Report Code: 11453 | Available Format: PDF | Pages: 152

Automotive NVH Materials Market by Type (Rubber, Foam, Polyvinyl Chloride, Metal Sheet, Cork, Felt), by Application (Sound Absorption, Insulation, Vibration Damping), by Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles), by Geography (U.S., Canada, Germany, U.K., France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Saudi Arabia, South Africa) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11453

- Available Format: PDF

- Pages: 152

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Automotive NVH Materials Market Overview

The automotive noise, vibration, and harshness (NVH) materials market is estimated to be valued at $7,579.8 million in 2017 and is projected to reach $11,467.5 million by 2023, witnessing a CAGR of 7.2% during the forecast period. The growing demand for lightweight vehicles and increasing automobile sales are the major factors driving the growth of the market.

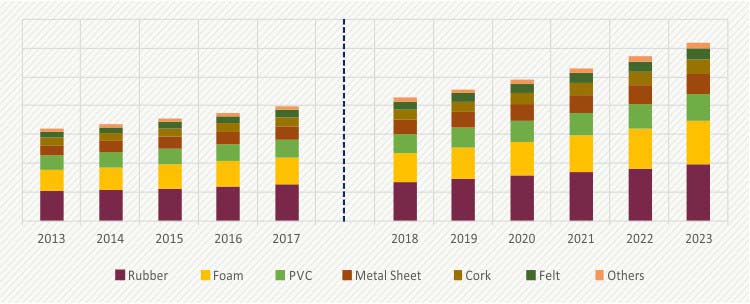

GLOBAL AUTOMOTIVE NVH MATERIALS MARKET, BY TYPE, KILOTONS (2013–2023)

Automotive NVH materials refer to the substances or agents that are capable of reducing or blocking NVH originating from vehicle parts such as engine box, steering wheel, and brakes and accelerator paddles. Generally, NVH is sensed at the steering wheel, engine box, seat, armrests, and the floor and pedals of the vehicle.

Based on type, the automotive NVH materials market is categorized into rubber, foam, polyvinyl chloride (PVC), metal sheet, cork, felt, and others. The other types include fiberglass and resins. Rubber has been the largest category in the market, with an estimated volume sales contribution of more than 30.0% in 2017. Rubber provides noise absorption and vibration damping; further, owing to its unique physical properties of high density and consistency, it is accepted as the ideal sound absorbing material in vehicles.

On the basis of application, the automotive NVH materials market is segmented into sound absorption, insulation, and vibration damping. During the forecast period, the demand for NVH materials is expected to witness the highest growth for sound absorption application, with a CAGR of 7.8%. The growth in demand of these materials for this application category is mainly driven by high number of complaints of unwanted noise from vehicle parts, globally.

In terms of vehicle type, the automotive NVH materials market is segmented into passenger vehicle, light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs). Passenger vehicles has been the largest category in the market, with an estimated revenue contribution of more than 60.0% in 2017. The high demand of passenger vehicles, coupled with the various safety regulations put forth by various government bodies for developing quieter and safer cars, is resulting in the category’s high share.

Automotive NVH Materials Market Dynamics

Emergence of bio-based polyurethane is the major trend witnessed in the automotive NVH materials market. In addition, the growing demand for lightweight vehicles, advances in material science field, and increasing demand for automobiles worldwide are the major factors driving the growth of the market.

Trends

In the current scenario, synthetic polyurethane is the material (NVH) of choice for all automotive NVH applications, owing to its light weight and excellent acoustic properties. However, with the perceptible shift toward more eco-friendly and comfortable cars, many automobile manufacturers have gradually begun to use natural materials such as sugarcane and soya for the development of bio-based polyurethane. These materials provide bio-based polyurethane with improved biodegradability and reduced carbon emissions from automotive parts, which in turn increases their demand over synthetic-based materials. Thus, the emergence of bio-based polyurethane is the major trend witnessed in the automotive NVH materials market.

Drivers

In the current scenario, vehicle weight reduction has become one of the major issues in the automotive industry. Light weight vehicles save energy, witness reduced brake and tyre wear as well as help cut down emissions. Lightweight vehicles also improve fuel economy and help in controlling NVH. As per the research study by Ottawa-Carleton Institute of Mechanical and Aerospace Engineering Carleton University in 2015, a vehicle mass reduction of about 15% decreases fuel consumption by 10% along with comparable reductions in emissions.

Further, Tecman Speciality Materials Ltd. has developed Neptune, an ultra-fine fibre that provides high sound absorption performance while being very lightweight. Hence, owing to the benefits of lightweight materials in reducing NVH, many vehicle manufacturing companies have increased their rate of NVH material consumption in order to cater to the growing demand. This is leading to the growth of the automotive NVH materials market.

The increasing demand for automobiles worldwide, on account of rapid urbanization, increasing disposable incomes, and changing lifestyles, directly accelerates the demand for noise control products in vehicles. With the increasing production of automobiles, the demand for NVH materials also increases as people are more inclined toward comfortable, lightweight, and eco-friendly vehicles. For instance, in 2016, around 88 million automobiles were sold worldwide, a 4.8% increase from the previous year. Further, in the U.S., the lightweight vehicle sales reached 17.5 million units in 2016. Hence, the increasing production of vehicles propels the automotive NVH materials market growth.

Restraints

The availability of substitute products to mitigate NVH in automobiles is limiting the growth of the automotive NVH materials market. NVH materials are of utmost importance in reducing noise and vibrations in vehicles. However, with the development in material sciences, advanced active noise control systems have been developed. These systems require less manual input and prevent the penetration of unwanted noise and vibrations to passenger cabins. Hence, the availability of such alternatives restrains the use of NVH materials in the automotive industry.

Automotive NVH materials market competitive landscape

Some of the major players operating in the global automotive NVH materials market are DowDuPont Inc., Exxon Mobil Corporation, Sumitomo Chemical Company Limited, Huntsman Corporation, Lanxess AG, Covestro AG, 3M Company, BASF SE, Mitsui Chemicals Inc., and Borgers SE & Co. KGaA.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws