Report Code: 10308 | Available Format: PDF

Audiology Devices Market Revenue Forecast Report: Size, Share, Recent Trends, Strategic Developments, Segmentation Analysis, and Evolving Opportunities, 2023-2030

- Report Code: 10308

- Available Format: PDF

- Report Description

- Table of Contents

- Request Free Sample

Market Overview

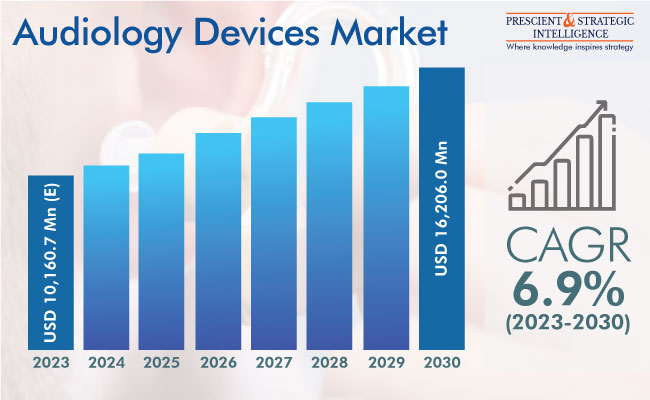

The audiology devices market revenue stands at USD 10,160.7 million (E) in 2023, and it will advance at 6.9% CAGR during 2023–2030, to reach USD 16,206 million by 2030. The growth of the industry is credited to the strong government support for easier hearing aid access, the surging elderly population, and the increasing incidence of hearing disorders.

Moreover, the surging count of government efforts to make people aware of hearing screening among older adults and infants will boost the progress of the industry. In addition, the advancements in technology, including the deployment of ML and AI in auditory products, are boosting the growth of the industry.

Additionally, the majority of the people are hesitant to wear hearing aids or find it hard to admit they have a hearing impairment. Misconceptions regarding hearing aids, social stigma, and low awareness have encouraged manufacturers to produce small, discreet, and hardly noticeable hearing aids, to meet the requirement of users.

Surging Prevalence of Hearing Loss Is Strong Market Driver

Hearing loss is the third-most common physical condition in the U.S., after arthritis and heart illnesses. The gradual loss of hearing can affect individuals of any age, differing from temporary to permanent and mild to severe, depending on the cause.

As per the WHO, more than 5% of the global population needs rehabilitation to address disabling hearing loss, and by 2050, more than 700 million people will have this condition. The hearing loss incidence rises with age, with more than 25% of the people over the age of 60 years affected by it. This increasing incidence is expected to boost the demand for diagnosis and treatment, which, in turn, will drive the advance of the industry.

Cochlear Implants Category To Observe Fastest Growth

Based on product, the hearing aids category dominates the industry in 2023. This is primarily attributed to the increasing requirement for complete-in-canal and invisible-in-canal hearing aids. Additionally, the recent launch of new products propels the category. For instance, Phonak unveiled its Vitro line of personalized hearing aids in September 2022.

The cochlear implants category is expected to observe the fastest growth during the projection period. The key driver for this category is the fact that these products can partially reverse hearing loss in the cases of damage to the ear structure. This is also because of the launch of new products by major companies, along with the increasing consciousness of consumers regarding their non-invasive nature.

For example, Cochlear Ltd. introduced a sound processor for a cochlear implants, named Nucleus Kanso-2, in August 2021. This small sound processor offers direct streaming from iOS or Android devices and connects with the company’s Nucleus Smart app.

The BAHA/BAHS category is also likely to observe lucrative growth, because of the technological innovations and surging investment in BAHA/BAHS. These surgically implanted devices are majorly popular among people who have at least one fully functional inner ear.

Retail Sales Category Has Largest Revenue Share

The retail sales category, based on sales channel, is the largest contributor to the industry. This is because of the existence of many big retail chains, including Walgreens, CVS, Amazon, and Walmart, around the world. Moreover, the increasing count of government initiatives for remote care and audiology care products is likely to boost the progress of this category.

The e-commerce category will observe the fastest growth during the forecast period. This is attributed to the increasing preference for online pharmacies and retail stores, particularly during the COVID-19 pandemic, and the surging utilization of smartphones. Furthermore, the convenience of shopping and the accessibility of various products offered by e-commerce drive the market.

The government purchases category is also likely to observe a substantial rise in its revenue contribution during this decade, because of the increasing consciousness regarding the sale of auditory devices under government programs. For instance, India’s National Programme for Prevention and Control of Deafness aims to prevent avoidable hearing loss and ease the access to the diagnosis and treatment of the condition, including the provision of hearing aids.

Usage of Digital Technologies To Grow Faster

The digital category, based on technology, leads the industry, and it is expected to advance at the higher rate during this decade. This is mainly because of the rapid adaptability of digital audiology devices.

The analog category will also advance at a considerable rate because of the microchip included in some analog hearing aids, which enable program setup for various listening environments. These variants are essentially popular because of the unadulterated sound delivery at a lower price.

Adults Are Leading Age Group Category

The adult category, based on age group, is the largest contributor to the industry, and it is likely to advance at a remarkable growth rate during the forecast period. This is attributed to the surging elderly population, along with the increasing consciousness regarding the available hearing devices and implants. Moreover, as per statistics about hearing published by the NIDCD, approximately 28.8 million adults in the U.S. could need hearing aids.

The pediatric category is expected to observe significant growth. This is because of the surging number of babies with congenital sensorineural hearing loss, as well as the fact that cochlear implants can effectively treat it.

| Report Attribute | Details |

Market Size in 2023 |

USD 10,160.7 Million (E) |

Revenue Forecast in 2030 |

USD 16,206 Million |

Growth Rate |

6.9% CAGR |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Explore more about this report - Request free sample

APAC To Observe Fastest Growth

The North American audiology devices market is the largest, because of the increasing number of audiologists, the arrival of advanced digital platforms, and the advancements in audiology systems. The introduction audiology systems that enable the easy handling of products, leads to patient compliance, thereby further boosting the expansion of the regional industry.

Around 30 million people in the U.S. are affected by hearing loss, and this results in a significant impact on social involvement, general health & wellbeing, and communication. The utilization of hearing aid reduces the severity or prevalence of cognitive decline, depression, and other health problems in the elderly. Moreover, these devices can also help in increasing social participation and bettering the life quality for patients.

The APAC industry is expected to witness the fastest growth, driven by the surging elderly population and the mounting incidence of hearing complications related to age. China and India have a huge elderly population, therefore generating rewarding growth opportunities. Moreover, the increasing healthcare expenses, rising product awareness, and rapidly enhancing healthcare infrastructure are boosting the growth of the regional industry.

Key Players in Audiology Devices Market Include:

- Siemens AG

- Demant A/S

- Cochlear Ltd.

- GN Store Nord A/S

- Starkey Laboratories Inc.

- Oticon Medical AB

- SeboTek Hearing Systems LLC

- MED−EL Elektromedizinische Geräte Gesellschaft m.b.H.

- Widex Holding A/S

- Beltone

- Sonova Holdings AG

- INVENTIS s.r.l.

- MAICO Diagnostics GmbH

- WS Audiology Denmark A/S

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws