Electric Bus Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

Get a Comprehensive Overview of the Electric Bus Market Report Prepared by P&S Intelligence, Segmented by Propulsion (Battery Electric Bus, Plug-in Hybrid Electric Bus, Hybrid Electric Bus), Length (Less than 10 m, More than 10 m), Battery (Lithium–Iron Phosphate, Lithium–Nickel–Manganese–Cobalt Oxide), Application (Intercity, Intracity), End Use (Public, Private), and Geographic Regions. This Report Provides Insights From 2017 to 2030.

Electric Bus Market Data

Market Statistics

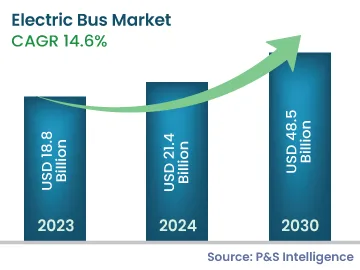

| Study Period | 2017 - 2030 |

| 2023 Market Size | USD 18.8 Billion |

| 2024 Market Size | USD 21.4 Billion |

| 2030 Forecast | USD 48.5 Billion |

| Growth Rate (CAGR) | 14.6% |

| Largest Market | Asia-Pacific |

| Fastest-Growing Market | North America |

| Nature of the Market | Consolidated |

| Largest Application | Intercity |

Market Size Comparison

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

Electric Bus Market Analysis

The electric bus market size was USD 18.8 billion in 2023, and it is expected to grow at a CAGR of 14.6% during 2024–2030, to reach USD 48.5 billion by 2030. It is due to the growing concerns over greenhouse gas (GHG) emissions, declining cost and improving operational efficiency of batteries, long-term cost benefits of electric buses, and increasing replacement sales.

The depleting oil reserves in major oil-producing countries have led to an increase in crude oil prices globally. Since crude oil imports constitute a significant amount of expenditure of most of the developing countries, an increase in the prices of this commodity have compelled these countries to cut down on imports via the adoption of alternative fuels.

Despite their high initial cost, electric buses have considerably low operating costs. This is the reason transit agencies in developing countries are focusing on the long-term environmental and cost benefits of these buses. The establishment of new cities and satellite cities in developing countries has offered significant space to support the infrastructure for electric buses.

An electric bus in its entire life cycle saves fuel worth USD 365,000 compared to a diesel variant and USD 225,000 as compared to one running on CNG. Moreover, electric buses are less noisy and require less maintenance s compared to their conventional counterparts.

According to industry experts, the average price of Li-ion battery packs for large orders declined to approximately USD 139/kWh in 2023. As the battery accounts for around 40% of the electric bus manufacturing cost, any decline in its price would help OEMs cut down the price of their buses, thus boosting their sales. Moreover, an increase in the battery production, particularly in China, would further help achieve economies of scale, thereby lowering the battery prices during the forecast period.

Additionally, with technological advancements, the battery capacity is likely to increase to meet the demand for a longer driving range. Thus, manufacturers are consistently working to achieve a higher energy density and lower reliance on cobalt, an expensive raw material used in these batteries, which, in turn, would increase the operational efficiency of these batteries and lower their cost. It is expected that the running cost of electric vehicles will come down due to the declining cost of these batteries. As in the case of the ICE, the costs have reduced with decades of experience in manufacturing, those of electric buses too would also continue to fall during the forecast period.

Electric Market Trends & Growth Drivers

Emergence of Autonomous Buses Is Key Trend

- The technological advancements in the fields of instrumentation and actuation and sensing technologies have led to the emergence of autonomous and semi-autonomous transportation systems.

- Autonomous buses are well equipped with features such as light detection and ranging (LiDAR), odometer, global positioning system (GPS), and computer-aided vision, which aid them in perceiving their surroundings. Sensory information is interpreted by advanced control systems to identify signage, obstacles, and appropriate navigation paths.

- Over the years, automated driving has gained traction in the global electric bus market because the technology provides improved efficiency (more-predictable transport times) and reduced costs (including fuel, labor, and maintenance costs).

- Due to the above-mentioned benefits, OEMs, such as Navya SAS, AB Volvo, Easy Mile SAS, and SB Drive, are embracing autonomous driving and working toward the development of autonomous bus shuttles. For instance, in March 2024, a trial project was launched with driverless electric buses integrated with the 5G technology in the city of Ayutthaya, Thailand. These buses are driverless, but safety operators will be in each of them.

Growing Concerns over GHG Emissions Is Key Diver

- The growing concerns of governments and environmental agencies over air quality degradation due to the increasing urban vehicular emissions have led to the formulation of stringent environmental policies. Currently, conventional diesel-powered buses are an integral part of the public transportation system, but they contribute significantly to GHG emissions.

- Thus, stringent emission policies are being encouraged, which, coupled with the rising environmental awareness among people, encourages the deployment of low- and zero-emission transport systems across the world.

- GHG emissions from diesel-based buses have become a major concern globally, compelling countries to look for environment-friendly means of transportation. CNG-based public transportation system is still the predominant alternative to diesel-based public transport systems; however, electric buses are gaining traction due to their zero carbon emissions.

High Prices of Electric Buses Are Key Restraining Factor

- The high cost of electric buses is the dominant factor hindering their large-scale adoption, especially in developing countries.

- The average price of electric buses is three to four times that of diesel buses, which can be attributed to the high cost of battery packs.

- In many countries, local governments do not have adequate funds to procure electric buses for public transportation despite the financial support received from the central government. Additionally, the market is in its nascent phase, and the production is considerably low due to the underdeveloped charging and policy ecosystem, which results in the high cost of these buses.

Electric Bus Industry Outlook

Propulsion Insights

- Based on propulsion, battery electric buses (BEBs) held the largest share, of around 45%, in 2023, owing to the increasing government support, in the form of incentives and subsidies, to enhance their adoption.

- Besides, major manufacturers in the market are focusing on adding BEBs to their product portfolios, which is further boosting their availability globally.

The propulsions covered in the report include:

- Battery Electric Bus (BEB) (Largest Category)

- Plug-in Hybrid Electric Bus (PHEB) (Fastest-Growing Category)

- Hybrid Electric Bus (HEB)

Length Insights

- On the basis of length, the less than 10 meters category holds the larger share in the market. This is due to the ease of driving smaller buses and the better control the driver has on them. Further, buses of a short length can be easily controlled on a sharp turn, such as in hilly area and on congested road.

- The more than 10 meters category is expected to be the faster-growing category over the forecast period, due to the rising population and increasing transportation needs in cities.

The following lengths are included in the report:

- Less than 10 m (Larger Category)

- More than 10 m (Faster-Growing Category)

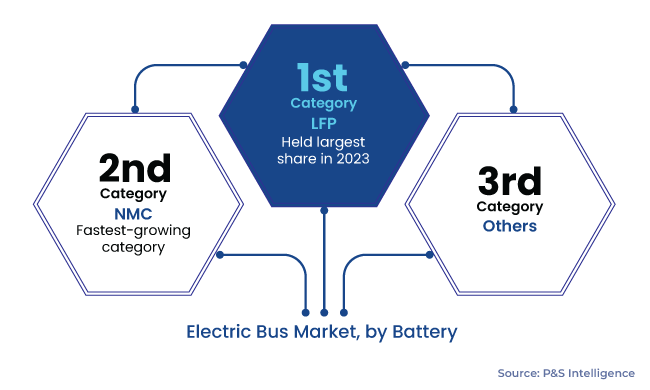

Battery Insights

- Based on battery, the lithium–iron phosphate (LFP) category is expected to continue dominating the market in the coming years. LFP batteries are more durable than others and, therefore, are recommended for heavy-duty electric buses.

- During the forecast period, however, the fastest growth in the market is expected in the Li–NMC category, with 14.9% CAGR.

- With the increasing investments for the development of advanced NMC batteries, their safety is expected to come at par with that of LFP variants, which, in turn, will positively affect the former’s sales during the forecast period.

The batteries covered in the report are:

- Lithium–Iron Phosphate (LFP) (Largest Category)

- Lithium–Nickel–Manganese–Cobalt Oxide (NMC) (Fastest-Growing Category)

- Others

Application Insights

- By application, the intracity category held the larger share in 2023. This is attributed to the increasing demand for public transport and the increasing number of workplaces, schools, collages, and tourist places adopting electric buses in their fleets.

- The intercity is the faster-growing category. This is due to the increasing interest of tourists in long journeys, which is propelling the adoption of electric buses in intercity fleets.

The application segment is classified as:

- Intercity (Faster-Growing Category)

- Intracity (Larger Category)

End Use Insights

- Based on end user, the public bifurcation held the larger share, of around 70%, in the global electric bus market during the historical period (2017–2023). The increasing efforts of public transport operators to add electric buses to their fleets have predominantly benefited the market growth in this category globally.

- The private bifurcation is expected to grow faster during the forecast period.

- With the ongoing decline in Li-ion battery prices, the upfront cost of electric buses is expected to decrease, which, in turn, will reduce their total cost of ownership (TCO) in the coming years.

- The decreased TCO, in turn, is expected to attract private transport operators to replace their diesel buses with electric/hybrid variants.

The end user segment has the following categories:

- Public (Larger Category)

- Private (Faster-Growing Category)

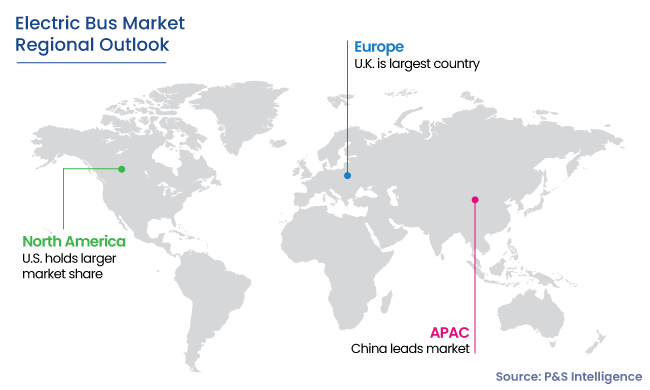

APAC Holds Largest Market Share

- APAC held the largest share, of around 50%, in the global electric bus market in 2023. Among all countries, China continues to remain the largest market for electric buses globally. The demand for these clean automobiles in China is strongly driven by the favorable government subsidies, municipal air quality targets, and national sales targets for alternative-fuel vehicles.

- North America is expected to be the fastest-growing regional market because manufacturers in these regions are investing heavily to manufacture and advance these vehicles.

The regions and countries analyzed for this report include:

- North America (Fastest-Growing Regional Market)

- U.S. (Larger and Faster-Growing Country Market)

- Canada

- Europe

- Germany

- U.K. (Largest Country Market)

- France (Fastest-Growing Country Market)

- Italy

- Spain

- Rest of Europe

- Asia-Pacific (APAC) (Largest Regional Market)

- China (Largest Country Market)

- Japan

- India (Fastest-Growing Country Market)

- South Korea

- Australia

- Rest of APAC

- Latin America (LATAM)

- Brazil (Largest and Fastest-Growing Country Market)

- Mexico

- Rest of LATAM

- Middle East and Africa (MEA)

- Saudi Arabia (Largest Country Market)

- South Africa

- U.A.E. (Fastest-Growing Country Market)

- Rest of MEA

Electric Bus Market Share

Companies in the global electric bus industry are taking strategic measures to increase their market share. These strategic moves range from mergers and acquisitions to business expansions and partnerships. To gain a competitive edge and expand their market reach, companies are also focusing on improving their existing product portfolios and entering into collaborations with other key players.

Electric Bus Companies:

- BYD Company Limited

- YUTONG Bus Co. Ltd.

- Zhongtong Bus Holding Company Limited

- Solaris Bus & Coach sp. z o.o.

- Anhui Ankai Automobile Co. Ltd.

- Yinlong Energy International Pte. Ltd.

- Skywell New Energy Vehicles Group Co. Ltd.

- Beiqi Foton Motor Co. Ltd.

- VDL Bus & Coach B.V.

- Switch Mobility

- AB Volvo

Electric Bus Industry News

- In February 2024, Yutong Bus Co. Ltd. completed road tests of its pure-electric buses in cold weather in Norway.

- In February 2024, BYD Auto Co. Ltd. announced plans to set up an e-bus plant in Mexico.

- In December 2021, BYD UK partnered with Alexander Dennis Limited (ADL) to deliver four 10.2-meter-long BYD ADL Enviro200EV e-buses to Nottinghamshire County Council.

Frequently Asked Questions About This Report

The electric bus market value will reach USD 48.5 billion in 2030.

The market for electric bus will touch USD 21.4 billion in 2024.

The arrival of autonomous buses is the key electric bus industry trend.

Intracity application hold the larger electric bus market share.

The APAC market for electric bus is the largest.

The electric bus market players are taking strategic measures to improve their position. These strategic measures include mergers & acquisitions, partnerships, and business expansions.

Request the Free Sample Pages

Want a report tailored exactly to your business need?

Request CustomizationWe are Trusted by

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws