Report Code: 11021 | Available Format: PDF | Pages: 255

Automotive Window and Sealing Systems Market By Component (Glass Run Channel, Waist Belt Seal, Roof Ditch Molding, Hood Seal, Trunk Seal, Front Windshield Seal, Door Seal, Rear Windshield Seal, Sunroof Seal, Encapsulated Glass, Corner Molding, End Cap), By Material (TPE, TPV, EPDM), By Application (Passenger Cars, Commercial Vehicles, Electric Vehicles), By End Use (OEMs, Aftermarket), By Region (U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Netherlands, China, Japan, India, South Korea, Brazil, Russia) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2025

- Report Code: 11021

- Available Format: PDF

- Pages: 255

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Valued at $21.7 billion in 2017, the global automotive window and sealing systems market is expected to surpass $38.7 billion by 2025, witnessing a CAGR of 7.6% during 2018–2025.

Globally, APAC is expected to continue being the largest automotive window and sealing systems market in the coming years. The region contributed more than 45% volume share to market in 2017. The market in the region is primarily driven by increasing automotive production in developing economies.

Fundamentals Governing Automotive Window and Sealing Systems Market

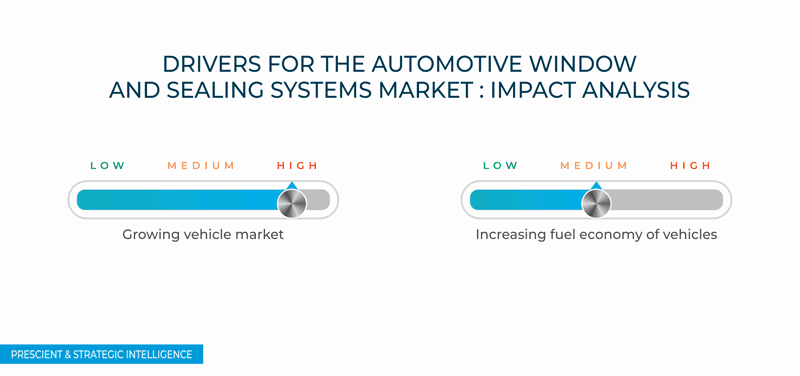

Growing inclination of original equipment manufacturers (OEMs) toward lightweight sealants is the latest trend observed in the automotive window and sealing systems market. Lightweight sealants help increase fuel efficiency of automobiles, as the reduction in vehicle’s weight directly lowers the fuel usage. With advancements in sealing technology, the OEMs are now able to produce high-performance engineered solutions for aerospace, automotive, and industrial sealing applications.

Increasing vehicle market is one of the key factors boosting the automotive window and sealing systems market growth. With the growing urbanization in developing economies across the world, such as China, India, and Indonesia, the demand for passenger and commercial vehicles is on the rise. Disposable income has increased in both developing and developed economies, leading to better living standard. Consumers are readily spending a part of their increased disposable income on vehicles, which in turn, is contributing to the increased demand for vehicles for both personal and commercial uses. This substantial growth in sales of these vehicles is positively impacting the automotive window and sealing system sales, thereby driving the growth of the market.

Automotive Window and Sealing Systems Market Segmentation Analysis

On the basis of component, the glass run channel category contributed the largest revenue to the automotive window and sealing systems market in 2017. This is mainly attributed to the high utilization of glass run channels by both OEMs and aftermarket users, and increase in research and development activities for alternative materials to meet the requirement of the automotive cockpit industry.

Based on application, passenger cars held the largest share in the automotive window and sealing systems market in 2017. The category is expected to dominate the market in the coming years as well, owing to the increasing sales of passenger cars globally.

Competitive Landscape of Automotive Window and Sealing Systems Market

The global automotive window and sealing systems market is fragmented in nature, with the presence of key players, such as Cooper Standard Holdings Inc., Hutchinson Sealing Systems Inc., and Toyoda Gosei Co. Ltd. Cooper Standard Holdings Inc. held the highest share in the market in 2017. Whereas, Hutchinson Sealing Systems Inc. was the second biggest player in the market.

Recent Strategic Developments of Major Automotive Window and Sealing Systems Market Players

In recent years, major players in the automotive window and sealing systems market have taken several strategic measures, such as facility expansions and partnerships. For instance, in June 2018, Cooper Standard Holdings Inc. announced the construction of a new 100,000-square-foot rubber-manufacturing facility in Aguascalientes, Mexico. With an investment of $11 million into this facility, the company aims to localize elastomer mixing capabilities and boost its growth in Mexico. In April 2018, Magna International Inc. entered into a joint venture with GAC Component Co. Ltd. (GACC), a GAC subsidiary, to manufacture composite liftgates for a crossover vehicle to be offered by a global automaker (name undisclosed).

Key Questions Addressed/Answered in the Report

- What is the current scenario of the global automotive window and sealing systems market?

- What are the historical size and the present size of the market segments and their future potential?

- What are the major catalysts for the market and their impact during the short, medium, and long terms?

- What are the evolving opportunities for players in the market?

- Which are the key geographies from the investment perspective?

- What are the shares of major players operating in the market?

- What are the key strategies adopted by major players to expand their market shares?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws