Report Code: 11366 | Available Format: PDF | Pages: 120

Asia-Pacific (APAC) Air Quality Monitoring (AQM) Market by Product (Indoor [Fixed, Portable], Outdoor [Portable, Fixed, Dust & Particulate, AQM Station]), by Pollutant (Chemical, Physical, Biological), by Sampling Method (Continuous, Manual, Passive, Intermittent), by End User (Government Agencies & Academic Institutes, Commercial & Residential Sectors, Petrochemical Industry, Power Generation Plants, Pharmaceutical Industry), by Geography (Japan, China, India, Australia, South Korea, Singapore, Taiwan) - Market Size, Share, Development, Growth and Demand Forecast, 2013-2023

- Report Code: 11366

- Available Format: PDF

- Pages: 120

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

APAC Air Quality Monitoring Market Overview

The APAC air quality monitoring market generated $936.6 million revenue in 2017 and is projected to witness a CAGR of 10.0% during the forecast period, on account of increasing prevalence of respiratory diseases, large scale industrialization, and increasing pollution level.

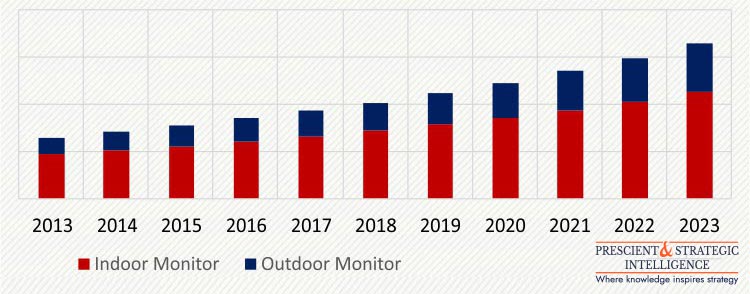

On the basis of product, the APAC air quality monitoring market is categorized into indoor monitors and outdoor monitors. Of the two, outdoor monitors are expected to witness faster growth in the market during the forecast period, with 11.6% CAGR.

APAC AIR QUALITY MONITORING MARKET, BY PRODUCT, $M (2013-2023)

Based on pollutant, the APAC air quality monitoring market is categorized into chemical, physical, and biological. Of these, chemical pollutants held the largest share in the market, accounting for 77.4% in 2017.

Based on sampling method, the APAC air quality monitoring market is categorized into continuous, manual, passive, and intermittent. Among all types, the sales from the continuous sampling method is expected to exhibit the fastest growth in the APAC air quality monitoring industry, registering a CAGR of 10.9% during the forecast period.

Based on end user, the APAC air quality monitoring market is categorized into government agencies and academic institutes, commercial and residential sectors, petrochemical industry, power generation plants, pharmaceutical industry, and others. Of these, government agencies and academic institutes held the largest share in the market, accounting for 35.8% contribution in 2017.

Geographically, Japan held the largest share in the APAC air quality monitoring market, accounting 24.4% revenue in 2017. This can be attributed to the development of products with the help of advanced technologies by various big players such as HORIBA Ltd., Thermo Fisher Scientific Inc., and others in the country.

APAC Air Quality Monitoring Market Dynamics

Growth Driver

Increasing prevalence of respiratory diseases is one of the drivers for the growth of the APAC air quality monitoring market. Large scale industrialization, increasing prevalence of smoking and increasing pollution levels are the several factors responsible for the occurrence of respiratory disorders.

According to the International Association for the Study of Lung Cancer, mortality due to lung cancer is higher than mortality due to breast, colon, and prostate cancers combined. As per the study, out of the total lung cancer deaths registered globally in 2014, 21% occurred in Asia. Smoking is one of the factors of lung cancer. Globally, China is the largest tobacco consumer with around 301 million tobacco smokers. The number of deaths due to smoking in China is projected to be 2 million in 2030.

APAC Air Quality Monitoring Market Competitive Landscape

As part of business strategy, companies are launching various products in the APAC air quality monitoring industry to increase their market share. For instance, in September 2017, HORIBA Ltd. introduced a new portable emissions measurement system (PEMS), as a direct response to new requirements and testing procedures for certifying passenger cars and light commercial vehicles. The OBS-ONE series measures concentrations of emissions, particulate matter, particle number, exhaust flow rate, monitors GPS data and environmental conditions, and calculates mass emissions. The three main products comprise OBS-ONE-GAS (Gas), OBS-ONE-PN (Particle Number) and OBS-ONE-PM (Particulate Matter) units.

Furthermore, in June 2017, HORIBA Ltd. introduced a PEMS for measuring real driving emissions as a direct response to new requirements and testing procedures for certifying passenger cars and light commercial vehicles. The product is easy to install and is a safe and accurate solution, which allows stable operation over long driving periods.

Some of the other key players operating in the APAC air quality monitoring market are Thermo Fisher Scientific Inc., TSI Incorporated, 3M Company, Siemens AG, ECOTECH GROUP, Envirotech Instruments Pvt. Ltd., Autotronic Enterprise Co. Ltd. and Aeroqual Limited.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws