Report Code: 11452 | Available Format: PDF | Pages: 155

Aerospace Composites Market Research Report: by Type (Carbon Fiber, Glass Fiber, Aramid Fiber), Resin Type (Thermoset, Thermoplastic), Aircraft Type (Commercial Aircraft, Business & Civil Aviation, Civil Helicopter, Military Aircraft), Application (Interior, Exterior) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 11452

- Available Format: PDF

- Pages: 155

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

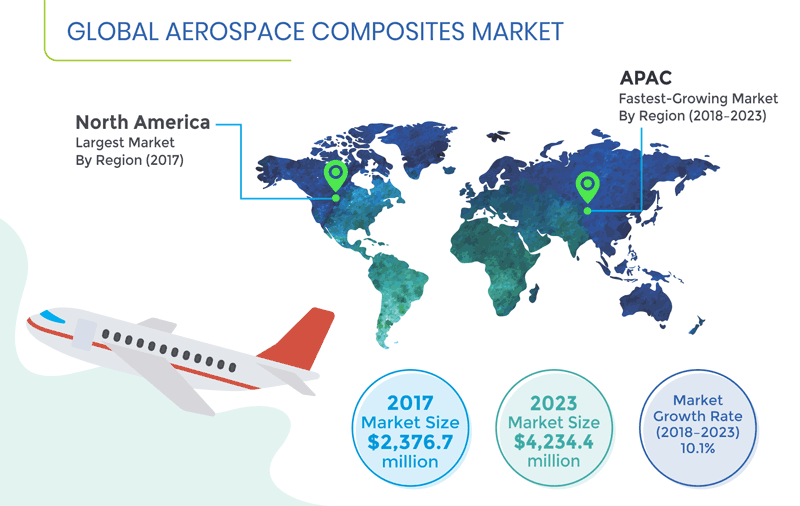

Valued at $2,376.7 million in 2017, the global aerospace composites market is projected to reach $4,234.4 million by 2023, witnessing a CAGR of 10.1% between 2018 and 2023.

The market, during this period, is expected to witness the fastest growth in the MEA region. This can be mainly ascribed to the increasing focus of countries in the region, including Saudi Arabia and the U.A.E., on non-oil industries, such as aircraft manufacturing, as part of their efforts toward economic diversification. In view of this, Solvay SA and Mubadala Investment Company, in 2016, formed a joint venture to manufacture lightweight prepreg composite materials for aircraft components. Thus, the growing focus of regional countries on the manufacturing sector is expected to propel the demand for aerospace composites in the region in the near future.

Dynamics of Aerospace Composites Market

The key trend observed in the aerospace composites market is the growing preference for the out-of-autoclave (OOA) process over the autoclave process for the manufacturing of composite materials. The autoclave process involves the use of pressure vessels to carry out the production of composite materials; the process is not only time-consuming but also expensive. This increases the overall cost of the product so produced. On the other hand, in the OOA process, composites are manufactured in a closed mold without the use of autoclaves, which lowers the production cost and improves the material strength.

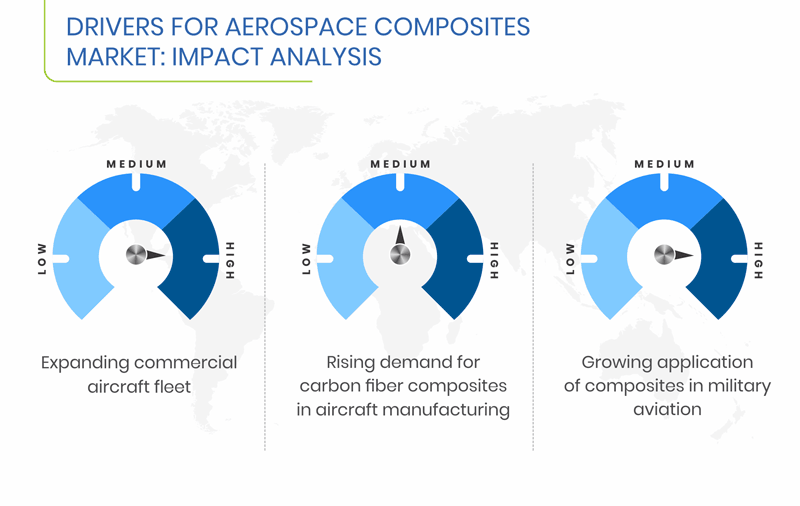

One of the major factors driving the aerospace composites market is the large-scale demand and adoption of carbon fiber composites for aircraft manufacturing. Aircraft manufacturers are increasingly focusing on the use of lightweight, high-performance structural materials to improve the fuel economy of their aircraft and lower their operational cost. Carbon fiber composites demonstrate properties such as low weight, high stiffness, and high tensile strength, owing to which they are witnessing a high demand in the industry.

Developing nations such as China, India, and Indonesia hold immense potential for the growth of the players operating in the aerospace composites market, as the countries are witnessing growth in their manufacturing sector on account of the rapid urbanization, increasing middle-class population, and rising disposable income. Moreover, with people increasingly opting for air travel, there has been a rise in air traffic and demand for commercial aircraft. This, in turn, is offering impetus to the demand for composites used in aircraft manufacturing.

Segmentation Analysis of Aerospace Composites Market

Carbon fiber composites, among all composite types, accounted for the largest volumetric share in the market in 2017. This can be mainly attributed to the high demand for carbon fiber composites owing to their high tensile strength, high chemical resistance, high temperature tolerance, low thermal expansion, and exceptional load-carrying capacity, as compared to other materials.

The thermoset category held the largest market share in terms of both volume and value in 2017, on the basis of resin type. The superior properties of thermoset resins, such as high mechanical strength, high corrosion resistance, and low weight, have supported their adoption for various aerospace applications. In addition, thermoset resins impart high stiffness and tensile strength to aircraft components, owing to which they are preferred in the aerospace sector.

The aerospace composites market, during the forecast period, is expected to witness the fastest growth in the civil helicopter category, registering 11.1% CAGR in terms of revenue. Civil helicopters are primarily used for short-distance travel and in emergencies for evacuation purposes and delivery of medical services. In order to be prepared for emergency conditions, the demand for such vehicles is projected to increase, particularly in developed nations, such as the U.S., Russia, Germany, and France.

Between the two application categories, the interior category is expected to witness faster growth in terms of value during the forecast period, with 10.7% CAGR. This can be attributed to the growing demand for composite materials for the manufacturing of interior parts of aircraft, such as seat frames, cabin components, lavatories, floor boards, wall and ceiling panels, and stowage bins.

| Report Attribute | Details |

Historical Years |

2013-2017 |

Forecast Years |

2018-2023 |

Market Size by Segments |

Type, Resin Type, Aircraft Type, Application |

Market Size of Geographies |

U.S., Canada, Germany, U.K., France, Italy, Russia, China, India, Japan, South Korea, Brazil, Mexico, Saudi Arabia, U.A.E., South Africa |

Explore more about this report - Request free sample

Geographical Analysis of Aerospace Composites Market

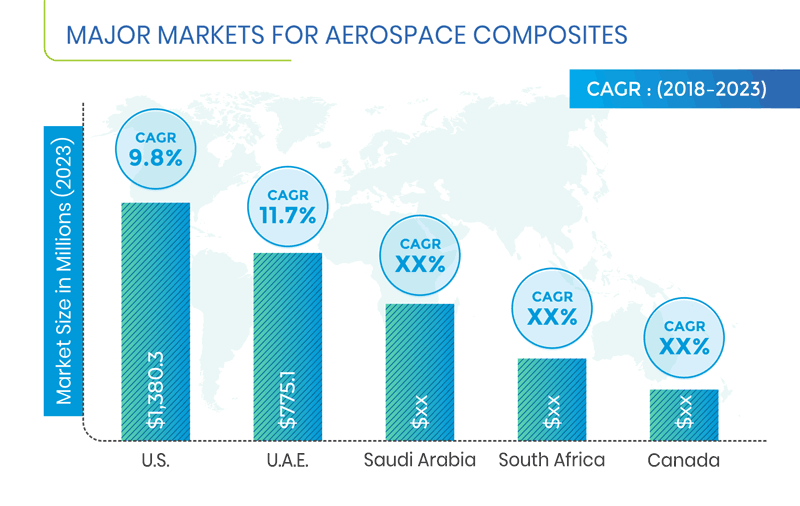

Geographically, North America accounted for the largest volumetric share in the aerospace composites market in 2017. This can be mainly attributed to the presence of a large base in the region for the manufacturing of all types of aircraft. Besides, the region is a major exporter of commercial aircraft to the APAC, MEA, and European regions. Considering the future industry scenario, the U.S. is expected to lead the North American market, generating revenue worth $1,380.3 million by 2023.

During the forecast period, the market is expected to witness the fastest growth in MEA, primarily on account of the increasing investments for the manufacturing of aircraft and aerospace components. The U.A.E. is expected to account for the largest volumetric share in the regional market in 2023.

Competitive Landscape of Aerospace Composites Market

The global aerospace composites market is consolidated in nature, characterized by the presence of established companies such as Hexcel Corporation, Teijin Limited, SGL Carbon SE, and Toray Industries Inc. Some other important players operating in the market are Mitsubishi Chemical Carbon Fiber and Composites Inc., Renegade Materials Corporation, Royal DSM N.V., Materion Aerospace Metal Composites, and Solvay SA.

Recent Strategic Developments of Major Aerospace Composites Market Players

In recent years, major players in the market have taken several strategic measures to increase their market share. For instance, in December 2017, Hexcel Corporation acquired the aerospace and defense (A&D) business of Oxford Performance Materials, a developer of biomedical polymers, biomedical devices, and industrial parts. The acquisition of asset included intellectual property, equipment, and manufacturing process technology related to the company’s A&D operations in Connecticut, U.S.

Market Size Breakdown by Segment

The Aerospace Composites Market report offers comprehensive market segmentation analysis along with market estimation for the period 2013–2023.

Based on Type

- Carbon Fiber

- Glass Fiber

- Aramid Fiber

Based on Resin Type

- Thermoset

- Thermoplastic

Based on Aircraft Type

- Commercial Aircraft

- Business and General Aviation

- Civil Helicopter

- Military Aircraft

Based on Application

- Interior

- Exterior

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Russia

- Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- Latin America (LATAM)

- Brazil

- Mexico

- Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- U.A.E.

Key Questions Addressed in the Report

- What is the current scenario of the global aerospace composites market?

- What is the historical and the present size of the categories under market segments and their future potential?

- What are the evolving opportunities for the players in the market?

- Which application is expected to dominate the market during the forecast period?

- Which are the key geographies from the investment perspective?

- Which region is expected to lead the market during the forecast period?

- What are the key strategies adopted by the major players to expand their market share?

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws