Report Code: 11695 | Available Format: PDF | Pages: 397

Asia-Pacific (APAC) Physical Security Market Research Report: By Type (Hardware, Software), Regional Insight (China, Japan, India, Australia, South Korea) - Industry Analysis and Forecast to 2024

- Report Code: 11695

- Available Format: PDF

- Pages: 397

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Asia-Pacific Physical Security Market Overview

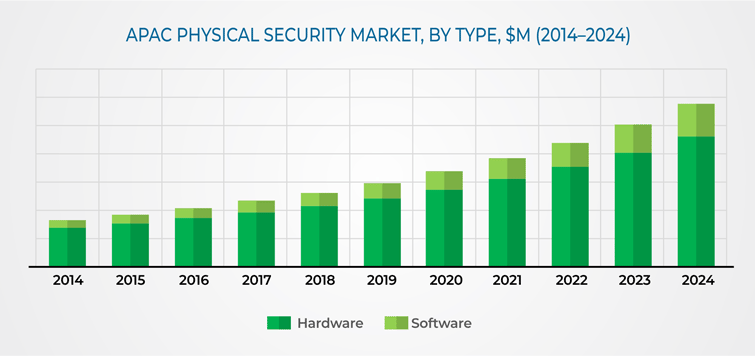

Asia-Pacific physical security market registered revenue of $26.3 billion in 2018, and is expected to register a CAGR of 14.3% during 2019-2024. Rising security concerns pertaining to rising crime rate and terrorist activities, propelling the growth of the market. Furthermore, strong growth in hospitality industry owing to increasing tourism and upcoming various sports events in the region is providing huge opportunities for the market players.

Based on type, Asia-Pacific physical security market has been divided into hardware and software, wherein hardware category accounted for largest share in 2018. The category is expected to lead throughout the forecast period buoyed by the increasing deployment of physical security systems such as video surveillance systems, access control systems, perimeter intrusion detection systems, and metal and weapon detector systems. The hardware market is further segmented into video surveillance, access control, automatic security gate, perimeter intrusion detection, under vehicle inspection system, road blocker, and metal and weapon detection system, wherein video surveillance system held the largest revenue share in 2018.

On the basis of road blocker type, anti-ram bollard category is expected to register fastest growth in the coming years. This is due to extensive use of anti-ram bollards for traffic control, property protection, and hostile vehicle mitigation (HVM) strategy. In road blocker segment, China held the largest share in the region, which is about twice of India, Japan, and Australia. Government and transportation, commercial offices/buildings, and retail verticals generated major portion of revenue in the market in 2018. Avians Innovation Technology Pvt Ltd., Polite Enterprises Corporation, and Avon Barrier Corporation Ltd, are some of the key players operating in the region.

On the basis of vertical, the market is segmented into government and transportation, banking, financial services and insurance (BFSI), hospitality and healthcare, retail, industrial and manufacturing, commercial offices/buildings, education, residential, and others which include data centers and warehouses. In video surveillance market, government and transportation segment accounted for largest revenue share in 2018; owing to rising number of government projects in several Asia-Pacific countries such as Singapore, China, and India.

Among countries, China held the largest market share, accounting for highest share in 2018, primarily driven by significant investments in video surveillance system. Chinese government is investing substantially on safe city projects, particularly on city surveillance, and traffic monitoring to ensure security of public places. The country recorded a significant rise in the number of smart city pilot projects in recent years. Since the formation of China Smart City Industry Alliance under the Ministry of Industry and Information Technology in 2010, 500 smart cities have been developed across the country, and the government further plans to develop 100 more by 2020.

Asia-Pacific Physical Security Market Dynamics

Growth Drivers

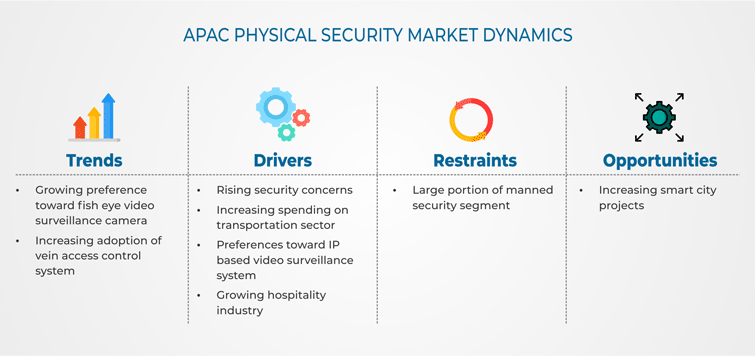

Asia-Pacific physical security market has been driven by several key factors, predominantly rising security concerns and growing number of terrorist threats. With rising security concerns, several countries including India, China, Indonesia, Vietnam, and Singapore are deploying physical security systems, particularly video surveillance systems; wherein government accounts for major contribution toward this deployment. For instance, in China, 7,990 homicide cases, 39,230 robberies, and 3,459,742 thefts were recorded in 2017. In Malaysia, 379 homicide cases, 14,128 robberies, 42,160 vehicle thefts, and 16,200 house break-ins and thefts were recorded in 2017. In Australia, 679 homicides, 3,796 robberies, and 41,669 thefts were recorded in 2018.

In addition, the region is also exhibiting increased deployment of physical security systems owing to security concern pertaining to rising terrorist threats. The region has been facing increased terrorist attacks since last two decades. For instance, more than 300 terrorist attack incidents were recorded in the region during 2012-2018. In Asia-Pacific, Pakistan and Afghanistan have witnessed the largest number of terrorist incidences followed by Malaysia and Indonesia.

Trends

Growing preference toward fish eye video surveillance camera has been observed to be one of the key trends in Asia-Pacific physical security market. Fish eye cameras offer 180-degree and 360-degree close circuit television (CCTV) monitoring with high-definition (HD) panoramic surveillance experience. Security camera with fisheye lens is capable of recording HD CCTV footage without any blind spot. Fish eye camera has the capability to record video at 20 – 30 frames per second (FPS). This camera also offers different viewing mode such as panoramic, rectilinear, and normal view, thus, providing enhanced security to the users.

Restraints

Large portion of manned security segment is restraining the physical security market in the region. In Asia-Pacific, due to cheap labor, lack of trust in technology, and lack of awareness in rural areas, manned security is still the largest segment in application areas such as banks, hotels, hospitals, and offices. For instance, in India, in 2018, manned security held 70% share in the total security space, and is expected to further generate around 5 million jobs in the country by the end of 2020.

Asia-Pacific Physical Security Market Competitive Landscape

Asia-Pacific physical security is highly fragmented and competitive market with the presence of several global and local physical security system manufacturers. However, few companies such as Hangzhou Hikvision Digital Technology Co., Ltd., Zhejiang Dahua Technology Co. Ltd, CP Plus International, and Panasonic Corporation held leading share in the market. Hangzhou Hikvision Digital Technology Co., Ltd. accounted for the highest market share of in 2018, buoyed by their broad and balanced surveillance product portfolio.

Johnson Controls International PLC, United Technologies Corporation, Siemens AG, Panasonic Corporation, Schneider Electric SE, Honeywell International Inc., Robert Bosch GmbH, Zhejiang Dahua Technology Co. Ltd, Hangzhou Hikvision Digital Technology Co., Ltd., CP PLUS GmbH & Co. KG. are some of the key players in the Asia-Pacific physical security market.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws