E-Cigarette Market Size & Share Analysis - Trends, Drivers, Competitive Landscape, and Forecasts (2024 - 2030)

Get a Comprehensive Overview of the E-Cigarette Market Report Prepared by P&S Intelligence, Segmented by Product (Cig-a-Like, Vaporizer, Vape Mod, T-Vapor), Gender (Male, Female), Age Group (16–24, 25–34, 35–44, 45–54, 55–65, 65+), Distribution channel (Vape Shop, Online, Hypermarket/Supermarket, Tobacconist), and Geographic Regions. This Report Provides Insights From 2017 to 2030.

E-Cigarette Market Size

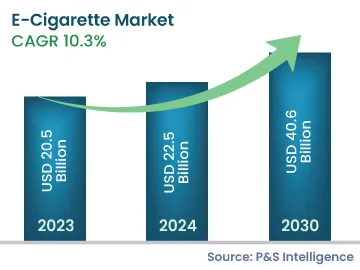

Market Statistics

| Study Period | 2017 - 2030 |

| 2023 Market Size | USD 20.5 Billion |

| 2024 Market Size | USD 22.5 Billion |

| 2030 Forecast | USD 40.6 Billion |

| Growth Rate (CAGR) | 10.3% |

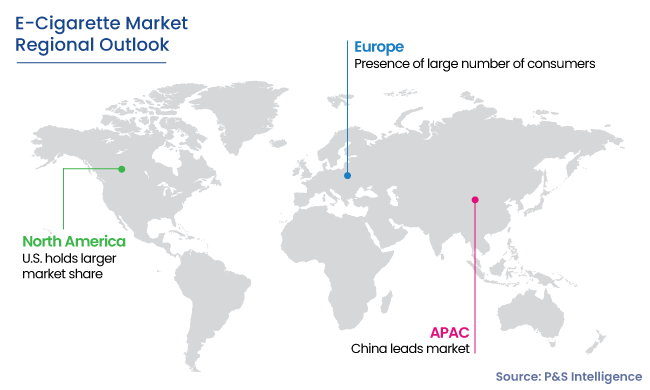

| Largest Market | Europe |

| Fastest-Growing Market | Asia-Pacific |

| Nature of the Market | Fragmented |

Market Size Comparison

Key Players

Key Report Highlights

|

Explore the market potential with our data-driven report

E-Cigarette Market Analysis

The global e-cigarette market generated revenue of USD 20.5 billion in 2023, which is expected to witness a CAGR of 10.3% during 2024–2030, to reach USD 40.6 billion by 2030. The fall in the number of people smoking conventional cigarettes is a major driver, with people adopting safer alternatives, specifically electronic cigarettes. Essentially, the increasing awareness regarding the higher safety of e-cigarettes than traditional ones, particularly among the young population, contributes to the growth in sales.

Countries such as the U.S., the U.K., France, China, Japan, and Italy are the major markets for e-cigarettes. Further, with the increasing popularity in the APAC and African regions, sales in several countries, such as South Korea, Indonesia, the Philippines, South Africa, and Australia, are projected to witness rapid market growth in the coming years.

With the growing popularity of e-cigarettes, allied sectors are introducing a large variety of flavors to attract manufacturers and customers. Menthol, chocolate, mint, bubble gum, cola, and fusions of fruits and other flavoring substances are attracting a huge number of consumers. Users in North America and Europe, predominantly the U.S., Canada, and the U.K., are recording a shift toward flavored products.

For instance, a significant proportion of the young populace from middle and high schools uses these products because of their appealing flavors. Hence, with the increasing demand for flavored products in different regions of the world, market players are prospering.

Moreover, in order to increase the presence of their goods globally, vendors are expanding their sales channels to identify prospective customers. Companies are increasingly marketing through e-commerce and social media channels and offering online discounts.

E-Cigarette Market Trends & Growth Drivers

Rising Focus on Online Marketing

- In order to increase the presence of their products globally, e-cigarette vendors are expanding their sales channels to identify prospective customers for their products.

- The e-cigarettes companies are increasingly marketing through online channels and are promoting their products through social media channels and online discounts.

- Social media acts as a major platform for product promotion among companies, with influencers, ardent users, and brand ambassadors posting promotional photos and videos.

- With growing digital marketing trend in many countries, such as China, the U.K., and the U.S., there is growing focus of e-cigarettes manufacturers to increase the promotion of their products through online channels. Hence, increasing focus toward online marketing is trending in the e-cigarette market.

Usage of E-Cigarette as an Alternative to Tobacco Smoking Is Key Driver

- The growing awareness pertaining to the harmful effects of smoking traditional cigarettes is increasing day by day across the world. This has resulted in the development of alternatives that help consumers quit traditional cigarettes.

- Cancer caused by smoking is one of the major global concerns. E-cigarettes claim to lower cancer and lung disease risk by preventing the intake of more than 4,000 toxins and carcinogens that are present in tobacco smoke.

- They emit less toxic material and are less risky to smokers with asthma problems.

- Burning tobacco generates smoke, which harms the environment and humans almost equally. E-cigarettes do not produce smoke and, instead, emit mist, which dissolves in the air in seconds. This decreases the negative effects of tobacco to the people around and the surroundings to a greater extent.

- They eliminate the need for dumping butts and flicking ash openly. As they do not produce ash and smoke, these devices can be used where cigarettes are not allowed due to the smoke emitted from them.

Government Ban on Sales of E-Cigarettes Hampers Market in Many Countries

- E-cigarettes, despite being less harmful, do not completely eliminate the risk of health damage caused by nicotine or the emission of certain chemicals. Several governments, such as Scottish, have strict regulations to monitor the production and distribution of e-cigarettes. Stringent legal policies and framework in countries such as Brazil, Austria, and India have led to the ban on e-cigarettes.

- Several incidents of major injuries to consumers using e-cigarettes have been reported. Many of them were due to the malfunctioning of atomizers and batteries, causing explosions in people’s mouths and pockets. E-liquid contained in e-cigarette is extremely harmful to infants and can cause major damage to their health.

- There is a lack of information provided by manufacturers regarding the safety, use, and maintenance of these devices, which restricts consumers from adopting them as an alternative to tobacco cigarettes. Besides, several e-cigarette legislations, such as laws related to their advertisement and promotion through television, are under consideration in various countries.

E-Cigarette Market Industry Outlook

Product Insights

- The vaporizer category accounted for the largest share, of around 45%, in the e-cigarette market in 2023, and it is projected to maintain its dominance in the coming years. The rising popularity of vaporizers is attributed to their moderate cost, dense aerosol production, and flexibility with a variety of flavors.

- The T-Vapor category is projected to have the highest CAGR, of 10.7% during the forecast period.

- The T-vapor is primarily popular in Japan and South Korea, wherein people prefer the tobacco flavor and the close resemblance of this device to traditional smoking.

- The recreation industry, which comprises pubs and bars, is following regional policies, which strengthens the sales and production of these devices. Electronic vaping devices are easy to carry and allow personalized consumption for vaporizing herbs and other substances.

- Technological advancements, such as temperature control for the optimum taste, have a positive influence on the sales expansion in this category.

- Cig-a-likes are expected to have a moderate growth rate in the coming years, owing to their compact size and low price. Rechargeable cig-a-likes are witnessing high sales, primarily owing to their low operational cost. They can be used repeatedly and require less-frequent replacement of components, thus also ensuring ease of use for customers.

During the study, we have analyzed the following types of products in the report:

- Cig-a-Like

- Disposable

- Rechargeable

- Vaporizer (Largest Category)

- Open-tank

- Closed-system

- Vape Mod

- T-Vapor (Fastest-Growing Category)

- Heat-not-burn

- Infused

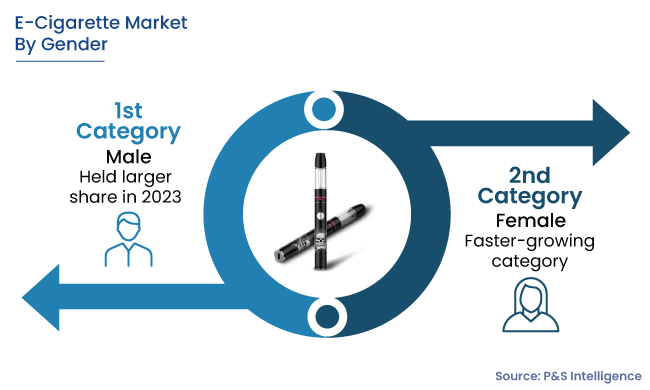

Gender Analysis

- The male category held the larger market share, of around 75%, in 2023. With more male consumers switching toward e-cigarettes as a smoking-cessation alternative, this category is projected to continue dominating the market throughout the forecast period.

Below are the genders covered in the report:

- Male (Larger Category)

- Female (Faster-Growing Category)

Age Group Insights

- The 16–24 category generated the highest revenue share of 30%, in 2023, and it is likely to retain its position in the long run. E-cigarette, such as the JUUL device, appeal to the youth and have become an instant hit in the age group of 16–24.

- They do not stink as strongly as traditional cigarettes, making it much simpler for people to use them covertly. Even teenagers who would not try cigarettes may be tempted by JUUL and other well-known vape brands' appealing flavors and packaging. A trending notion is that vaping is less harmful and that it is simple for youths to purchase vaping equipment online.

The following age groups are included in the report:

- 16–24 (Largest Category)

- 25–34 (Fastest-Growing Category)

- 35–44

- 45–54

- 55–65

- 65+

Distribution Channel Analysis

- The online distribution channel is projected to witness the highest CAGR, of 10.6%, during 2024–2030 in the market. People are more tempted to procure e-cigarettes and other vape products online due to the convenience of purchase, freedom of cost analysis, and access to a greater selection of goods.

- With the emergence of e-commerce, manufacturers are either selling their goods on the websites of third parties or introducing their own online portals to sell them. The increasing sales possibility for these products through e-commerce has encouraged sellers to strengthen the security and dependability of their online purchasing procedures, which has increased online product sales.

Below are the distribution channels covered in the report:

- Vape Shop (Larger Category)

- Online (Faster-Growing Category)

- Hypermarket/Supermarket

- Tobacconist

- Others

Europe Is Largest Market

- Geographically, Europe held the largest market share, of around 50%, in 2023, due to the presence of a large number of consumers. Moreover, with a fall in the habit of traditional smoking in the region, the consumer base is expected to shift toward electronic variants during the forecast period.

- Major industry companies frequently promote their e-cigarettes and vaping goods on social media, which fuels the popularity and sales of their products. Their consumption among the young population as a less-harmful alternative to conventional forms of tobacco consumption is proliferating at a robust rate due to the availability of a wide selection of brands and flavors online, as well as in physical stores.

- The U.K., France, and Russia are the major revenue-generating countries here. In the EU, one in seven traditional cigarette smokers classify themselves as a current vaping product user. This indicates that the majority of the users are current and former cigarette smokers and those who has opted to quit tobacco.

- Moreover, several health bodies have accepted that e-cigarettes and vaping devices are better alternatives to tobacco, which, in turn, fortifies their production and sales. They do not create tar, which is produced by conventional cigarettes and is the foremost reason for lung cancer. Further, a large chunk of the population is trying e-cigarettes at least once, either for a change to their regular cigarettes or to gain a new experience. This dual use case has significantly escalated the number of consumers and is projected to inflate the market growth rate in the future.

The regions and countries analyzed in this report include:

- North America

- U.S. (Larger and Faster-Growing Country Market)

- Canada

- Europe (Largest Regional Market)

- Germany (Largest Country Market)

- U.K. (Fastest-Growing Country Market)

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific (APAC) (Fastest-Growing Regional Market)

- China (Largest Country Market)

- Japan

- South Korea

- Australia (Fastest-Growing Country Market)

- Rest of APAC

- Latin America (LATAM)

- Brazil (Largest and Fastest-Growing Country Market)

- Mexico

- Rest of LATAM

- Middle East and Africa (MEA)

- Saudi Arabia (Largest Country Market)

- South Africa

- U.A.E. (Fastest-Growing Country Market)

- Rest of MEA

Competitive Analysis

The global e-cigarette market is fragmented with the presence of several key players. In recent years, they have been involved in product launches in order to attain a significant position.

Imperial Brands plc held the largest share in the global e-cigarette market in 2023. The company offers its e-cigarettes under the brand blu. With continuous advancements in product technology, Imperial’s blu is focusing on improving its vapor devices and product reliability, to consolidate its market position.

Top E-Cigarette Companies:

- JUUL Labs Inc.

- British American Tobacco plc

- Altria Group Inc.

- Japan Tobacco Inc.

- Imperial Brands plc

- Philip Morris International

- NJOY LLC

- Turning Point Brands Inc.

- Vapor Hub International Inc.

- FIN Branding Group LLC

- MCIG Inc.

Global E-Cigarette Industry News

- In June 2023, Altria Group Inc. revealed its acquisition of NJOY Holdings Inc., a vaping company. Under its subsidiary NJOY LLC (NJOY), Altria markets NJOY e-vapor products, with the distribution handled by Altria Group Distribution Company.

- In July 2022, British American Tobacco plc launched the Glo hyper X2, the latest addition to its rapidly expanding global heated tobacco brand, in Tokyo, Japan. The product's new barrel-style design was influenced by consumer feedback and the demand for innovative and user-friendly features.

- In August 2021, Philip Morris International Inc. launched the IQOS ILUMA in Japan. This new addition to the IQOS range was the brand's first tobacco heating system to incorporate advanced induction heating technology. This technology removes the need for a blade and cleaning, thus improving the product's convenience and user experience.

Frequently Asked Questions About This Report

The e-cigarette market value will reach USD 40.6 billion in 2030.

The market for e-cigarette will reach USD 22.5 billion in 2024.

The Europe market for e-cigarette is the largest, with approximately 50% share in 2023.

Usage of e-cigarette as a substitute for tobacco smoking is the key e-cigarette industry driver.

Online distribution channel will observe the highest e-cigarette market CAGR, of 10.6%.

The e-cigarette industry is fragmented with the existence of several players.

Request the Free Sample Pages

Want a report tailored exactly to your business need?

Request CustomizationWe are Trusted by

Working with P&S Intelligence and their team was an absolute pleasure – their awareness of timelines and commitment to value greatly contributed to our project's success. Eagerly anticipating future collaborations.

McKinsey & Company

IndiaOur insights into the minutest levels of the markets, including the latest trends and competitive landscape, give you all the answers you need to take your business to new heights

We take a cautious approach to protecting your personal and confidential information. Trust is the strongest bond that connects us and our clients, and trust we build by complying with all international and domestic data protection and privacy laws