EdTech Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

Get a Comprehensive Overview of the Edtech Market Report Prepared by P&S Intelligence, Segmented by Type (Hardware, Software, Services), Application (K–12, Higher Education, Competitive Exams, Certifications), End User (Individual Learners, Institutes, Enterprises), and Geographic Regions. This Report Provides Insights From 2017 to 2030.

EdTech Market Data

Market Statistics

| Study Period | 2017 - 2030 |

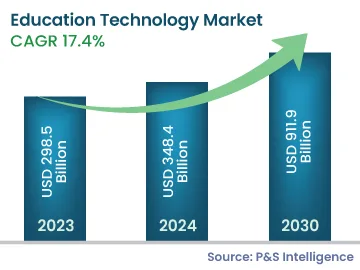

| 2023 Market Size | USD 298.5 Billion |

| 2024 Market Size | USD 348.4 Billion |

| 2030 Forecast | USD 911.9 Billion |

| Growth Rate (CAGR) | 17.4% |

| Largest Region | Asia-Pacific |

| Fastest Growing Region | Asia-Pacific |

| Nature of the Market | Fragmented |

| Largest Application | K-12 |

Market Size Comparison

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

EdTech Market Analysis

The global education technology market size was valued at USD 298.5 billion in 2023, and it is expected to grow at a CAGR of 17.4% during 2024–2030, reaching USD 911.9 billion in 2030. This is ascribed to the emergence of AI and digitalization in EdTech solutions. The educational curriculum has traditionally been highly standardized as it could not be tailored to the preferences and capabilities of individual students.

AI enables the creation of customized courses after due interpretation, observation, and prediction of learners’ behavior. AI enables the identification of the gaps in learning based on test scores as well as non-verbal stimuli, such as classroom behavior and facial expressions. This method can thus enhance engagement, focus, and knowledge retention in students.

Companies and startups are now merging the organic and the artificial by applying deep learning systems to innovate how people are educated. For instance, Nuance Communications Inc., a software company, makes speech recognition software for students and faculties to transcribe up to 160 words per minute. The technology is of special help for students who have limited mobility or struggle with writing. It also enhances their ability to spell and recognize words.

Instructors use the software to dictate lectures for later use or streamline tedious tasks, such as document and email creation. Moreover, Age of Learning Inc. provides mathematics, reading, and other foundational literacy for pre-K to 2nd-grade students. The company’s applications use AI-driven interactive entertainment to create personalized and engaging learning curricula depending on students’ skills. Along with at-home learning options, the company offers mathematics and reading curricula for physical classrooms.

One of the fundamental components of the United Nations’ Sustainable Development 2030 Agenda is quality education. It aims to ensure inclusive and equitable quality education for all. Digital technologies reduce or stop pollution and waste, at the same time driving production and efficiency, which is why they have had a powerful impact on the education system. The recent COVID-19 pandemic has further fueled the acceptance of digital technologies in education.

With smartphones and other wireless devices becoming popular among the general public, it schools and educational institutions are focusing on making efficient use of them in teaching. Modern technology's non-intrusive character and adaptability make learning more appealing to students.

EdTech Market Trends & Drivers

Involvement of Players in Various Strategic Developments

- Players in the education technology industry are continuously launching new solutions to stay in the competition.

- Players are involved in mergers & acquisitions to increase opportunities in the education industry.

- Players are partnering with various firms to increase the adoption of various technologies evolving in the education industry.

Advancements in Technologies

- EdTech solutions are expected to evolve in parallel with advancements in technologies, such as IoT and AI. Further, the incorporation of AR and VR in these solutions allows for a more-interactive learning experience for students. It enables students to explore and seamlessly connect with abstract concepts, thereby increasing their engagement.

- The incorporation of the blockchain technology enables users to store and secure records of students and learners, thereby allowing educators to analyze the consumption patterns of materials offered and make data-driven decisions.

- The improvements in connectivity infrastructure and smartphone penetration, the introduction of the 5G technology, and the rise in the investments by private equity & venture capital firms drive the education technology market growth.

- The increasing use of smartphones has enabled students to easily access content and learning materials. In both developed and developing countries, the rise in disposable income and the high internet penetration have increased the demand for mobile learning platforms.

- The incorporation of advanced technologies has resulted in a revolution in the education industry, making it more convenient for people all over the world to read and learn, thus resulting in a greater reliance on devices such as smartphones and tablets to pursue skills. As a result of the ease of access to information, the demand for tech-based education is expected to rise significantly in the coming years.

Rising adoption of EdTech platforms

- The adoption EdTech platforms is rising constantly in government organizations, academic institutions, and other educational settings. Various EdTech platforms are used as test preparation platforms for government, banking, and other exams.

- Several companies have been involved in partnerships with government organizations and private institutions to offer their platforms.

- For instance, in May 2022, Coursera Inc. partnered with IIM Indore, IIM Ahmedabad, IIIT Bangalore, Hero Mindmine, Indian Institute (IISc), Tally Education, and PwC India to build business, technology, and data science skills. This takes Coursera's total number of university partners to 14 and industry partners to five in the country.

- Moreover, in August 2022, Coursera Inc. collaborated with the Private Sector Commission (PSC) for national upskilling and reskilling programs aligned to the needs of the local private sector.

- In addition, in September 2021, BYJU’S partnered with NITI Aayog to provide free access to its learning programs for children from 112 aspirational districts of the country. As part of the partnership, a dedicated working group was set up that actively monitors and evaluates the implementation of the programs. Thus, the surging adoption of EdTech platforms is driving the education technology market growth.

Growing Security and Privacy Concerns

- The heightened attention on data privacy is making K–12 schools prioritize this aspect of their operations.

- Educational institutions and businesses can acquire a variety of data in the connected environment, including information about students, with the help of IoT-enabled smart devices and electronic wearables.

- Businesses and educational institutions have access to learners’ location and other pertinent information, which may violate their privacy. This data can be easily accessed since the educational IT infrastructure might not be as secure as it should be at a corporate level.

- The inappropriate use of student data by vendors is one of the top EdTech data privacy risks. Third-party vendors use the data collected by their EdTech platforms to advertise to students and rent or share it with other companies, organizations, and other entities. This can create profiles of students using data collected over time, which can be used for discipline, discrimination, college acceptance, and/or other potentially harmful purposes.

- The stored data of students can be used against them in the future, for instance, if the pupil enrolls for government service.

- Data breaches involving K–12 schools in the U.S. have resulted from security incidents among vendors and partners. Thus, the growing security and privacy concerns in the education technology sector is constraining the market.

In-Depth Segmentation Analysis

Education Technology Type Insights

- The hardware category held the largest revenue share, of around 50%, in 2023, and it is expected to generate over USD 500 billion revenue by 2030. This is due to the surge in the sales of tablets, laptops, computers, and other hardware for education purposes across the world.

- The rising adoption of digital classrooms throughout the education industry also drives the market growth in this category.

During the study, three types were considered in the report:

- Hardware (Largest & Fastest-Growing Category)

- Software

- Others

Education Technology Application Insights

- Based on application, the K–12 category held the largest revenue share, of around 40%, in 2023, and it is projected to progress at a CAGR of 17.5% during the forecast period.

- This is on account of the gamification trend for the enhancement of math skills among students. Moreover, EdTech solutions offer an immersive experience in classrooms and provide exposure in the form of lab-based experiments and virtual field trips to K–12 students.

The following applications were analyzed in the education technology market report:

- K–12 (Largest Category)

- Higher Education

- Competitive Exams (Fastest-Growing Category)

- Certifications

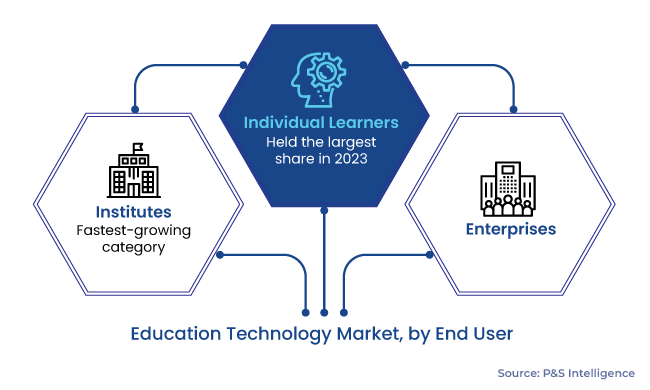

Education Technology End User Insights

- The institutes category is expected to grow at the highest CAGR, of 17.7%, during 2024–2030. This can be ascribed to the active involvement of EdTech companies in different market strategies, such as mergers and acquisitions.

The following are the key end users that shape the educational technology market growth potential:

- Individual Learners (Largest Category)

- Institutes (Fastest-Growing Category)

- Enterprises

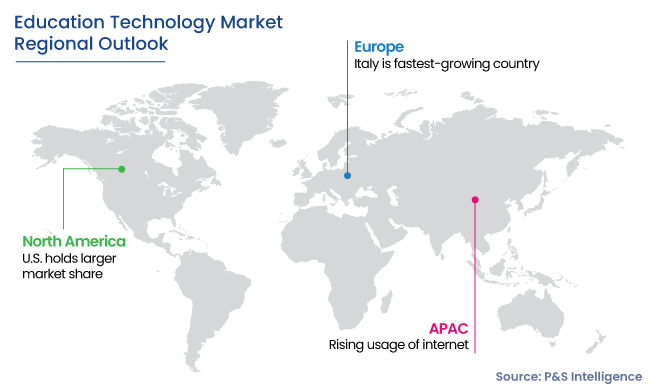

Asia-Pacific is the Largest Market for EdTech

- Globally, APAC is the largest market for education technology, holding around 55% revenue share in 2023. This is mainly driven by the rising usage of the internet and smart devices.

- Additionally, the large-scale financial aid by governments in developing countries, such as India and China, combined with the increase in accessibility of digital devices for students, is boosting the market growth. For instance, in January 2022, the Indian government set up around 20,000 digital boards in Delhi to increase the education level in the country.

The regions and countries analyzed for this report include:

- North America

- U.S. (Larger Country Market)

- Canada (Fastest-Growing Country Market)

- Europe

- Germany

- U.K. (Largest Country Market)

- France

- Italy (Fastest-Growing Country Market)

- Rest of Europe

- Asia-Pacific (APAC) (Largest and Fastest-Growing Regional Market)

- China (Largest Country Market)

- Japan

- India (Fastest-Growing Country Market)

- South Korea

- Australia

- Rest of APAC

- Latin America (LATAM)

- Brazil (Largest and Fastest-Growing Country Market)

- Mexico

- Rest of LATAM

- Middle East and Africa (MEA)

- Saudi Arabia

- South Africa (Fastest-Growing Country Market)

- U.A.E. (Largest Country Market)

- Rest of MEA

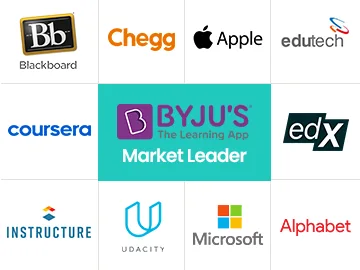

Competitive Analysis

The market has a high degree of fragmentation because of the presence of many domestic and international players.

Top EdTech Companies:

- BYJU’S

- Blackboard Inc.

- Chegg Inc.

- Coursera Inc.

- Apple Inc.

- Edutech

- edX LLC

- Instructure Holdings Inc.

- Udacity Inc.

- Microsoft Corporation

- Alphabet Inc.

Education Technology Industry News

- In January 2024, Lenovo unveiled a comprehensive set of hardware, software, and service, aimed at fostering and facilitating learning from any location. The updated Lenovo Education portfolio introduces new laptops equipped with either Windows 11 or ChromeOS, specifically designed to support students and educators in embracing advanced hybrid learning approaches. Furthermore, the latest improvements to Lenovo's VR Classroom solutions promise an immersive educational experience by incorporating visuals, content, and audio.

- In January, 2024, Baims, a Kuwaiti EdTech company, acquired Orcas, an Egyptian online tutoring startup. This move aims to allow Baims to tap into the thriving education market in the Middle East and North Africa (MENA) region.

Request the Free Sample Pages