Report Code: 10735 | Available Format: PDF | Pages: 195

Adhesion Barrier Market by Product (Synthetic [Hyaluronic Acid, Regenerated Cellulose, Polyethylene Glycol {PEG}], Natural [Collagen- & Protein-Based, Fibrin-Based]), by Formulation (Film, Gel, Liquid), by Application (Gynecological Surgeries, General/Abdominal Surgeries, Orthopedic Surgeries, Cardiovascular Surgeries, Neurological Surgeries, Urological Surgeries, Reconstructive Surgeries), by Geography (U.S., Canada, Germany, U.K., France, Italy, Spain, Japan, China, India) - Global Market Size, Share, Development, Growth, and Demand Forecast, 2013-2023

- Report Code: 10735

- Available Format: PDF

- Pages: 195

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Outlook

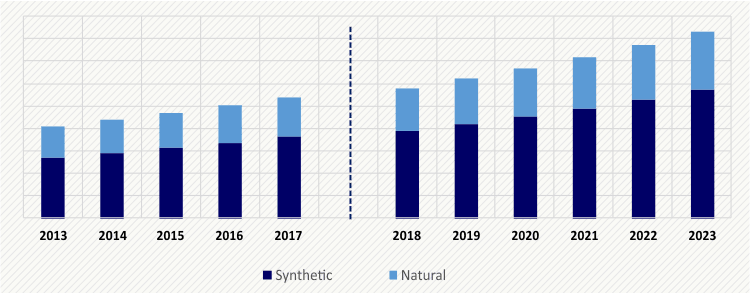

The adhesion barrier market value was $541.3 million in 2017, and it is expected to register a CAGR of 7.5% during 2018–2023. The major factors driving this growth include the surging volume of surgeries, advancements in technologies, and rising geriatric population.

The synthetic adhesion barrier category, within the product segment, dominated the market in 2017, with an around 67.2% revenue contribution. This can be primarily ascribed to the advantageous properties of synthetic adhesion preventing products such as higher flexibility and bio absorbability.

The film category, under the formulation segment, will demonstrate the fastest growth in the adhesion barrier industry, at an 8.0% CAGR, during 2018–2023. This can be credited to the burgeoning demand for film-based formulations for surgical procedures owing to their higher level of safety and efficacy and lower cost as compared to liquid and gel variants.

In 2017, the gynecological surgeries category held the major share, of 23.0%, under the application segment. This can be owed to the surge in the usage of anti-adhesion products in peritoneal and intrauterine surgeries owing to the immense risk of peritoneal adhesions with these procedures.

Geographically, the North American region is expected to emerge as the largest contributor to the adhesion barrier market during 2018–2023. This can be mainly ascribed to the growing incidence of chronic illnesses and rising healthcare spending in the region.

Market Dynamics

The increasing volume of surgeries on account of the high prevalence of chronic illnesses and other health conditions will propel the market for adhesion barriers in the near future. Liquid, gel, and film-based formulations are used in several types of surgical procedures, including abdominal and gynecological surgeries. These products are used on the surgical site for separating the internal organs and tissues during the healing process and preventing post-surgical adhesions.

According to the World Health Organization (WHO), 266.2–359.5 million surgical procedures were performed in 2012 worldwide. The number is projected to magnify in the coming years primarily on account of the soaring cases of chronic illnesses, such as arthritis and cardiovascular diseases (CVDs).

Moreover, the surging incidence of sports injuries will accelerate the demand for these products. Strains and sprains are the most-common sports injuries reported globally, and they require surgeries, which, in turn, is acting as a growth driver for the adhesion barrier market. According to Stanford Children's Health, a healthcare system based in San Francisco emphasizing obstetric and pediatric care, more than 3.5 million injuries in the U.S. are recorded among 30 million children participating in any organized sport and nearly one-third of all the injuries that take place during childhood are sports-related.

The regulations related to the affiliation of medical devices are complicated, and they undergo amendments with altering needs. The complexity of these regulations can be owed to the legal aspects attached to them. The performance and quality of medical devices are necessary aspects that require stringent evaluation to ensure public safety.

The United States Food and Drug Administration (USFDA) states that a resorbable adhesion barrier is an important risk device, as defined in 21 Code for Regulations (CFR) 812.3(m)(4). The USFDA defines a resorbable adhesion barrier as a class III device, which is why it must undergo numerous procedures for approval, including product development protocol (PDP), premarket approval (PMA), and investigational device exemption (IDE). Thus, the long time consumed during research and development (R&D) and the approval process for medical devices restricts the growth of the adhesion barrier market to a certain extent, by leading to their low availability.

Competitive Landscape

With a number of technological advancements taking place in the adhesion barrier industry, the players are seeking approvals and introducing new and advanced adhesion prevention products. For instance, in July 2018, FzioMed Inc. announced the enrolment of patients for a study to check the efficacy and safety of Oxiplex, an adhesion prevention product for use in the lumbar surgery. The trial is aimed at obtaining the U.S. approval for the company’s product.

In April 2018, Integra LifeSciences Holdings Corporation introduced its extended portfolio of the Codman specialty surgical products at the American Association of Neurological Surgeons (AANS) Annual Scientific Meeting in New Orleans, U.S. The products showcased by the company included adhesion prevention solutions, such as DuraSeal, DuraGen and DuraFlex.

Some of the other key players operating in the adhesion barrier industry are Medtronic plc, Sanofi, Johnson & Johnson, Getinge AB, Baxter International Inc., C.R. Bard Inc., MAST Biosurgery AG, and Anika Therapeutics Inc.

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws