these fluids after considering the freezing points, clarity, densities, and temperature/pressure freeze points of the wells. Brines display faster shale penetration, improved wellbore stability in the salt, and lesser fine-hole formation, gauge, and fill damage, as compared to other fluids. Moreover, the usage of brine reduces the initial cost of setting up the casting for the mud, for drilling.

Rising Adoption of Bromine-Based Storage Technology for Grids Widening Growth Opportunities

The requirement for efficient energy storage technologies is rising due to the surging production of non-conventional energy. Bromine-based technology has emerged as a cost-effective solution for storing clean energy owing to the continuous research and development (R&D), which is propelling the bromine market advance. This technology is being widely adopted in grids because batteries powered by it does not require a change in their electroactive materials for recharging.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Market Size by Segments |

Derivative, Application |

Market Size of Geographies |

U.K., Ukraine, Germany, Belgium, France, U.K., Spain, China, India, Japan, Israel, Jordan |

Explore more about this report - Request free sample

Capacity Expansion is Strongest Strategic Move in Market

To increase their revenue by catering to the rising demand for the gas and its derivatives, bromine market players are radically expanding their manufacturing capacity. For instance, in September 2019, the Industrial Products division of Israel Chemicals Limited announced its intentions to increase the annual production capacity of the gas and its derivatives, such as tetrabromobisphenol A, to around 25,000 tons by 2021.

Similarly, LANXESS AG announced capacity expansion plans for phosphorus- and bromine-based flame retardants, in December 2018, to strengthen its bromine asset base.

Major players in the global bromine market are Gulf Resources Inc., LANXESS AG, Jordon Bromine Company Limited, Hindustan Salts Limited, Tetra Technologies Inc., Tosoh Corporation, Israel Chemicals Limited, Albemarle Corporation, Perekop Bromine, and Tata Chemicals Limited.

Market Size Breakdown by Segment

The bromine market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Derivative

- Hydrogen Bromide

- Bromide Salts

- Organobromide

Based on Application

- Flame Retardants

- Clear Brine Fluids

- Pharmaceuticals

- Water Treatment

Geographical Analysis

- North America

- U.S.

- Europe

- U.K.

- Germany

- France

- Spain

- Belgium

- Ukraine

- Asia-Pacific (APAC)

- China

- Japan

- India

- Rest of World (ROW)

- Israel

- Jordan

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws