U.S. Mattress Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024-2030)

Get a Comprehensive Overview of the U.S. Mattress Market Report Prepared by P&S Intelligence, Segmented by Product (Innerspring, Memory Foam, Hybrid, Latex), Size (Single, Double, Queen, King), Distribution Channel (Offline, Online), End Use (Residential, Commercial) and Geographic Regions. This Report Provides Insights From 2017 to 2030.

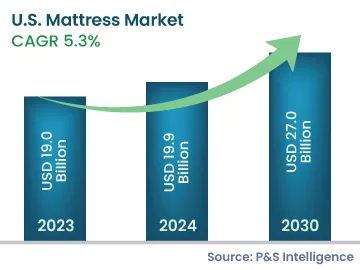

U.S. Mattress Market Data

Market Statistics

| Study Period | 2017 - 2030 |

| 2023 Market Size | USD 19.0 Billion |

| 2024 Market Size | USD 19.9 Billion |

| 2030 Forecast | USD 27.0 Billion |

| Growth Rate (CAGR) | 5.3% |

| Largest Region | South |

| Fastest Growing Region | West |

| Nature of the Market | Fragmented |

| Largest End User Category | Commercial |

Market Size Comparison

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

U.S. Mattress Market Analysis

The U.S. mattress market size was USD 19.0 billion in 2023, which is expected to witness a CAGR of 5.3% during the forecast period 2024–2030, to reach USD 27.0 billion in 2030. The key factors responsible for the growth of the market include the advancing construction industry and booming hospitality and tourism sectors in the country.

The U.S. is one of the largest construction markets worldwide, majorly driven by the boom in residential construction. According to the U.S. Census Bureau, in January 2024, the U.S. construction spending amounted to USD 2,102 billion, which was 11.7% more than 2023's figure of USD 1,882.2 billion. The spending on private construction in November 2024 was 0.1% more in comparison to the previous year's figures. Similarly, in January 2024, residential construction spending was 0.9% greater than the previous year.

Other key drivers are the rise in the disposable income, availability of affordable mattresses through the bed-in-a-box concept, decrease in the replacement cycle from 9–12 years to 6–8 years. Further, the growing awareness pertaining to the importance of sleep among the populace is projected to drive the demand for mattresses in the coming years.

According to the National Centre for Biotechnology Information (NCBI), around 50–70 million Americans suffer from chronic, long-term sleep disorders, affecting day-to-day work and adversely impacting health. In order to overcome these, mattress manufacturers are focusing on product innovation, such as heating/cooling technology via gel foam, breathable mattress borders, and improvised memory foam for firm back support.

Traditionally, specialty stores and furniture stores were the popular distribution channels for these products; however, the introduction of the direct-to-customer (DTC) model has resulted in an increase in sales through the online channel. The DTC model offers quality mattresses at an affordable price to customers. Presently, over 200 DTC mattress providers are present in the country, among which Casper, Tuft & Needle, Leesa, Saatva, and Purple are some of the popular ones. Therefore, the growing importance of sleep and increasing sales through the online channel are projected to accelerate the U.S. mattress market growth during the forecast period.

U.S. Mattress Market Trend & Growth Drivers

Innovation in Mattress Manufacturing Process Is Key Trend

- Consumers’ interest in healthy and hygienic sleep habits has been increasing lately, thus propelling the demand for hybrid mattresses. These products are made of various components, such as spring coils, polyurethane foam, Thermagel, and layers of latex, each of which offers some benefit to the user.

- For instance, In October 2023, The Company Store Launched luxury hybrid mattresses containing curated foam and fiber layers for better pressure relief. Silver, copper, and gel fibers create an antimicrobial effect, while natural latex helps the mattress adapt to people’s body shapes.

- Body support is further enhanced by an all-natural cotton layer between two layers of coils, 1,800 micro coils, and 900 steel coils in the deepest layer.

- Similarly, Brooklyn Bedding, an Arizona-based company, uses the far-infrared rays technology in its Spartan series mattresses. This high-tech coating on the mattress cover transforms users’ body heat into far-infrared rays, which are reflected back to the user. Far Infrared Rays penetrate, soothe, and stimulate the human body, helping the user feel energized and well-rested.

- Further, the technology harnesses and recycles the body’s natural energy throughout the sleep cycle. Other major benefits the technology provides include a temporary increase in local blood flow, thus promoting restful sleep.

- Additionally, consumers are switching to eco-friendly products, owing to which innovation is being brought about in the fabrics used in the outer covering of mattresses. Natural fabrics, such as fiber, wool, and bamboo, are some of the materials being used in order to serve environment-conscious customers.

- In addition, innovative heat minimizing fabrics are gaining attention among consumers, thus paving the way for further innovations in the mattress technology. All such innovations will boost the adoption of mattresses and augment the U.S. mattress market revenue.

Booming Hospitality and Tourism Sector in Country Is Key Driver

- The tourism and hospitality sectors are interconnected to each other. According to the International Trade Administration, 5.3 million people arrived in 2023 the in U.S., which is 26% higher than the previous year. Moreover, according to the Bureau of Economic Analysis, tourists spend around USD 32 billion on travel-related goods and services on a yearly basis.

- Similarly, the hospitality industry in the U.S. has been growing with the rising number of international travelers visiting it for leisure, as well as business. All these developments are contributing to the growth of the mattress industry of the U.S.

Volatile Prices of Raw Material Present Challenges in Market Growth

- Polyurethane foam, polyethylene foam, polyester, and steel innerspring components are the key raw materials for mattresses. The rise in their prices, owing to an increase in the price of steel and petroleum, severely affects the mattress industry.

- The price of raw latex increased significantly during the historical period, globally. In such cases, manufacturers either have to increase the price of the final product to offset their higher investment in raw material procurement or compromise with their profit margins.

- Several mattress manufacturers incurred losses during the last few years due to the increase in the prices of raw materials, such as petroleum-based polyurethane foam, polyester, and polyethylene foam and steel innersprings. Though the penetration of innerspring and memory foam mattresses is increasing in the country, the high cost of mattresses, on account of the costly raw materials, is one of the major factors restraining the market growth.

U.S. Mattress Industry Outlook

Product Insights

- Based on product, the memory foam mattress category is expected to be the fastest-growing, with a growth rate of 5.6%, in U.S. mattress market during 2024–2030. This will mainly be due to the rising awareness among consumers regarding health.

- These mattresses are helpful in reducing allergies and beneficial for side-sleepers. This mattress usually conforms to the user’s body and helps in relieving body stress and muscle pain.

The products covered in the report include:

- Innerspring (Largest Category)

- Memory foam (Fastest-Growing Category)

- Hybrid

- Latex

- Others

Size Insights

- Based on size, the queen-size mattress category held the largest share in the U.S. mattress market in 2023. This was mainly due to the fact that it provides adequate space for two and does not take up much space in a room. Moreover, it provides ample space for a couple of adults and a child, which is essential for a smaller bedroom.

- The market for double-size mattress is going down as more people are moving toward the queen size due to the advantages it offers over the former.

- The rising disposable income and dropping prices are enabling the populace to afford king-size (including California king) mattress in the country.

- According to the International Sleep Products Association (ISPA), millennials (age 18–36) are more inclined toward purchasing king-size beds when compared to generation X (age 37–50).

The following sizes are included in the report:

- Single

- Double

- Queen-Size (Largest Category)

- King-Size (Fastest-Growing Category)

Distribution Channel Insights

- The offline distribution channel dominated the market for mattresses in 2023. This was mainly due to the higher preference for purchasing mattresses from a specialty store.

- As most people like to try them out first hand, they usually visit a physical store. Additionally, consumers believe more in physical retailers to provide better post-sales services.

The distribution channels covered in the report are:

- Offline (Larger Category)

- Online (Faster-Growing Category)

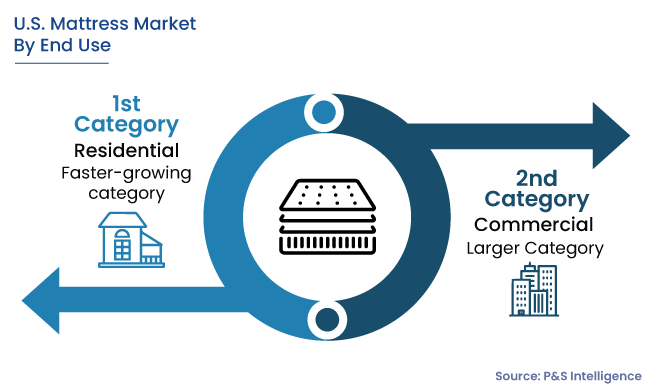

End Use Insights

- Based on end use, the commercial category accounted for the larger share, of around 70%, in the market in 2023. Among commercial facilities, hotels are the main end users of mattresses as they change them more frequently than residential users. On an average, residential users change their mattresses in 9–10 years, while hotels change the mattresses in around 5–6 years.

- Thus, commercial end users change their mattresses more frequently due to the increasing tourism and corporate needs.

- However, according to the ISPA, the replacement period among residential end users has reduced to 6–8 years, which is projected to increase the demand for mattresses in the residential sector of the U.S. during the forecast period.

The end use segment is classified as:

- Residential (Faster-Growing Category)

- Commercial (Larger Category)

Southern Region Holds Largest Share

- The southern region accounted for the largest share, of 40%, in 2023 in the U.S. market, as it is offering growth opportunities to market players, particularly on account of the growing urbanization rate here.

- Southern cities in the country have the highest populations, and they are witnessing growing urbanization. For instance, Metropolitan Atlanta has been witnessing an addition of 69,200 residents every year.

- The western region is set to be the fastest-growing during the forecast period.

- This is due to the setup of manufacturing facilities on the West Coast to cater to the increasing demand for bedding and mattresses.

The regions analyzed in this report include:

- South (Largest Regional Market)

- West (Fastest-Growing Regional Market)

- Midwest

- Northeast

Market Nature – Fragmented

The U.S. mattress industry is fragmented in nature owing to the presence of several key players. Major players in the market are Serta Simmons Bedding LLC, Tempur Sealy International Inc., Casper Sleep Inc., and Sleep Number Corporation. In recent years, the players in the market have been involved in product launches in order to attain a significant position. Further, companies are focusing on acquisitions to expand their reach.

U.S. Mattress Companies:

- Tempur Sealy International Inc.

- Serta Simmons Bedding LLC

- Casper Sleep Inc.

- Purple Innovation LLC

- Brooklyn Bedding LLC

- Spring Air International

- Sleep Number Corporation

- Saatva Inc.

- Kingsdown Inc.

- Corsicana Mattress Company

- McRoskey Mattress Company

U.S. Mattress Companies News

- In January 2024, Serta Simmons Bedding LLC announced that it will launch its new range of Serta and Beautyrest products this year.

- In January 2024, Tempur Sealy International Inc. launched its new TEMPUR-ActiveBreeze smart bed. The aim of this launch is to help the majority of the population who has at least one hot sleeper in the house. It provides modifiable climate programs.

- In March 2023, Brooklyn Bedding LLC announced the acquisition of Leesa Sleep.

Frequently Asked Questions About This Report

The U.S. mattress market value will reach 27.0 billion in 2030.

Innovation in the process of mattress manufacturing is the key U.S. mattress industry trend.

The mattress market in the U.S. will reach USD 19.9 Billion in 2024.

The southern region is the largest mattress market in the U.S.

Offline distribution channel hold the larger U.S. mattress market share.

The U.S. mattress industry is fragmented, because of the existence of some major players.

Request the Free Sample Pages

Want a report tailored exactly to your business need?

Request CustomizationWe are Trusted by

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws