Report Code: 11639 | Available Format: PDF | Pages: 154

Americas Self-Checkout Systems Market by Offering (Hardware, Software, Services), by Model Type (Cash Based, Cashless), by Mounting Type (Standalone, Wall-mounted & Countertop), by Vertical (Entertainment, Healthcare, Hospitality, Retail, Travel), by Retail Store (Hypermarkets, Supermarkets & Departmental Stores, Convenience Stores), by Geography (U.S., Canada, Brazil, Mexico) - Market Size, Share, Development, Growth and Demand Forecast, 2014-2024

- Report Code: 11639

- Available Format: PDF

- Pages: 154

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Americas Self-Checkout Systems Market Overview

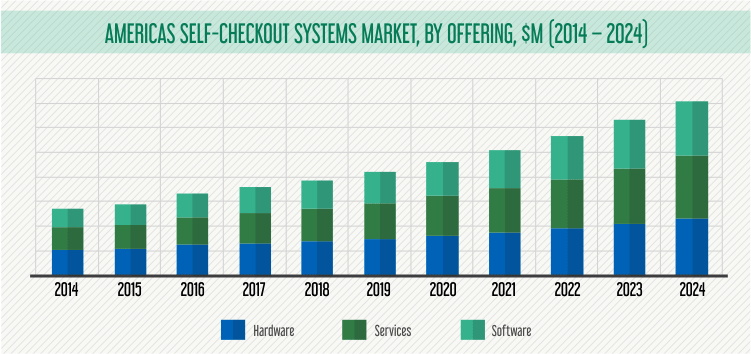

The Americas self-checkout systems market is estimated to value of $3.9 billion in 2018 and is expected to witness a CAGR of 10.9% during 2019-2024. Increasing labor shortage in Americas propelled by suppressed wage growth was the major driver pushing the market growth.

On the basis of offering, the Americas self-checkout systems market is categorized into hardware, software and services. Among these, hardware is estimated to hold the largest share in the market in 2018. Countries such as the U.S., and Canada account for a large share in self-checkout terminals due to growing hospitality and retail industries. For instance, according to U.S. Census Bureau, the retailers reported $3.5 trillion in sales in 2017, a 3.9% increase from 2016. Additionally, large retailers are increasingly investing in interactive kiosks to enhance customer experience.

Based on model type, the Americas self-checkout systems market is split into cash based and cashless models, wherein of the two, cashless category is poised to witness faster growth in the market, during the forecast period. This can be attributed to increasing adoption of cashless payment in the region. According to Federal reserve study, it has been recorded that in the U.S., the number of non-cash transactions reached 148.5 billion in 2016, an increase of 5.7% from 2015.

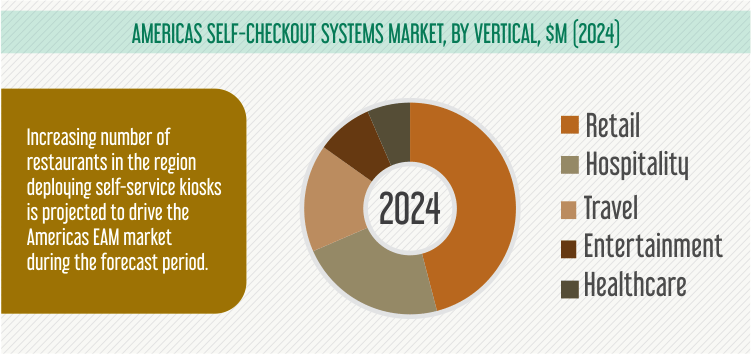

On the basis of vertical, the Americas self-checkout systems market is segmented into entertainment, healthcare, hospitality, retail, and travel. Among these, retail category is expected to continue holding largest share during the forecast period. This can be attributed to increasing demand for self-checkout systems from hypermarkets, supermarkets and departmental stores in the region that make it easy for customers to purchase items from these stores, and hence speeds-up the whole purchasing process. With advancement in self-checkout systems technology, customers shopping in malls and hypermarkets prefer self-checkout systems as they reduce their billing time and improve their overall shopping experience.

Based on country, the U.S. is estimated to hold the largest share in the Americas self-checkout systems market in 2018. This is attributed to increasing installation of self-checkout systems at hypermarkets, supermarkets and departmental stores in the country. Also, restaurants in the U.S. are increasingly deploying self-checkout systems in the country. For instance, quick service restaurants (QSRs) like McDonald’s deploying self-order kiosks to reduce customer wait time and improve customer satisfaction.

Americas Self-Checkout Systems Market Dynamics

Growth Drivers

Increasing number of digital transactions mainly in Canada and the U.S., is supporting the growth of self-checkout systems market in the region. Presently, most of the countries in Americas are moving toward cashless economy. For instance, as of 2018, in Canada, 90% of population owned credit cards. Earlier in 2017, debit cards witnessed a growth of 7% in terms of volume, and 9% in terms of value, over 2016. Meanwhile, electronic payments witnessed a rapid growth in Canada, with an increase of online transfers by 48% in 2017 over 2016.

With growth in digital transactions in Americas, companies are focusing on offering self-checkout services which provide digital payments for hassle-free shopping. For instance, with the launch of Amazon Go in 2018 and its hype since past two years, the scan-and-go technology has been observed as a rising trend in the market, which enables the customers in a store to make purchases without dealing with any checkout counters, by making automatic mobile payments.

Opportunities

The increase in demand for self-checkout systems among small retail businesses would provide growth opportunities for market players. Presently, growth of small businesses in Americas is very high. For instance, as of 2017, small businesses accounted over 99% of all businesses in the U.S. Due to high budgets and focus on improving customer experience, presently, large retail stores, are implementing self-checkout systems.

To maintain competitiveness in the market, small retail businesses are focusing on deploying self-checkout systems. Adoption of self-checkout systems would reduce their labor costs and increase their profitability in the long run. In addition, it can improve customer shopping experience which would attract more consumers in the store. Hence, increasing demand for self-checkout systems among small retail businesses in Americas are posing lucrative opportunities for market players.

Trends

Mobile scan and go has been observed to be a key trend in the Americas self-checkout systems market. Mobile scan and go systems enable customers to use their smartphones to scan items they want to purchase from the store at a service point-of-sale (POS) terminal before leaving the store and make payments digitally. Mobile scan and go systems enable customers to make payments without actually being in contact with any machine, which saves their overall purchase time.

Americas Self-Checkout Systems Market Competitive Landscape

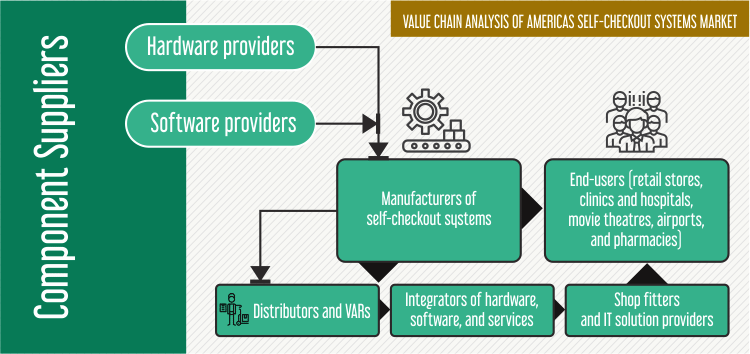

The Americas self-checkout systems market is characterized by presence of a limited number of players. Companies such as NCR Corporation, Fujitsu Limited, Toshiba TEC Corporation, PCMS Group Ltd., Diebold Nixdorf Incorporated, and International Business Machines (IBM) Corporation hold major portion of the market share. Digimarc Corporation, ECR Software Corporation, ITAB Shop Concept AB (publ), Olea Kiosks Inc., Slabb Inc., and Versatile Credit Inc are some of the other key players operating in the market.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws