Published: January 2023 | Report Code: 10371 | Available Format: PDF | Pages: 320

- Home

- Chemicals and Materials

- Paints and Coatings Market

Paints and Coatings Market Size and Share Analysis by Technology (Water-Borne, Solvent-Borne, High Solids, Powder Coatings, UV), Formulation (Acrylic, Polyester, Polyurethane, Epoxy), Application (Architectural Coatings, Industrial Coatings, Special Coatings) – Global Industry Demand Forecast to 2030

- Published: January 2023

- Report Code: 10371

- Available Format: PDF

- Pages: 320

- Report Description

- Table of Contents

- Market Segmentation

- Request Free Sample

Market Overview

The paints and coatings market estimated size stood at USD 164.1 billion in 2022, and it is expected to grow at a CAGR of 4.80% during 2022–2030, to reach USD 238.8 billion by 2030.

The growth is credited to the rising product consumption in the automotive, general industrial, and construction sectors. In this regard, it is projected that the rapid urbanization and industrialization in emerging economies, such as India, China, and those in Southeast Asia, will drive product demand across a range of applications.

Moreover, the global demand has expanded moderately in recent years despite a number of uncertainties, including the slowdown of major economies, the negative effects of the low crude oil prices, the shutdown of the automotive and construction industries, and changes in global regulatory norms.

Even though many of these factors are not in the control of formulators, manufacturers, distributors of raw materials and finished goods, and marketers, the sector has grown with these significant changes remarkably quickly. This has been made possible by the introduction of numerous cutting-edge manufacturing techniques that have enabled businesses to immediately mitigate a variety of potential negative effects and maximize their opportunities for driving the demand for products that are decorated and glazed.

Growing Construction Industry

The construction industry is growing at a significant pace in Sweden, the U.S., China, India, Canada, Australia, and the U.K., owing to the rising population and increasing rate of urbanization. This has resulted in the increasing investment in construction projects, such as hotels, apartments, offices, retail centers, and civic infrastructure.

The construction industry of China, which is already the largest in the world, is expected to develop at a significant rate between 2022 and 2030. Such growth in the construction industry is driving the demand for decorative coatings in the APAC region.

Furthermore, governments of several countries are funding the development and improvement of infrastructure. Such initiatives to incorporate high technology into the building and construction process are part of China's 14th Five-Year Plan. Specifically, the government is predicted to prioritize energy and transportation infrastructure, with special emphasis on improving connectivity inside urban clusters.

Moreover, China has one of the greatest rates of urbanization worldwide. According to data from the American Institute of Architects (AIA), China will have built cities with a combined size of 10 New York cities between the 1990s and 2025. Moreover, the Market Status and Trends of China's Architectural Design Industry in 2020 report states that China's architectural design and engineering industry generated more than USD 1 trillion in sales in 2019.

This growth will increase the demand for paints and coatings to provide aesthetic benefits. Additionally, the changing lifestyle of people has resulted in the rising demand for sophisticated housing, which has further fueled the expansion of product demand.

| Report Attribute | Details |

Historical Years |

2017-2022 |

Forecast Years |

2023-2030 |

Market Size in 2022 |

USD 164.1 Billion |

Revenue Forecast in 2030 |

USD 238.8 Billion |

Growth Rate |

4.80% CAGR |

Report Scope |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

Segments Covered |

By Technology; By Formulation, By Application; By Region |

Explore more about this report - Request free sample

APAC’s Revenue Contribution To Rise at Highest Pace Globally

Globally, the paints and coatings market in APAC will witness the highest growth rate, of 5.9%, during the forecast period. This is mainly driven by the growing construction industry in China and India, which is driving the adoption of new coating resins and formulations. This is itself essentially credited to the increasing demand for paints and coatings for the renovation and repair of commercial and residential buildings. Additionally, the increase in government and overseas investments in the construction and automotive sectors is driving the market in the region.

Furthermore, the growing real estate activities, combined with the rapid urbanization, booming population, and increasing disposable income, propel the demand for paints and interiors in the region.

For instance, the Indian real estate sector has witnessed rapid growth in recent times, with a rise in the demand for office as well as residential spaces. A key reason for the growth of the sector is the shift in the work culture and development of a taste for the high-end lifestyle. This, in turn, is leading to the development of designer commercial spaces and elegant homes, thus advancing the scope of painting materials, such as acrylic and polyester.

Product sales revenue in Europe stood at an estimated USD 32,640 million in 2022. This can be ascribed to the presence of a large number of market players and an established automotive sector in the region. Moreover, with the increasing residential construction and renovation activities and growing maritime industry, the region is expected to undergo continued market advance during the forecast period.

Introduction of Nanotechnology

The advent of nanotechnology has revolutionized the formulations of paints and coatings. Apart from developing zero- or low-VOC formulations, industry players have leveraged this technology to create nano paints and coating solutions, which have superior characteristics, such as water/dirt repulsion, microbial resistance, and scratch resistance. This has also resulted in the introduction of ceramics or metals in various types of formulations, in the form of granules, free powders, and particles, which are then combined into the finished product matrix.

Some of the recent formulations developed using nanotechnology even conduct electricity and offer UV protection and self-healing property. Apart from these, they are also highly resistant to mar and corrosion. Hence, the introduction of such advanced technology is expected to provide growth opportunities to the players operating in the paints and coatings industry.

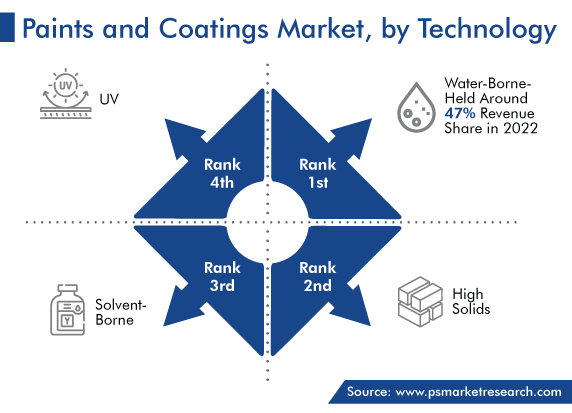

Due to Their Eco-Friendly and Low-VOC Properties, Water-Borne Coatings Hold Dominant Share

Due to their rising use in the automotive, furniture, plastic, wood, and printing inks industries, water-borne coatings currently have the largest share, of around 47%, in 2022. Their advantages include low VOC emissions, quick drying, and simpler application.

Moreover, the growth in the demand for these variants will be consistent during the forecast period owing to their increasing consumption by several automobile and furniture manufacturers, due to the cost-effective nature and superior adhesion properties of these materials.

The powder category will experience a growth rate of 6% during the forecast period. The key application areas of these alternatives are critical auto, engine, and industrial machinery parts, because powder coat finishes are resistant to corrosion, abrasion, chemicals, and detergents.

Top Paint and Coating Producing Companies Are:

- Akzo Nobel N.V.

- PPG Industries Inc.

- The Sherwin-Williams Company

- Kansai Paint Co. Ltd.

- Nippon Paint Holdings Co. Ltd.

- BASF SE

- RPM International Inc.

- Jotun A/S

- Axalta Coating Systems Ltd.

- Masco Corporation

- Asian Paints Limited

Market Size Breakdown by Segment

This report offers deep insights into the paints and coatings market, with size estimation for 2017 to 2030, the major drivers, restraints, trends and opportunities, and competitor analysis.

Based on Technology

- Water-Borne

- Solvent-Borne

- High Solids

- Powder Coatings

- Ultraviolet (UV)

Based on Formulation

- Acrylic

- Polyester

- Polyurethane

- Epoxy

Based on Application

- Architectural Coatings

- Residential

- Non-residential

- Industrial Coatings

- Automotive original equipment manufacturer (OEM) coatings

- Wood finishes

- Powder coatings

- Coil coatings

- Packaging finishes

- General industrial finishes

- Special Coatings

- Automotive refinish coatings

- Protective coatings

- Marine coatings

Geographical Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- Russia

- Italy

- U.K.

- Turkey

- France

- Spain

- Poland

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Middle East and Africa

- Saudi Arabia

- U.A.E.

- South Africa

- Iran

The estimated revenue of the market for paints and coatings in 2022 is USD 238.8 billion.

The key driver for the paints and coatings industry is the growth in the construction and automotive sectors.

APAC is the largest and fastest-growing market for paints and coatings.

Nanotechnology is trending in the paints and coatings industry.

The market for paints and coatings is dominated by architectural applications.

Get a bespoke market intelligence solution

- Buy report sections that meet your requirements

- Get the report customized as per your needs

Want a report tailored exactly to your business strategy?

Request CustomizationWant an insight-rich discussion with the report author?

Speak to AnalystOur dedication to providing the most-accurate market information has earned us verification by Dun & Bradstreet (D&B). We strive for quality checking of the highest level to enable data-driven decision making for you

Our insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

With 24/7 research support, we ensure that the wheels of your business never stop turning. Don’t let time stand in your way. Get all your queries answered with a simple phone call or email, as and when required

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws