India Compressor Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024-2030)

Get a Comprehensive Overview of the India Compressor Market Report Prepared by P&S Intelligence, Segmented by Type (Positive Displacement, Dynamic), Lubrication Type (Oil-Free, Oil-Flooded), Portability (Portable, Stationary), Pressure (Ultra-Low-Pressure, Low-Pressure, Medium-Pressure, High-Pressure, Hyper-Pressure), Application (Construction, Power, Industrial Manufacturing, HVAC-R, Chemical and Cement, Automotive, Oil and Gas, Food and Beverage, Textile), and Geographic Regions. This Report Provides Insights From 2017 to 2030.

India Compressor Market Size

Market Statistics

| Study Period | 2017 - 2030 |

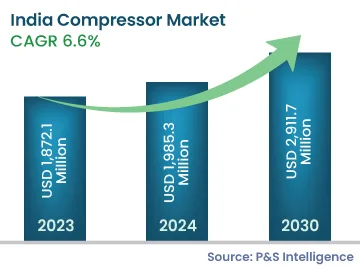

| 2023 Market Size | USD 1,872.1 Million |

| 2024 Market Size | USD 1,985.3 Million |

| 2030 Forecast | USD 2,911.7 Million |

| Growth Rate (CAGR) | 6.6% |

| Largest Region | North India |

| Fastest Growing Region | North India |

| Nature of the Market | Fragmented |

| Largest Application | Automotive |

Market Size Comparison

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

India Compressor Market Analysis

The Indian compressor market generated USD 1,872.1 million revenue in 2023, and it is projected to witness a CAGR of 6.6% during 2024–2030, to reach USD 2,911.7 million by 2030. The growing automotive sector in India is expected to drive the demand for compressors. Additionally, the manufacturing sector in India is growing rapidly and is expected to reach USD 1 trillion by 2025, owing to the constant support from the government.

For instance, the total production of passenger vehicles was around 2.22 million units in 2023. Due to the increasing production of vehicles, the country is expected to be the world's third-largest automotive market in terms of volume by the end of year 2026. Further, the country's automobile industry is expected to reach USD 300 billion by 2026.

Compressed air plays an important part in the production process of different automobiles. The uses of compressed air include product finishing, tire inflation, cutting and welding, car painting, and engine construction. It is also used to turn metal sheets into critical vehicle components, assemble vehicle components, and clean and paint using dry oil-free compressors. Thus, the surging automotive sector is likely to create high demand for compressors.

India Compressor Market Trends & Drivers

Inclination Toward Rotary Screw Compressor

- The inclination toward rotary screw compressors is currently being witnessed in the market. Presently, screw compressors are widely used for compressing air, processing gas, and refrigerants.

- The screw compressor works on a rotary-type displacement mechanism, which provides a continuous supply of compressed air, with minimum fluctuation in delivery pressure.

- As compared to reciprocating compressors, rotary compressors provide high capacities of compressed air with minimum installation space.

- The physical size of the compressors is smaller, thus they are considered to provide high reliability, resulting in lower maintenance costs and reduced downtime, as compared to reciprocating machines.

- These compressors are increasingly being used in industries, including food packaging and automated manufacturing, which require continuous pressurized air.

Growing Manufacturing Sector Due to Increasing Government Support

- The manufacturing sector in India is growing rapidly and is expected to reach USD 1 trillion by 2025, owing to the constant support from the government. In the sector, industrial air compressors are used for tool powering, clamping, and stamping.

- The government has been promoting the manufacturing sector coupled with the inflow of FDI in India. For instance, the government of India launched the ‘Make in India’ initiative, which focuses on making India a manufacturing hub. This initiative aims to encourage foreign investors to invest in the manufacturing sector in the country through FDI.

- As per the FDI factsheet released by the Department for Promotion of Industry and Internal Trade (DPIIT), India has registered a record total FDI of USD 33 billion in FY 2023–2024. The rising number of manufacturing facilities in the country would propel the demand for compressors in the coming years.

- The government introduced the National Policy on Electronics (NPE), which is predicted revenue generation of USD 400 billion by 2025 in the electronics manufacturing industry. This would increase the demand for compressors in the country.

- The government brings a new Foreign Trade Policy, which aims to enhance e-commerce exports by bringing promotion schemes of the government.

- The government increased export incentives by 2%, which would be available for labor-intensive MSME sectors, under the Mid-Term Review of Foreign Trade Policy.

- Under the ‘Make in India’ initiative, the government launched a phased manufacturing programme (PMP), which aims at adding more smartphone components, thereby boosting the domestic manufacturing of mobile handsets.

- In order to generate employment and boost the ‘Make in India’ initiative, the government is planning to further ease FDI in the defense sector to 51% from the current 49%, under the automatic route.

- Thus, due to the increasing support from the government, the market for compressors is expected to achieve significant growth in the coming years.

Increased Import Duty on Compressors

- The rise in customs duty is one of the major restraints for the Indian compressor market. In India, compressors are mostly imported from countries, including China, Thailand, Germany, and Indonesia, on which import duties have been levied.

- It is expected that the government will hike the customs duty on items, such as fans, food grinders, mixers, shavers, toasters, heaters, and compressors. This was done to cut down the current account deficit and promote the ‘Make in India’ initiative.

- Owing to the increase in import duties, the prices for all home appliances are expected to rise, which may restrict customers from buying. The price hike for air conditioners is expected to rise by 3–4%, whereas the price for refrigerators is likely to increase by 5–6%.

- As a result, this would have a negative effect on the demand for compressors, as well. Thus, the market may face a slowdown in India.

India Compressor Industry Outlook

Type Insights

- Based on type, the market is witnessing increasing demand for dynamic compressors. This category is further projected to continue its dominance in the market during the forecast period.

- It is noted that more than 90% of the centrifugal compressor market in India is organized, with majorly large manufacturers producing compressors, owing to their complex design and relatively high investment requirement.

- Moreover, the rising number of industries, such as oil & gas, steel, and cement, and the increasing government initiatives pertaining to energy-efficient solutions are augmenting the demand for dynamic compressors.

- Additionally, centrifugal compressors have high capacity and efficiency, thus their demand is increasing. Hence, the market for dynamic compressors is projected to witness faster growth in India, during the forecast period.

Types of compressors covered in the report include:

- Positive Displacement (Larger Category)

- Dynamic (Faster-Growing Category)

Lubrication Type Insights

- Oil-flooded compressors have low initial costs, in addition to the fact that these compressors need considerably less maintenance than oil-free compressors.

- Indian consumers are price-driven, whilst focusing on optimal solutions for their business operations. Thus, the demand for oil-flooded compressors is higher in the market.

- Whereas, the oil-free compressor category is projected to witness faster growth during the forecast period. With time, manufacturers are becoming aware of operational efficiency, and thus, are manufacturing systems that produce oil-free air at the same efficiency and cost as of oil-flooded compressors.

The following lubrication types are included in the report:

- Oil-Free (Larger Category)

- Oil-Flooded (Faster-Growing Category)

Portability Insights

- On the basis of portability, the stationary category held a larger share of around 75% and it is also expected to register faster growth during the forecast period.

- This can be primarily attributed to the high growth in the automotive and manufacturing industries in the country.

- In addition, stationary compressors are appropriate for automotive usage, including rotating tires and other small tasks. As a result, the market for stationary compressors is projected to continue holding a larger share in the coming years.

Portability categories covered in the report are:

- Portable

- Stationary (Larger and Faster-Growing Category)

Application Insights

- On the basis of application, the automotive industry held the largest share, of around 40%, in the market. This is due to the high domestic production of automobiles in the country.

- In addition, due to environmental regulations in the country, low gas-emitting, less noisy, and energy-efficient compressors are in huge demand in the automotive industry. As a result, the demand for compressors in the industry is projected to witness the fastest growth during the forecast period.

It is further classified as:

- Construction

- Power

- Industrial Manufacturing

- Heating, Ventilation, Air Conditioning, and Refrigeration (HVAC-R)

- Chemical and Cement

- Automotive (Largest and Fastest-Growing Category)

- Oil and Gas

- Food and Beverage

- Textile

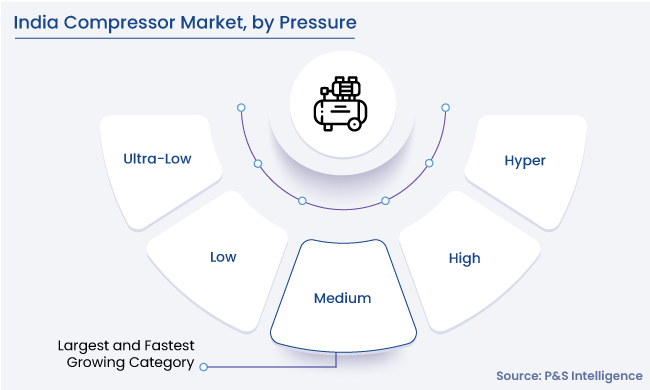

Pressure Insights

- In the market, the medium-pressure category generated the largest revenue in 2023, and it is also expected to witness the highest growth rate of 45% over the forecast period.

- Medium-pressure compressors find their applications across vehicles as well as in home air conditioners and refrigerators.

- The growth of the automotive and home appliances industries is the primary factor driving the demand for these compressors.

Further, it is divided into the following:

- Ultra-Low

- Low

- Medium (Largest and Fastest-Growing Category)

- High

- Hyper

Regional Analysis

- The northern region of India registered the largest revenue share in the compressor market in 2023. Automotive and industrial manufacturing are the major application areas of compressors in the region.

- Further, Uttar Pradesh, Uttarakhand, Haryana, Punjab, Himachal Pradesh, and Madhya Pradesh are the major states in the region.

- In the region, the consumption of compressors is high in National Capital Region (NCR) cities, due to the high demand from automobile production applications as well as high industrial growth. For instance, the NCR produces over 30% of passenger cars and more than 50% of two-wheelers in India.

- Furthermore, the industrial sector in the NCR is witnessing the highest growth rate, in terms of both set-up of new production facilities and revenue generation. This is attributed to the strong transport network.

- Besides this, Manesar, a town in Gurugram district (Haryana) witnessed huge investments in past years for the development of the industrial sector. This has led to investments by various large industrial manufacturers, including Maruti Suzuki India Limited, Toshiba International Corporation, Denso Corporation, and Hero Motor Corp.

- The government support in developing industrial corridors, such as the Delhi–Mumbai industrial corridor and Amritsar–Delhi–Kolkata industrial corridor, as well as developing small and medium enterprises, is expected to drive the demand for compressors in the northern region during the forecast period.

Further, regions analyzed for this report include:

- Northern (Largest and Fastest-Growing Regional Market)

- Southern

- Eastern

- Western

India Compressor Market Share

Recent activities of major players in the market include mergers and acquisitions, and product launches. Companies involved in mergers and acquisitions, including Atlas Copco AB and Elgi Equipments Limited, are focusing on strengthening their market position and expanding their operations in several countries. Also, major companies are involved in product launches to cater to the increasing demand for energy-efficient compressors from industrial users.

Top Compressor Manufacturing Companies in India:

- Atlas Copco AB

- Ingersoll Rand Inc.

- ELGi EQUIPMENTS LTD

- Kobe Steel Ltd.

- Mitsubishi Heavy Industries Ltd.

- Indo-Air Compressors Pvt. Ltd.

- Kirloskar Pneumatic Co. Ltd.

- Anest Iwata USA Inc.

- Burckhardt Compression AG

- KAESER Kompressoren SE

- Zen Air Tech Pvt. Ltd.

India Compressor Industry News

- In September 2023, Elgi Equipments Limited, an air compressor provider, announced the launch of Air~Alert, for the Indian market. It is an IoT-enabled data analysis technology that enhances energy efficiency.

- In August 2023, Atlas Copco AB began the construction of a new factory in India. This new facility will manufacture air & gas compressors.

Request the Free Sample Pages