Automotive Active Purge Pumps Industry Insights

Component Analysis

- DC motors dominate the market with 40% revenue share in 2024. This is because of DC motors’ crucial role of providing supply mechanical power to the automotive active purge pump.

- The DC motor integrates with the control system to automate the purging process, enabling control over the flow of fuel vapor. This enhances the fuel efficiency with minimal emission of the pollutants.

- The sensors category is projected to grow at the highest CAGR, of 22.8%, during 2024–2030. Sensors ensure accuracy, function timing, and safety, thus helping in reducing emissions and enabling regulatory compliance.

- Continuous monitoring of the fuel vapor level and pressure changes enhances the functionality of the pump, as well as enabling shutdown in the case of the detection of any abnormal condition, thus preventing damage to the vehicle.

Classifying on the basis of component, the following are the categories:

- DC Motors (Largest Category)

- Sensors (Fastest-Growing Category)

- Valves

- Actuators

- Others

Material Analysis

- The non-metal category holds the larger share in the market in 2024, of 65%. Purge pumps not made of metals are lightweight, durable, and flexible to design changes.

- Being cost-efficient and durable, non-metallic materials, such as high-strength plastics and advanced polymers, are widely used to manufacture these components. Further, their non-corrosive nature gives them a clear advantage over metals, as it reduces the effort in maintaining the pump and lessens the need for replacement.

- The advanced polymers used display stability amidst high temperatures and pressures, improve the performance, and enhance the mechanical properties of the vehicle, thereby resulting in higher fuel efficiency.

Based on material, the two categories are:

- Non-Metal (Larger and Faster-Growing Category)

- Metal

Vehicle Type Analysis

- The passenger vehicles category holds the larger share, and they will showcase the higher CAGR, of 22.6%, during the forecast period. With the rapid increase in population, the sales of passenger vehicles have risen significantly over the years.

- Now, customers seek vehicles with advanced features, minimal emissions, and high fuel efficiency, which directly propels the active purge pump market growth.

- Compliance with new regulations mandates passenger vehicles to have active purge pumps for emission control.

The following are the categories in the vehicle type segment:

- Passenger Vehicles (Larger and Faster-Growing Category)

- Commercial Vehicles

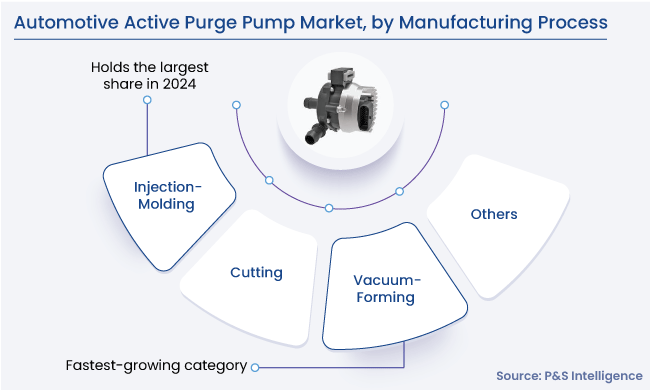

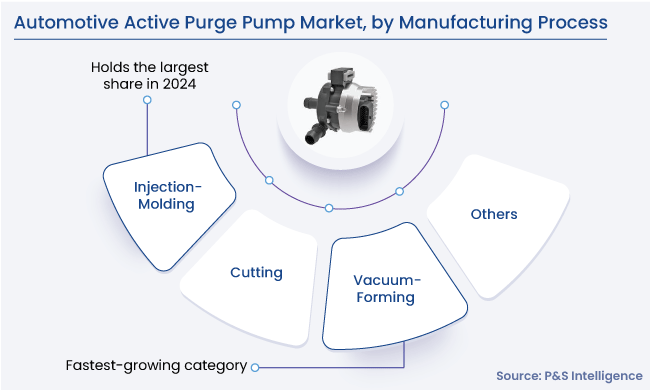

Manufacturing Process Analysis

- Injection-molding holds the largest share, in 2024, being highly efficient in saving time and money.

- The production of the purge pump is made easier by the injection-molding method as it enables an easier and more-precise way for making the complex and challenging parts for the machine.

- The vacuum-forming category is projected to grow at the highest CAGR, during 2024–2030.

- Owing to its minimalistic efforts, this method is gaining popularity rapidly among small-scale manufacturers for less-complicated and low-priced designs. Thus, the increasing competition among the players leads to the growth of the market in this category.

- It has a minimal probability of making a defective piece as it creates a consistent wall thickness from the start of the process, thus saving time and resources.

The following manufacturing processes are covered in the report:

- Injection-Molding (Largest Category)

- Vacuum-Forming (Fastest-Growing Category)

- Cutting

- Others

Sales Channel Insights

- OEMs dominate the market in 2024 with a share of 65%. The need for active purge pumps in large numbers for the continuously moving assembly lines has led to the dominance of OEMs on product sales.

- Most OEMs have long-term purchase contracts with the manufacturers of these systems, as vehicle orders keep piling up and timely delivery is key.

- The aftermarket bifurcation is projected to grow at the higher CAGR, of 22.7%, during 2024–2030.

- The aftermarket provides vehicle owners with customizable and cost-effective solutions.

- The challenge of compliance with strict emission regulations leads to a consistent demand for active purge pumps for retrofitting or replacement in vehicles, which increase the business for aftermarket entities.

The following are categories on the basis of sales channel:

- Original Equipment Manufacturers (OEMs) (Larger Category)

- Aftermarket (Faster-Growing Category)

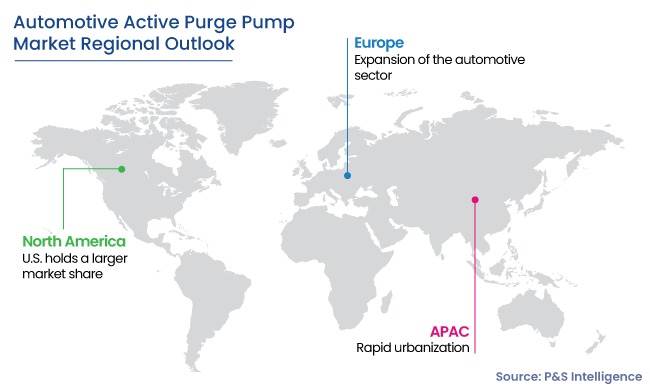

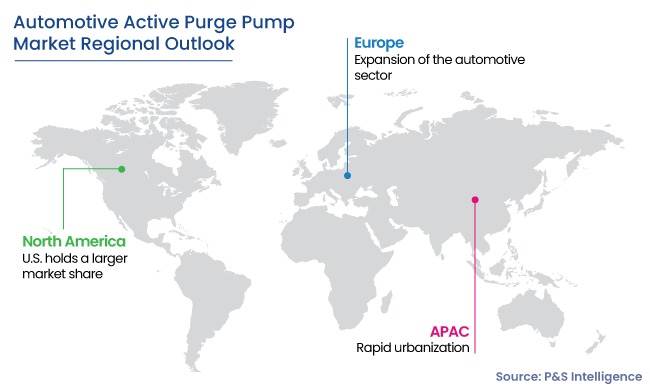

Geographical Analysis

APAC Region Dominates Market

- The Asia-Pacific region holds the largest share of around 45% in 2024, and is projected to grow at the highest CAGR, of 23.0%, during 2024–2030.

- The rapid urbanization and the large population in the region have led to the fast-paced growth in vehicle sales and emission levels, especially in major cities.

- The implementation of regulations to clean the air has led to a sharp increase in the purchase of automotive active purge pumps by OEMs as well as repair shops and garages.

- The European region holds significant share, in 2024, being the hub for many automotive manufacturers.

- The expansion of the automotive sector in the region is rapid, while new emission regulations have impelled OEMs to install these devices in all their latest models.

The regions and countries analyzed in this report include:

- North America

- U.S. (Larger and Faster-Growing Country Market)

- Canada

- Europe

- Germany (Largest and Fastest-Growing Country Market)

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- APAC (Largest and Fastest-Growing Regional Market)

- China (Largest and Fastest-Growing Country Market)

- Japan

- India

- South Korea

- Australia

- Rest of APAC

- Latin America (LATAM)

- Brazil (Largest and Fastest-Growing Country Market)

- Mexico

- Rest of LATAM

- Middle East and Africa (MEA)

- U.A.E. (Largest and Fastest-Growing Country Market)

- Saudi Arabia

- South Africa

- Rest of MEA