Report Code: 10118 | Available Format: PDF | Pages: 199

Acetic Anhydride Market Research Report: By Application (Synthesizers, Reagents, Plasticizers, Coating Materials), End-Use Industry (Pharmaceuticals, Agriculture, Textiles, Food & Beverages, Tobacco, Plastics) - Global Industry Analysis and Demand Forecast to 2030

- Report Code: 10118

- Available Format: PDF

- Pages: 199

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Acetic Anhydride Market Overview

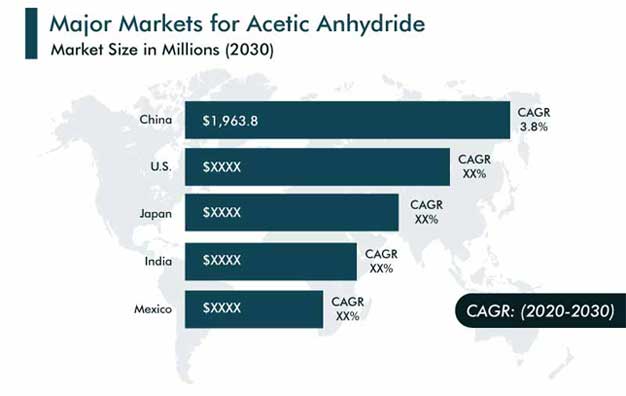

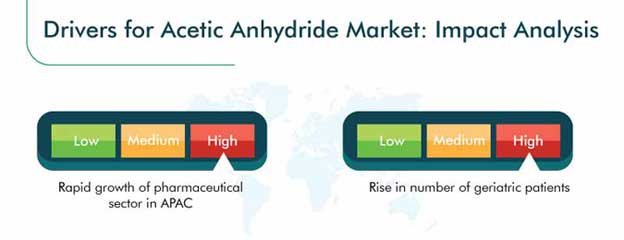

The acetic anhydride market stood at $3,476.1 million in 2019, and the market size is expected to demonstrate a CAGR of 2.3% during the forecast period (2020–2030). Some of the key growth factors for the acetic anhydride industry include the rapid expansion of the pharmaceutical sector in the Asia-Pacific (APAC) region and rise in the number of geriatric patients.

.jpg)

The global market is likely to be negatively impacted due to the coronavirus pandemic, showcasing a significant rise in the price of acetic acid, which is a key raw material for the production of the compound. The market has witnessed supply chain disruptions due to the shutdown of Chinese factories and increasing interest of manufacturers in sourcing raw materials from countries other than China. Such factors are creating a turmoil in the supply chain of the chemical compound.

Segmentation Analysis

Synthesizers Dominated Market under Application

The synthesizers category accounted for the largest size in the acetic anhydride industry in 2019, based on application. This is majorly attributed to the high-volume consumption of the chemicals for the production of cellulose acetate. The demand for cellulose acetate is witnessing a surge, on account of the increase in its usage in end-use industries including automotive and plastics. In order to meet the ever-increasing cellulose acetate demand from these sectors, the consumption of the chemical compound, as a synthesizer for cellulose acetate, is projected to increase, thereby promoting the growth of the acetic anhydride market.

Tobacco Industry Is Projected to Witness Highest Demand

The tobacco category is expected to account for the largest market size in 2030, on the basis of end-use industry, on account of generating the highest demand. Cigarette filters are made from cellulose acetate, which helps in the prevention of the passage of excess nicotine and tar inside the consumer. In order to meet the rising demand for cellulose acetate, for cigarette production at a global level, the consumption of the compound has increased. In addition, with the increasing cigarette consumption worldwide, the acetic anhydride market is projected to grow during the forecast period.

Geographical Outlook

APAC Region To Account for Largest Market in Acetic Anhydride Industry

The APAC region held the largest share in the acetic anhydride market in 2019, and the trend is likely to continue during the forecast period. This can majorly be attributed to the high-volume production of cellulose acetate, which requires the compound as a synthesizer. Cellulose acetate witnesses a high demand, owing to its usage in the manufacturing of cigarette tows, plastic products, and textile fibers.

Moreover, the pharmaceutical sector in the region is expected to showcase fast-paced growth, on account of the increasing investments, which, in turn, are augmenting the industrial demand for the chemical compound, as a synthesizer for medicated drugs, such as aspirin.

With the growth of the end-use industries in the developing countries of the region, including China, India, and several Southeast Asian countries, the consumption of the compound is projected to increase in the coming years, thereby propelling the acetic anhydride market in the region.

Middle East & Africa (MEA) Region To Witness Fastest Consumption Surge

The consumption of the chemical has increased significantly in Middle Eastern countries, majorly on account of the high demand for it in several industrial applications. These include the usage of the compound as a food additive, along with its requirement as a synthesizer for cellulose acetate, for the production of cigarette filters. In addition, the market demand is expected to increase from the textiles industry, owing to the usage of the chemical in automotive upholstery, as well as home-furniture upholstery.

Moreover, the acetic anhydride market in the region is expected to grow on account of the increasing investments in the chemical manufacturing sector of Saudi Arabia, owing to the high growth potential of the chemical sector in the country.

Trends & Drivers

Expanding Pharmaceutical Sector in APAC To Boost Demand for Acetic Anhydride

In the recent past, the healthcare sector in the developing countries of the APAC region, including China, India, Thailand, and Indonesia, has witnessed a rapid surge, on account of the increasing research and development (R&D) investments, along with the geographical expansion of large medical drug manufacturers in the APAC region. This is attributable to the high growth potential of the medical sector in these markets, along with the availability of low-cost labor and raw materials.

This, in turn, is creating a significant demand for the compound, owing to the requirement for the compound as a synthesizer in aspirin, acetaminophen, and several other medicated drugs. With the increasing number of drug manufacturing plants in the region, the consumption of the compound is projected to increase, thereby providing a boost to the global acetic anhydride market.

Rise in Number of Geriatric Patients Propelling Global Consumption of Compound

The chemical compound is vastly used in the production of medicated drugs, owing to its requirement as a synthesizer in such consumables. In the recent past, the number of geriatric patients has witnessed a rapid surge, owing to which the consumption of aspirin and other medicated drugs is witnessing. In addition, the rise in ageing population, is further propelling the consumption of body pain killers, due to which the consumption of the compound is witnessing a rise. In order to meet the demand for generic drugs, such as paracetamol, sulfa drugs, cortisone, acetaminophen, triacetin, and aspirin, the consumption of the chemical compound is projected to increase, thereby promoting the growth of the global acetic anhydride market.

| Report Attribute | Details |

Historical Years |

2014-2019 |

Forecast Years |

2020-2030 |

Base Year (2019) Market Size |

$3,476.1 million |

Forecast Period CAGR |

2.3% |

Report Coverage |

Market Dynamics, Pricing Analysis, End-Use Industry Purchase Patterns, Procurement Cost In India, Analysis on Conversion Yield From Acetic Acid to Acetic Anhydride, Alternative Sources of Acetic Acid for India, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Company Share Analysis, Regulatory Policy Analysis, Companies’ Strategic Developments, Competitive Benchmarking, Company Profiling |

Market Size by Segments |

Application, End-Use Industry, Geography |

Market Size of Geographies |

U.S., Canada, Germany, U.K., France, Italy, Spain, Netherlands, China, India, Japan, South Korea, Brazil, Mexico, Saudi Arabia, South Africa |

Secondary Sources and References (Partial List) |

American Cancer Society, China Chemical & Fiber Economic Information Network, Code of Federal Regulations, Defense Technical Information Center, Europe PubMed Central, European Federation of Pharmaceutical Industries and Associations, Indian Chemical Council |

Explore more about this report - Request free sample

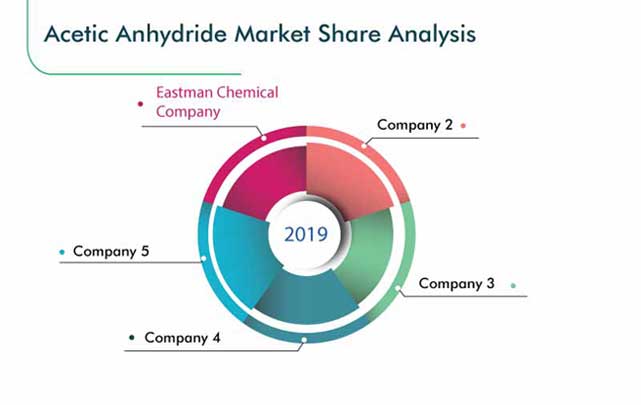

Leading Players Entering into Agreements to Collectively Gain a Larger Hold on Industry

The acetic anhydride market is consolidated in nature, with the presence of numerous major players, such as Eastman Chemical Company, Celanese Corporation, Jubilant Life Sciences Ltd., Jiangsu Danhua Group Co. Ltd., and Saudi International Petrochemical Company.

In recent years, the players have entered into agreements, in order to capture a larger share of the industry, collectively. For instance:

- In October 2019, BP p.l.c. and China’s Zhejiang Petroleum and Chemical Corporation (ZPCC) signed a memorandum of understanding (MOU) to explore the creation of a new equally-owned joint venture, to build and operate a one-million-ton-per-annum (tpa) acetic acid plant in eastern China. The proposed facility in Zhoushan, Zhejiang Province, would deploy BP’s CATIVA XL technology to produce acetic acid. It is also used for the production of purified terephthalic acid (PTA).

- In April 2018, Celanese Corporation announced that it has entered into an agreement with Southwest Research and Design Institute of Chemical Industry (SWRDICI), a subsidiary of ChemChina, to extend their joint R&D on the acetyls technology. The agreement is for the continued exclusive collaboration between SWRDICI and Celanese to jointly develop advanced technologies for the production of acetic acid and other acetyl products.

Some of Key Players in Acetic Anhydride Market Are:

-

Eastman Chemical Company

-

Celanese Corporation

-

Jubilant Life Sciences Ltd.

-

Jiangsu Danhua Group Co. Ltd.

-

Saudi International Petrochemical Company

-

BP p.l.c

-

China National Petroleum Corporation

-

Taj Pharmaceuticals Limited

-

RLG Group

-

Daicel Corporation

-

Lonza Group Ltd.

-

Merck KGaA

-

Thermo Fisher Scientific Inc.

-

Vizag Chemical International

-

Tokyo Chemical Industry Co. Ltd.

-

Honeywell International Inc.

Acetic Anhydride Market Size Breakdown by Segment

The acetic anhydride market report offers comprehensive market segmentation analysis along with market estimation for the period 2014–2030.

Based on Application

- Synthesizers

- Reagents

- Plasticizers

- Coating Materials

Based on End-Use Industry

- Pharmaceuticals

- Agriculture

- Textiles

- Food & Beverages

- Tobacco

- Plastics

Geographical Analysis

-

North America

- U.S.

- Canada

-

Europe

- U.K.

- Germany

- Italy

- France

- Spain

- Netherlands

-

Asia-Pacific (APAC)

- China

- India

- Japan

- South Korea

-

Latin America (LATAM)

- Brazil

- Mexico

-

Middle East & Africa (MEA)

- Saudi Arabia

- South Africa

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws